We are a ’Financial Powerhouse‘. The strength of our Group in its multiple segments is matched by none.

The Bank

Commencing business in 1979 as a state-owned development bank, National Development Bank PLC (‘Bank’) today operates under the Companies Act No. 07 of 2007, and as a Licensed Commercial Bank, it is regulated under the Banking Act No. 30 of 1988, as amended from time to time. The Bank is listed on the Colombo Stock Exchange (stock code: NDB.N0000). The Bank holds a Credit Rating of A+(LKA)/Stable Outlook from Fitch Ratings Lanka Ltd.

While building on its original strengths the Bank has ventured into new products and services. Today, the Bank provides a full spectrum of financial solutions such as retail banking, small and medium enterprise (SME) banking, corporate banking, project and infrastructure financing, leasing, housing finance, cash management, correspondent banking, remittance services, margin trading, pawning, treasury and investment services, Bancassurance and card operations.

The Group

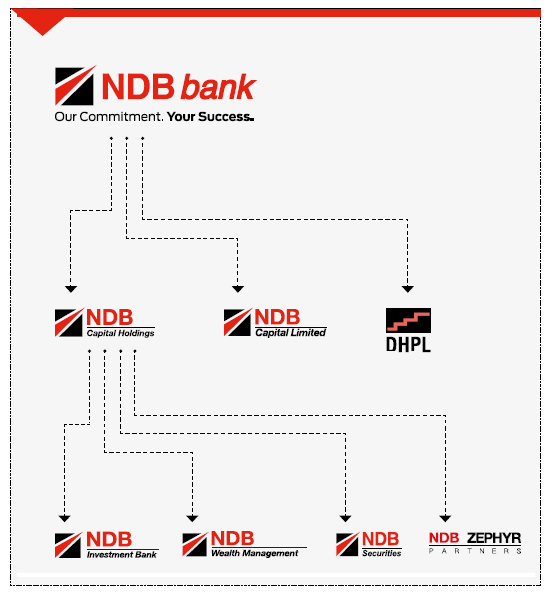

The Bank together with its group companies are referred to as the ‘Group’. The main activities of the group companies are depicted in the table given below.

Group structure

NDB Capital Holdings Ltd.

NDB Capital Ltd.

Development Holdings (Pvt) Ltd.

NDB Investment Bank Ltd.

NDB Wealth Management Ltd.

NDB Securities (Pvt) Ltd.

NDB Zephyr Partners Ltd.

NDB Zephyr Partners Lanka (Private) Ltd.

Ayojana Fund (Pvt) Ltd. (Under Liquidation)

NDB Venture Investment (Pvt) Ltd. (Under Liquidation)

Markets Served

The Group’s significant operations are located within Sri Lanka, with services delivered through locally domiciled entities. The Group is also engaged in fee-based businesses in Bangladesh through NDB Capital Ltd., and private equity in Mauritius through NDB Zephyr Partners Ltd. which was set up in 2014 in partnership with the US-based Zephyr Management LP. The Bank operates a network of 104 branches (2015: 93) that are categorized into eight Regions. Our network covers 22 of the 25 administrative districts in the nine provinces of the country, and serves a broad spectrum of clientele ranging from individuals, micro enterprises, SMEs, emerging and large corporates to state-owned enterprises and multinational companies. In addition, the Bank continually increases its customer reach through automated distribution systems such as ATMs, internet banking, a virtual presence in a host of leading social interaction sites, telemarketing, a call centre and a unique sales force. More details are given under Social and Relationship Capital.

Scale of Operations

The total operating income of the Group increased by 3% during FY 2016 to LKR 13,677 million. Profit attributable to shareholders for the FY 2016 was LKR 2,691 million. Total assets of the Group grew by 8% to LKR 341 billion during the year, largely driven by enhanced volume growth across all business segments. The Bank’s market capitalization stood at LKR 25,769 million as at 31 December 2016, and ranked 25 (2015: 21) amongst the 295 listed companies on the Colombo bourse.

By end – 2016 the Sri Lankan banking industry comprised 25 licensed commercial banks and 7 licensed specialized banks, with 32 players in total (2015: 32 banks). In terms of market share within the industry, the Bank accounted for:

- 3.7% share of total assets (2015: 3.8%)

- 4.2% of loans and receivables (2015: 4.5%)

- 3.2% share of customer deposits (2015: 3.4%)

The Bank’s staff strength increased by 7.6% to 2,109 persons by end 2016, driven by business growth, with 79% employed in the permanent cadre.

| Company name |

Domicile |

Shareholding |

Nature of business |

| NDB Capital Holdings Ltd. |

Sri Lanka |

99.9% Bank’s holding, Direct |

Full service investment banking |

| NDB Capital Ltd. |

Bangladesh |

77.8% Bank’s holding, Direct |

Investment banking |

| Development Holdings (Pvt) Ltd. |

Sri Lanka |

58.7% Bank’s holding, Direct |

Property management |

| NDB Investment Bank Ltd. |

Sri Lanka |

99.9% Bank’s holding, Indirect |

Investment banking |

| NDB Wealth Management Ltd. |

Sri Lanka |

99.9% Bank’s holding, Indirect |

Wealth management |

| NDB Securities (Pvt) Ltd. |

Sri Lanka |

99.9% Bank’s holding, Indirect |

Investment advisory and securities trading |

| NDB Zephyr Partners Ltd. |

Mauritius |

60.0% Bank’s holding, Indirect |

Management of private equity funds |

| NDB Zephyr Partners Lanka (Private) Ltd. |

Sri Lanka |

60.0% Bank’s holding, Indirect |

Management of private equity funds |

| NDB Venture Investment (Pvt) Ltd. (An associate Company under Liquidation) |

Sri Lanka |

50.0% Bank’s holding, Direct |

Venture capital |

| Ayojana Fund (Pvt) Ltd. (An associate Company under Liquidation) |

Sri Lanka |

50.0% Bank’s holding, Direct |

Venture capital |