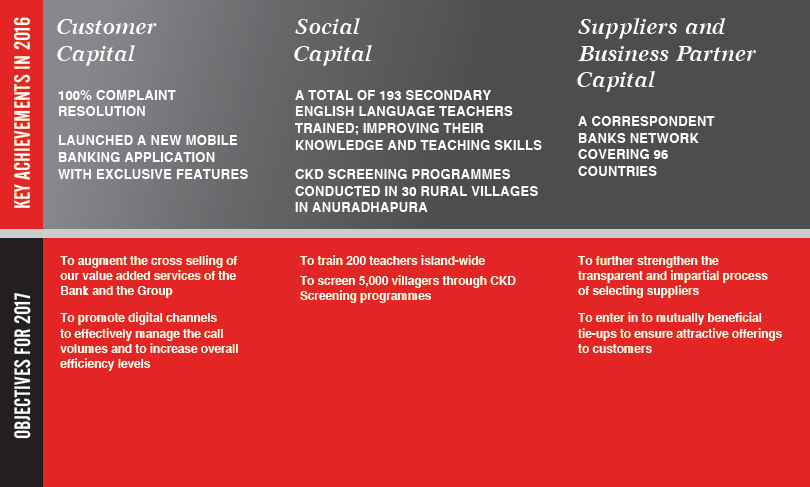

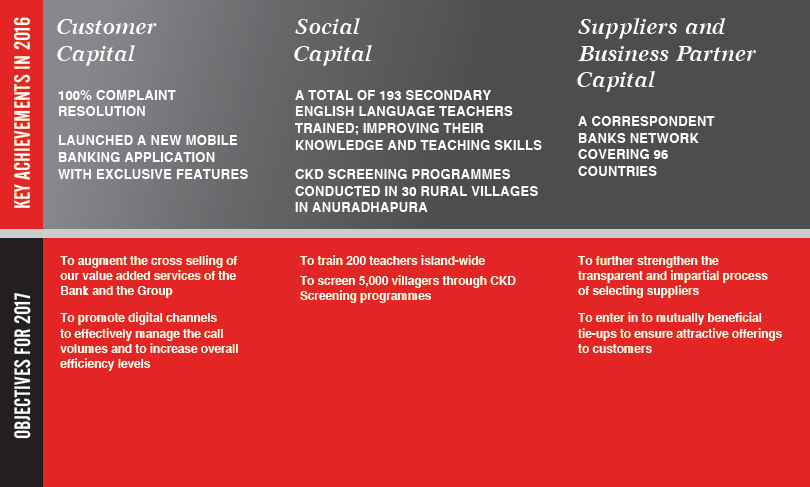

SOCIAL AND RELATIONSHIP CAPITAL

Strategy - Lasting relationships

The fact that customers are our lifeblood is the cornerstone of our product development and marketing strategy. We are in an industry that is fast changing and evolving, and there is a constant need to stay abreast of developments and surpass competition. We have a vast customer range; including micro-entrepreneurs, middle class individuals, SMEs, high-net-worth clients and large corporates. Our products and services have to be tailored and customised to cater to this tremendous diversity. As our core philosophy is based on sustainability, we have to be constantly conscious of social impacts; those of our own actions and those of our clients.

The Bank aspires to carve out a special niche for itself among banks in Sri Lanka in its reputation for customer service. Our highly trained staff, our innovative marketing and our leveraging of the potential of information technology all contribute synergistically to this end.

Customer Capital

Customer Service Process

The Bank aspires to be the leading Bank in Sri Lanka for customer service and advocacy. Value creation is a dual process; while delighting our customers by giving value to them, we in turn derive value for the Bank and the Group. Customer centricity drives our strategy and business processes. We strive to deliver unparalleled quality in customer service and reap the benefits in the form of utmost customer satisfaction and loyalty.

In 2017, we have several initiatives in view to further enhance our customer service.

The Bank is confident that with our stress on training and development of our staff, we will further upgrade their competencies and capabilities. We intend to further expand cross-functional collaboration, supported by information technology by way of combined digital platforms, to render a more effective customer service. Synergies generated by cross-selling and value added sales will enable us to grow our sales volume. Furthermore, benchmarking our service standards across the banking industry will enable us attain the pinnacle of customer satisfaction.

Key Performance Measures

| Indicator |

Target (MOM) |

Achievement 2016 |

| Contact Centre |

|

|

| Service levels of the incoming calls |

To maintain 80% or more |

82% |

| Abandon Rate |

To maintain below 5% |

4% |

| Call quality effectiveness |

To maintain at 80% |

84% |

| Average Call Handling Time |

=< 3mins per call |

Achieved |

| Online Channels |

|

|

| Online Banking (NBO) and contact@ndbbank.com mail box response time Turnaround times (TAT) |

80% or more to be responded within 3 working days |

86% |

| Bank |

|

|

| Complaints Handling Turnaround times (TAT) |

70% or more to be resolved within 10 working days |

70% achieved |

| Branch Network |

|

|

| Complaints Handling Turnaround times (TAT) |

70% or more to be resolved within 10 working days |

70% achieved |

| Customer Feedback Scores |

To maintain at 8 or above |

Achieved (94% of branches have scored 8 or more) |

| Mystery Customer Survey (visit and caller) |

To maintain 80% or above |

Achieved |

| Service Quality related customer complaints |

Less than 10% of overall customer complaints |

Achieved |

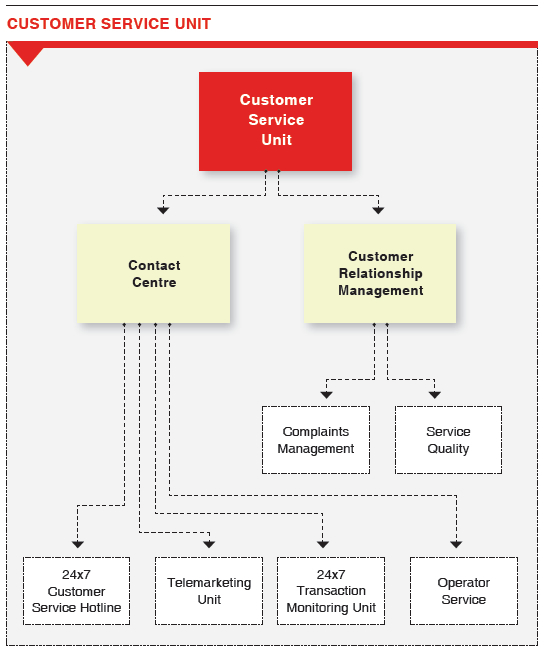

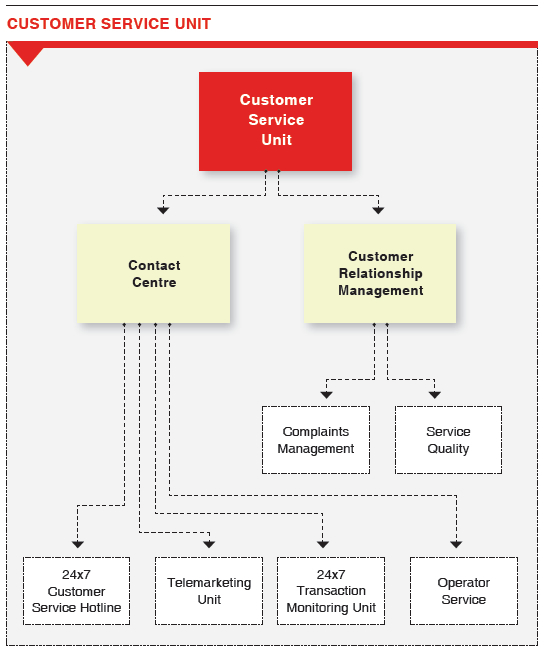

Feedback and Feedforward

Contact Centre

We fervently believe that giving customers constant and easy access to the Bank and its services are key to good customer relations. We maintain a 24x7 hotline which handles card activation, lost card deactivation and the online banking mailbox, in addition to routine customer inquiries. We maintain a maximum response time of three days for all queries received via mailbox and ensure seamless follow up until any issue is resolved.

Operator Services

Between the hours of 8.30 a.m.-5 p.m., the operator services handles direct calls received from existing and potential customers. Customers who require specific banking services are then routed to the respective personnel for further assistance.

Telemarketing

Cross-selling and upselling, which are carried out by the Telemarketing unit, are a major facet of the Bank’s marketing strategy. Several cross-selling projects were carried out during the year, the rewards of which were reaped by the Bank by way of increased revenues. The Bank also monitors the customer satisfaction at the branch level through Customer Feedback Score Surveys conducted by the telemarketing team on a monthly basis.

Transaction Monitoring

The Transaction Monitoring unit of the Bank, does its utmost to ensure the security of the customers’ assets and their transactions and prevent any unauthorised access. Any unusual transaction patterns can be identified by the unit, which carries out 24x7 monitoring to identify any suspicious patterns. There were no complaints regarding unauthorised access to or loss of customer data, which were found to be justified.

Customer Relationship Management

The unit’s key responsibility would be to manage all customer complaints received via internal and external channels across the Bank. The Bank’s complaint handling procedure is laid down in line with the Customer Charter set out by the Central Bank of Sri Lanka (CBSL). The Customer Relationship Management team ensures that the customer complaints received through all touch points are recorded in the Bank’s complaint tracking system and are resolved within 10 working days.

The Bank has published its complaints handling procedure, service levels and the complaints redress process through the Financial Ombudsman on the corporate website (www.ndbbank.com) and the same is displayed at all branches in line with the CBSL guidelines.

The unit also reviews the overall service quality aspects of key customer touch points, carrying out various quality surveys to measure the customer satisfaction levels. Further, the feedback received from customers through various channels are shared with the respective Business lines and are taken in to consideration when simplifying the Bank’s processes and developing new products and services.

Communication Policy

The Bank’s communication policy aims to foster effective communication, both internal and external, between the Bank and all its stakeholders: customers, investors, suppliers, business partners, employees, regulators, local communities and the general public.

The policy has been reviewed and made available to all staff members to read and comply.

Our Product Portfolio

| Commercial Banking |

|

- Short-term loans and overdraft facilities

- Trade finance

- Cash management

- Treasury products and services

- Distributor financing

- Receivable financing

- Guarantees

|

| Project and Infrastructure Financing |

|

- Term loans including syndicated and co-financing facilities

- Securitizations (Future Tea Sales, Lease and Hire Purchase Receivables)

- Investments in Debentures

- Preference share investments

- Guarantees related to project financing

- Long-term Islamic Banking solutions

- Lease facilities for Corporates

- Arranger and Lead bank services

- Project financing related legal services

|

| Retail Banking |

|

- Current accounts

- Privilege Select, Privilege banking

- Savings accounts, Children’s savings accounts

- NDB Salary Max

- NRFC/RFC accounts

- Fixed deposits

- Housing loans

- Education loans

- Personal loans

- Solar Loans

- Leasing and hire purchase facilities

- NDB credit cards, debit cards

- Pawning

- Remittances, money transfer services

- Internet banking

- Mobile banking

- Bancassurance

- Safe deposit lockers

- E-statement

- Margin trading

- Travel card

|

| SME and Micro Financing |

|

- Long-term loans

- Short-term working capital loans

- Distributor finance facilities

- Supplier banking products

- Funding for importers and exporters

|

| Islamic banking |

|

- Current accounts

- Mudarabah – Savings in LKR and other currencies

- Mudarabah – Short and Long-term investment

- Murabahah – Short term Facilities for trading and working capital

- Wakala Financing – Short-term facilities for Trading and working capital

- Wakala Deposits – Short and long-term investment.

- Ijarah – Leasing

- Diminishing Musharakah – Project financing, Long-term financing for working capital, vehicle financing and housing finance.

|

Key highlights of our product portfolio during the year is discussed below:

‘Privilege Select’

The ‘Privilege Select’ package gives our high-end clients, residing both locally and overseas, the opportunity to grow their net worth by availing themselves of highly professional portfolio management advisory services. Privilege select membership is granted to clients who maintain deposits or investments of more than LKR 20 million or an equivalent amount in foreign currency.

The expertise of the entire Group is leveraged to maximize the returns on investments, keeping in mind the client’s risk appetite. The services provided encompass relationship banking, investment banking, share trading, wealth management, insurance protection, foreign currency derivatives, banking products and wealth creation tools. A dedicated relationship manager services each of our clients and accordingly, convenient and seamless conduct of all business activities of the Bank is facilitated. The ‘Privilege Select’ customers also have the advantages of 24- hour access and preferential tariffs for all banking products and services. Our clientele includes high-net-worth individuals based in Sri Lanka and overseas. Looking forward, we see ourselves delighting our customers by fulfilling their investment ambitions with a world-class banking environment and services.

The Group pays special attention to its high-net-worth customers by providing all the possible services in the most convenient manner, giving individual attention, understanding their special needs and as speedily as possible. Our ‘Privilege Select’ package is a beacon of excellence to private banking in Sri Lanka, and provides portfolio management services to a selective clientele.

A significant event during the year was the partnership with GVR Lanka (Pvt.) Ltd., one of its premier customers in the Central Province to promote Dynasty Residence, the luxury apartment project in Kandy. The Bank hosted an event at the Earl's Regency, Kandy, which was attended by the Chief Executive Officer, Chief Operating Officer, Senior Staff members along with Regional & Branch Managers and many distinguished guests. The opportunity was taken, to announce special housing loan finance packages, carrying very attractive terms, to premier customers, enabling them to invest in Dynasty Residence.

For the third consecutive year, the Bank sponsored the NDB-RCGC Interschool Golf tournament, which was held on 22 October 2016. The event was organized by the past pupils of Ananda College and there were about 200 participants.

The Bank also hosted the Privilege Select Customers for the political comedy ‘Arsik Meediya Part 2 – BOGG’ by Stage Light & Magic Inc at Water's Edge – Grand Ballroom.

NDB Leasing

During the year under review, most of the players in the industry, inclusive of banks, finance companies and leasing companies, sought to exploit the favourable market conditions by actively advertising their leasing products. The Bank aligned itself with the trend by aggressive advertising through press advertising, PR and online media campaigns as well as tie-ups with key vehicle dealers and agents in the country including Dimo, United Motors and AMW. The diverse forms of communication maintained, grew the customer awareness and positive perception of the brand.

SME

The small and medium sector, which plays a vital role in the country, both economically and socially, is given high priority by policy makers and is also one of the priorities of the Bank and the Group. The Bank continued with its programmes on social and management processes, which are carried out at a regional level, to educate small and medium entrepreneurs.

The Bank continued to carry out its regional SME programmes to educate small and medium entrepreneurs (SME) on environment and social management processes. In-line with its commitment to sustainability, the Bank follows an Environmental and Social Management System (ESMS) which envisages identifying environmental and social impacts as well as risks involved in the projects it finances. This system, which is embedded into the Bank’s credit policy and process, advises clients on how to guard against such risks at an early stage of the credit evaluation process.

The Bank is firmly convinced that educating customers on these aspects will generate long-term value by way of sustainability, both to the Bank and the customer.

eStatements

Another initiative taken by the Bank, with both sustainability and customer service in view, is the innovative eStatement, which has now been upgraded into a fully integrated ‘Life Style Statement; this gives account holders a complete review of their finances. The statement is secure, instant, readily accessible and can be conveniently saved for future reference. The statement can consolidate across products and/or across the Group and give the customer a bird’s eye view of his/her finances in total. It also gives the Bank an opportunity to communicate with its clients in a personalised and focussed manner, rather than through the traditional statements, and gives a more personalised service. The eStatement provides extensive and detailed information, with donut graphs to display credit card usages and bar graphs to display saving trends over six months.

Mobile Banking

A major breakthrough by the Bank was the pioneering Mobile Banking App, which drew worldwide interest and was a complete shift from the traditional modes of banking. It has been of great value to customers in enabling them to access services and perform transactions while on the move. With the NDB Mobile Banking App, customers can bank at their convenience and access their accounts/cards to carry out various transactions while being assured of complete security from any mobile device running iOS, Android or Windows. The solution is flexible enough to be availed by a user, on any mobile network and to perform whatever transaction with the greatest ease and convenience.

NDB Shilpa

As part of its corporate social responsibility role, the Bank continues to assist talented students through its ‘NDB Shilpa’ scheme, through which cash rewards are bestowed on those who excelled at the Grade 5 scholarship exam. This year, the top five island rankers received a token of LKR 100,000, the next five LKR 50,000 and any student who gained more than 180 points LKR 5,000. ‘NDB Shilpa’ also contributed to motivate and build the morale of the younger generation by sponsoring a series of educational programmes initiated by Sirasa FM and Imashi Publications. Both programmes were carried out by an eminent panel of lecturers possessing a wealth of experience and expertise in the field of education. Further, the Bank also sponsored 10 mega programmes with Sirasa FM and 50 programmes with Imashi Publications. They were held in a wide geographical spread, covering most regions of the country and targeted all scholarship students with informative sessions including study tips and preparation guidelines. The seminars catered separately to children and parents, and the seminars for children comprised of 500 – 700 students.

Micro and SME Development

The Bank had its origins as a development bank. It still retains this focus; however, today our view of development is that it is not confined to large-scale enterprises but extends to the small and medium-scale rural or urban entrepreneur. Our far flung network ensures wide penetration of our micro and SME programmes at grass root level. We assist them not only by the provision of finance, but in other aspects of business as well. This includes training/capacity building workshops to build up their skills and competencies.

Since a majority of our microfinance clientele are women, by lending and other services to such entrepreneurs, we make our contribution to the empowerment of women. An outstanding example of the contribution we have made is the micro loans to female workers in the apparel industry.

A Milestone in Our Network

The Bank added 11 new Branches during the year, most of which were outside the Western Province. A major milestone was the opening of the 100th branch in Hingurakgoda. To mark the event, a number of socially oriented programmes were carried out concurrently, mainly to benefit the local community. All 100 Branch Managers country wide and Regional Managers participated in a tree planting project, where they planted 100 seedlings at the Vidyaloka Primary School and along the Hingurakgoda – Polonnaruwa Road. To educate the local business community, a workshop was conducted where the Bank’s SME and leasing products were explained in detail. The Bank also granted 100 micro loans to 100 new customers at the new branch premises. The Bank’s officers also toured the Hingurakgoda town to educate prospective clients about SME financing facilities. To encourage the younger generation to aspire to a career in the banking industry, a recruitment drive was conducted at the Central College, Anuradhapura in June 2016. A number of other social activities were carried out, including a programme to inculcate the savings habit in primary school children and library book donation at the Vidyaloka Primary School Hingurakgoda.

Redefining the Online Presence

To project its image and promote its brand, particularly among millennials, the Bank sought to augment its online presence with its corporate website and social media engagement.

Social Media Presence

The Bank maintains a dynamic and interactive Facebook page which greatly enhances its online presence with a fanbase above 377,000. The page continues to build high interactivity by hosting many campaigns and games. One important campaign was to mark the opening of the Bank’s 100th Branch. Good wishes, which were sent by the fans in advance were printed and put up on a wishing wall at the opening. A best wish was selected and rewarded.

Another important event was the cricket match fever, an interactive competition, which ran concurrently with the Sri Lanka vs. Australian cricket tournament. Questions were asked at the beginning of the matches and fans who gave the correct answer were gifted a miniature cricket bat signed by NDB Brand Ambassador Angelo Mathews.

The Bank also conducted various games and giveaways on the occasions of festival days, including Sinhala and Tamil New Year and Christmas. Special campaigns were also conducted to commemorate special events such as Mother’s Day, Father’s Day and Children’s Day.

The Bank also maintains a page named ‘Shilpa’, separate from its corporate page, which is aimed at educating parents, prospective parents and young adults on the saving habits for children and general tips on upbringing children. The Shilpa Facebook page maintains a fan base above 68,000.

The Bank also maintains a LinkedIn page which has a growing base of followers. With a follower base of 5,287, it is ranked at 2 place in the Financial Services Industry in terms of the follower base. The most popular postings on the page with high interactions are vacancy announcements which draw applications through the careers portal as well as comments, followers likes and sharing. A recent addition to the Linked In page has been sharing valuable career and personal advice extracted from internal training programmes. Corporate PR, events and announcements along with other useful business/motivational articles for professionals are also posted on the page. The Bank also sends out regular tweets through its Twitter page, which also has a large and enthusiastic group of followers. Updates include Bank events, products, insights from customer forums, notices; daily inspirational retweetable quotes are shared on the page, which create a good impression and drive lively interactions.

The Bank also has a YouTube channel which consists of all videos published by the Bank. Corporate announcements/media briefings, events and commercials are updated to the YouTube channel. The novel mobile app is catching on in popularity and the YouTube channel assists users to become familiarized with the application by way of a unique set of product demos. These Videos have been composed in-house. Another highlight on the YouTube page that gained a high viewership this year was the TV Music Video/Commercial on NDB Mobile Banking.

Corporate Website

The Bank’s Corporate website serves as a one stop hub, which is very informative on Bank’s products, branch network, investor details, NDB Careers etc. The Bank is currently in the process of revamping the website and the new website will be available towards the end of 1 quarter 2017.

The Bank also hosts a separate website akin to a lifestyle site, NDB Digital. The site contains useful material for its visitors such as ‘Home & You’, ‘Goals & Plans’, ‘Save & Invest”, ‘Wheels & Dreams’, ‘Kids & Money’ and ‘Cards & Offers’. The articles are also archived monthly so that visitors can view them whenever they wish.

An opt out eNewsletter named ‘eDigest’ is being sent to subscribers and customers based on these write-ups and they are also shared on the Bank’s Facebook page.

Social Capital

Market Presence

The percentages of senior management at different levels, for the eight regions are shown in the table below. The fact that there is a very substantial percentage at the Assistant Vice President level demonstrates our commitment to making appointments from within the communities wherever possible. This will bring payoffs by way of their knowledge of local communities and opportunities.

Percentage of senior management at significant locations of operation that are hired from the local community is 100%.

| Location Wise |

|

F (%) |

M (%) |

| HO – Colombo |

|

43 |

57 |

| Region 1 – Colombo |

|

39 |

61 |

| Region 2 – Greater Colombo |

|

42 |

58 |

| Region 3 – Southern |

|

26 |

74 |

| Region 4 – North Western |

|

38 |

62 |

| Region 5 – North Central |

|

26 |

74 |

| Region 6 – Central |

|

37 |

63 |

| Region 7 – Uva Sabaragamuwa |

|

17 |

83 |

| Region 8 – North East |

|

35 |

65 |

| Grand Total |

|

39 |

61 |

Strategic CSR

The CSR programmes implemented, with their degree of local community engagement, capacity building and impact assessment are given below. The information given demonstrates our commitment to creating sustainable social value. The Corporate Sustainability Committee of the Bank is responsible for decision-making of sustainability related economic, environment and social topics.

|

Strategic Focus |

Project |

Progress |

| 1 |

Education |

NDB English for Teaching Plus (EfT+) Project |

- Project implemented through 10 Regional English Support Centres (RESCs) in Matale, Moneragala, Ampara, Jaffna, Anuradapura, Balapitiya, Kurunegala, Bolawalana, Eheliyagoda & Vavuniya.

- Project addresses two aspects of the Teachers – language improvement and teaching ability.

- Training is more activity based with new and innovative training methods introduced so that teachers are equipped to teach as well as manage their students in a more holistic manner.

- The Bank has implemented this project since 2012 and to date 679 teachers have been trained from 456 schools in all Provinces of the nation with over 130,000 students benefiting from the project.

- As a value addition the Bank also conducted a 1 hour session on ‘Financial Health’ for the beneficiaries.

|

| 2 |

Environment |

Environment Literacy for Schools |

- Awareness programmes conducted in 150 schools in diverse parts of the country; sensitising, creating awareness and training on environmental conservation.

- Nature Clubs were set up in 30 Schools with assistance given to conduct environmental projects within their school.

- Project focuses on educating students on environmental aspects and encouraging them to be ‘Green Leaders’, increasing awareness on the following:

- The Environment we live in and Sri Lanka’s rich biodiversity

- Present Status of the Environment

- Climate Change

- Conservation

- Being a Green Leader

|

| 3 |

Health |

CKD Screening Programmes |

- Project commenced in 2014 to address this National issue.

- NDB carried out this project in collaboration with the Kidney Protection Foundation Anuradhapura, where Screening is conducted in the rural villages in Anuradhapura.

- From 2014 – 2015 a total of 5571 persons from 23 rural villages in Anuradhapura. 405 persons detected with CKD and referred for treatment. Public awareness raised in 23 villages.

- Impact for 2016

- 30 Screening Programmes conducted in rural villages in Anuradhapura

- 3,553 persons screened

- 554 detected with CKD and referred for treatment

|

| 4 |

Employee Volunteerism |

Trail 2016 – Walk for Cancer Relief |

- 217 staff members from NDB volunteered to walk completing different segments of the Walk from Point Pedro to Dondra from 06th October to 02nd November 2016.

- NDB’s ‘Silver’ sponsorship together with the sponsorship for the walkers contributed towards the expansion of the Cancer Treatment Centre at the Karapitiya Teaching Hospital in Galle.

|