Financial Capital

Strategy – Profitable Growth

Financial capital comprises the funds that are at the Group’s disposal that enabled its establishment by acquiring physical and human resources at the inception and its perpetuation by acting as a cushion for absorbing unforeseen losses as a going concern. It plays the primary roles of providing loans and investment opportunities for individuals, corporates, etc., safeguarding depositors, create value to shareholders, help promote the society and environment and keep a buffer for unforeseen losses. Financial capital has been acquired from external sources such as share capital and subordinated term debt as well as generated from internal sources such as retained profits and other revenue reserves. The Bank, and the Group have an extremely diverse range of operations to generate funds from. While nurturing traditional products, it is constantly innovating new products to cater to emerging needs and changing circumstances. Fund-based operations are judiciously managed to maintain satisfactory net interest margins. Simultaneously, through its dynamic capital markets cluster, it is constantly seeking to grow its share of fee-based income as a strategy for diversifying sources of income and managing capital. Costs too are rigorously controlled to keep profit margins, whilst not compromising on brand value.

Financial Review

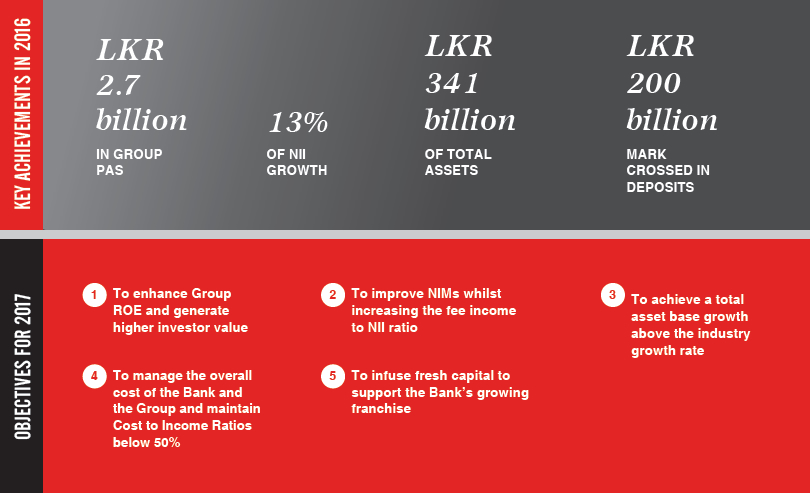

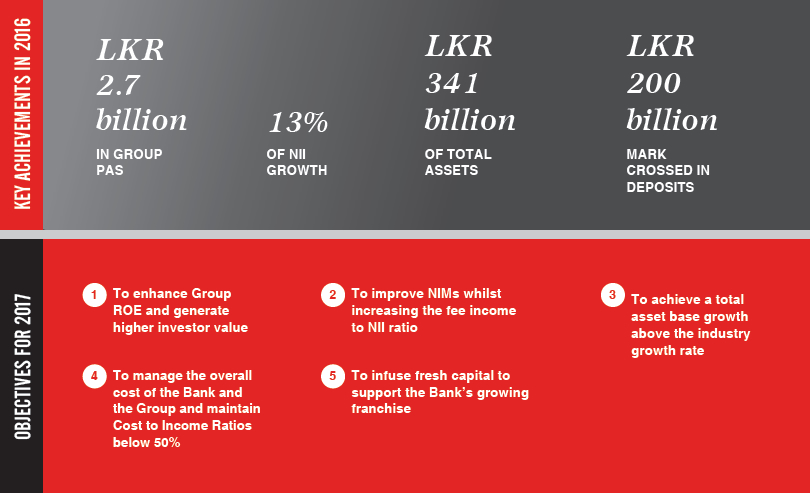

The year 2016 was marked by several monetary policy measures which impacted the banking and financial services industry. Liquidity, interest rates and demand for credit were the key variables which were impacted on by such policy measures which made performance during the year challenging for the banking industry.

Given below is a detailed analysis of how the Bank, its key business units and the group companies performed in generating and enhancing its financial capital.

The Financial Statements relevant to this discussion are available in the pages 282 to 402 of the Financial Reports section of this Report. Where applicable, extracts from the Financial Statements are presented alongside the discussion, and references are also made to Financial Notes, where further details of the items are given.

Profitability Analysis

Total Operating Income

|

Bank |

Group |

|

2016 |

2015 |

Change |

Change |

2016 |

2015 |

Change |

Change |

|

LKR '000 |

LKR '000 |

LKR '000 |

% |

LKR '000 |

LKR '000 |

LKR '000 |

% |

| Net-interest income |

8,487,312 |

7,521,823 |

965,489 |

13 |

8,860,769 |

7,807,377 |

1,053,392 |

13 |

| Non-interest income |

4,663,489 |

4,687,463 |

(23,974) |

(1) |

4,816,299 |

5,483,931 |

(667,632) |

(12) |

| Total operating income |

13,150,801 |

12,209,286 |

941,515 |

8 |

13,677,068 |

13,291,308 |

385,760 |

3 |

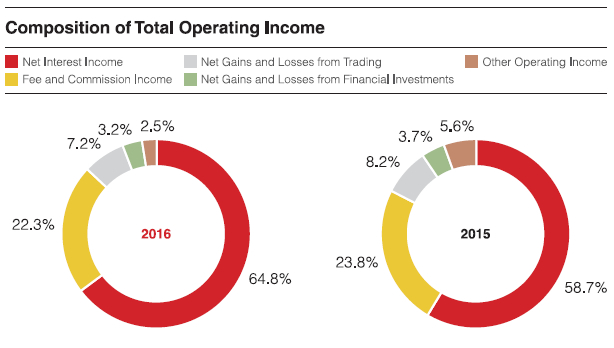

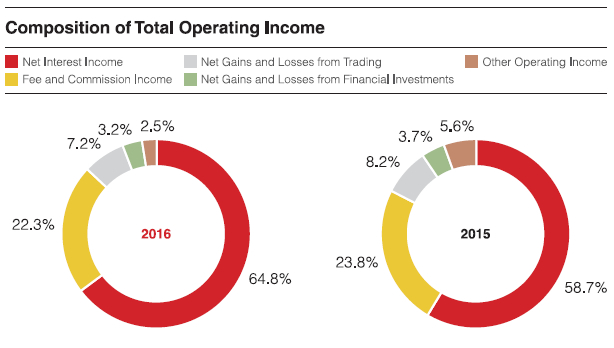

Total operating income for the Bank which comprised of net interest income and non-interest income increased by 8% in 2016 as compared to the previous year. Net interest income was the significant contributor towards this growth which highlights the growth recorded by the Bank in its core banking operations.

The total operating income for the Group was constrained to a growth of 3% due to the lower than expected performance of the group companies, as a result of the moderate capital markets activities experienced during the year.

The composition of Group total operating income for 2016 as compared with 2015 is depicted below.

Net Interest Income

|

Bank |

Group |

|

2016 |

2015 |

Change |

Change |

2016 |

2015 |

Change |

Change |

|

LKR '000 |

LKR '000 |

LKR '000 |

% |

LKR '000 |

LKR '000 |

LKR '000 |

% |

| Interest income – loans and receivables |

23,169,246 |

17,171,614 |

5,997,632 |

35 |

23,180,279 |

17,173,883 |

6,006,396 |

35 |

| Interest income – Placements and other investments |

5,449,001 |

3,996,234 |

1,452,767 |

36 |

5,780,327 |

4,258,049 |

1,522,278 |

36 |

| Total Interest Income |

28,618,247 |

21,167,848 |

7,450,399 |

35 |

28,960,606 |

21,431,932 |

7,528,674 |

35 |

| Interest expenses – Customer deposits |

12,362,362 |

8,157,526 |

4,204,836 |

52 |

12,331,264 |

8,137,635 |

4,193,629 |

52 |

| Interest expenses – Other borrowings |

7,768,573 |

5,488,499 |

2,280,074 |

42 |

7,768,573 |

5,486,920 |

2,281,653 |

42 |

| Total Interest Expenses |

20,130,935 |

13,646,025 |

6,484,910 |

48 |

20,099,837 |

13,624,555 |

6,475,282 |

48 |

| Net Interest Income |

8,487,312 |

7,521,823 |

965,489 |

13 |

8,860,769 |

7,807,377 |

1,053,392 |

13 |

| Net Interest Margin as a percentage of average total assets |

2.64% |

2.63% |

0.01% |

0 |

2.70% |

2.67% |

0.03% |

1 |

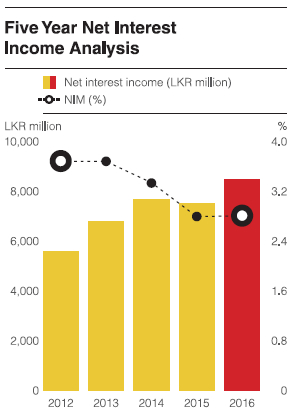

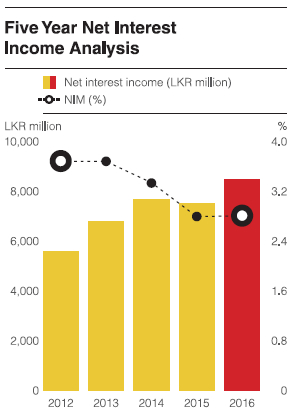

Net interest income (NII) of the Bank for 2016 was LKR 8,487 million and grew by 13% over the previous year. The growth in NII was supported by a 35% increase in interest income stemming from a gross loans and receivables base which stood at LKR 234 billion. The Bank largely benefited from the conscious asset re-pricing measures carried out during the year, with the upward movement in the interest rates. The Bank’s NII growth levels continue to be challenged due to the low CASA base of the Bank compared to the industry CASA base, which results in relatively high cost of funds for the Bank.

In this back drop, the Bank was able to defend its net interest margin (NIM), which is based on total average assets at 2.64% for the year, through effective management of the assets and liability portfolio.

Non-Interest Income

|

Bank |

Group |

|

2016 |

2015 |

Change |

Change |

2016 |

2015 |

Change |

Change |

|

LKR '000 |

LKR '000 |

LKR '000 |

% |

LKR '000 |

LKR '000 |

LKR '000 |

% |

| Net fee and commission income |

2,253,226 |

2,016,260 |

236,966 |

12 |

3,046,132 |

3,156,841 |

(110,709) |

(4) |

| Net gains from trading |

982,123 |

1,088,464 |

(106,341) |

(10) |

982,123 |

1,088,464 |

(106,341) |

(10) |

| Net gains from financial investments |

211,370 |

262,048 |

(50,678) |

(19) |

440,748 |

493,739 |

(52,991) |

(11) |

| Other operating income |

1,216,770 |

1,320,691 |

(103,921) |

(8) |

347,296 |

744,887 |

(397,591) |

(53) |

Net fee and commission income, which forms a primary source of core banking income, grew by 12% over the previous year. This growth was mainly due to the increase in the volumes of the fee generating assets and liability portfolios of the Bank.

At a Group level, net fee and commission income was reduced by 4% over the year 2015. The Group’s capital markets cluster, which is primarily fee based businesses, recorded a negative growth in performance due to lower than expected capital markets activity experienced in the country during the year.

Net gains from trading was a 10% decline over the prior year. This income category records income from foreign exchange trading activities and was adversely affected by the low foreign exchange trading opportunities and restrictions that prevailed in the market during the year.

Net gains from financial investments which represent mark to market unrealized and realized gains and losses also recorded a negative growth of 19% over the prior year, primarily due to the increasing interest rate environment that prevailed during the year.

Please refer Note 08 of the Financial Reports section in page 307 for more details.

Other operating income of the Bank was LKR 1,217 million for the year and was a reduction of 8% over the previous year primarily due to the decreased exchange gains from revaluation of retained profits held in foreign currency during the year, as compared with the previous year. At a Group level the reduction in other operating income was 53%, which was due to capital gains realized by the Group on the divestment of its equity securities during the year 2015.

Please refer Note 09 of the Financial Reports section in page 307 for more details.

Impairment for Loans and Receivables and Other Losses

|

Bank |

Group |

|

2016 |

2015 |

Change |

Change |

2016 |

2015 |

Change |

Change |

|

LKR '000 |

LKR '000 |

LKR '000 |

% |

LKR '000 |

LKR '000 |

LKR '000 |

% |

| Impairment on individually significant loans |

1,116,072 |

526,932 |

589,140 |

112 |

1,116,072 |

526,932 |

589,140 |

112 |

| Impairment on collective loan portfolio |

277,097 |

150,673 |

126,424 |

84 |

277,097 |

150,673 |

126,424 |

84 |

| Capital write offs/ (recoveries) |

(14,483) |

34,228 |

(48,711) |

(142) |

(14,483) |

34,228 |

(48,711) |

(142) |

| Provisions/(reversals) of investments in subsidiaries |

(11,733) |

– |

(11,733) |

(100) |

45,887 |

34,312 |

11,575 |

34 |

| Total impairment for loans and receivables and other losses |

1,366,953 |

711,833 |

655,120 |

92 |

1,424,573 |

746,145 |

678,428 |

91 |

The Bank recorded an impairment charge of LKR 1,367 million for 2016. This compares with an impairment charge of LKR 712 million in 2015, an increase of 92%.

Impairment on individually significant loans increased by 112% whilst the impairment on collective loan portfolio increased by 84% to LKR 1,116 million and LKR 277 million respectively as compared with the prior year. The increase in the charge for impairment on individually significant loans during the year was mainly attributable to one-off specific provisions made for a few individually significant customers, based on sound judgment and objective evidence as per the Bank’s impairment policy. The increase in the impairment on collective loan portfolio was mainly due to the increase in the lending portfolio of LKR 19 billion over the previous year.

Percentage of impairment allowance against gross loans and receivables of the Bank was 2.58% as compared with 2.52% as at 31 December 2015.

| LKR million |

2016 |

2015 |

| Impairment allowance for loans and receivables to other customers |

6,039 |

5,410 |

| Gross loans and receivables to other customers |

233,679 |

215,012 |

| Percentage of impairment allowance (%) |

2.58 |

2.52 |

Improving the NII to

net fee and commission

income ratio is a key

priority for the Bank,

whilst harnessing

the cross selling

opportunities available

through the Group

companies.

Total Operating Expenses

|

Bank |

Group |

|

2016 |

2015 |

Change |

Change |

2016 |

2015 |

Change |

Change |

|

LKR '000 |

LKR '000 |

LKR '000 |

% |

LKR '000 |

LKR '000 |

LKR '000 |

% |

| Personnel expenses |

3,434,550 |

3,204,228 |

230,322 |

7 |

3,792,590 |

3,633,627 |

158,963 |

4 |

| Other expenses |

3,014,294 |

2,845,350 |

168,944 |

6 |

3,366,359 |

3,196,253 |

170,106 |

5 |

| Total operating expenses |

6,448,844 |

6,049,578 |

399,266 |

7 |

7,158,949 |

6,829,880 |

329,069 |

5 |

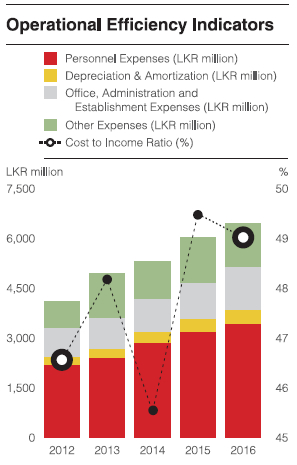

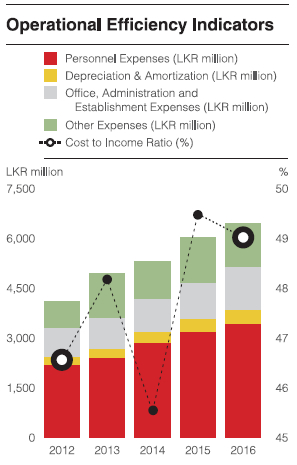

Total operating expenses of the Bank of LKR 6,449 million, grew by 7% whilst the Group total operating expenses of LKR 7,159 million grew by 5% over the prior year. Personnel expenses, which form the greater portion of total operating expenses, grew by 7% over the year. The increase in personnel expenses is due to the 7% increase in workforce of the Bank and the annual increments awarded to staff members. The Bank also increased its network by 11 branches during the year, which largely accounts for the increase in the workforce. At a Group level, the increase in operating expenses was only 5% due to the low scale of operations in the group companies compared to the previous year.

The reasonable growth levels in costs during the year 2016, affirms that ‘operational efficiency and cost optimization’, remain a key strategic focus of the Bank and the group companies in maximizing returns to shareholders.

Operating Efficiency

The cost to income ratio (CIR) of the Bank was 49.0% as compared to 49.6% for the year 2015. The Bank is still in an investment phase, targeting a higher market share. It is expected that the Bank’s CIR would improve

with the relatively new branches of the Bank improving their efficiency levels within the next few years. The average break-even duration for a new branch is approximately 18 months to 24 months. Depicted is a trend of the composition of key costs of the Bank and the CIR over the past five years.

Profit Before Taxation

The Bank’s profit before tax on financial services of LKR 5,335 million, declined by 2% over the prior year. The negative variance was primarily due to the higher impairment provisions made during the year compared to the prior year.

Higher impairment provisions, together with the less than anticipated performance of group companies resulted in the Group profit before tax on Financial Services of LKR 5,094 million declining by 11% over the prior year.

Profit Attributable to Shareholders (PAS)

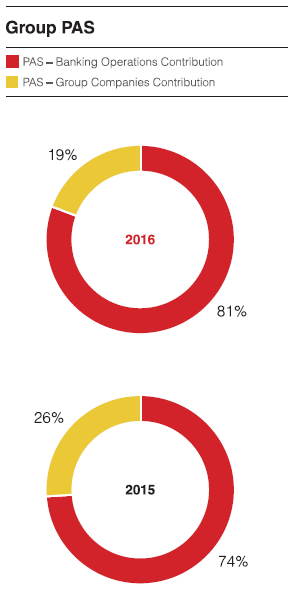

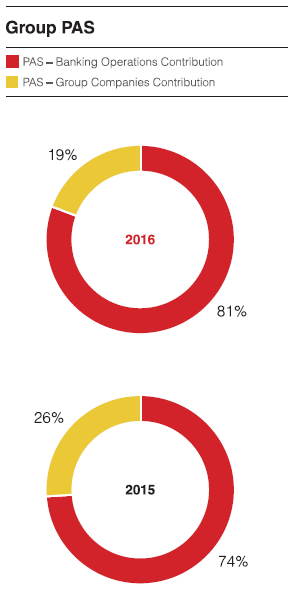

Group PAS for the year was LKR 2,691 million, a reduction of 24% over the prior year due to the key reasons explained above. The composition of banking profits and the profits from group companies are depicted below. The improvement in banking profits was a result of increase in scale of operations during the year coupled with sustained interest margins and effective cost management.

|

2016 |

2015 |

| PAS – Banking operations contribution |

81% |

74% |

| PAS – Group companies contribution |

19% |

26% |

Total Comprehensive Income for the Year

|

Bank |

Group |

|

2016 |

2015 |

Change |

Change |

2016 |

2015 |

Change |

Change |

|

LKR '000 |

LKR '000 |

LKR '000 |

% |

LKR '000 |

LKR '000 |

LKR '000 |

% |

| Profit for the year |

3,170,271 |

3,511,431 |

(341,160) |

(10) |

2,814,959 |

3,670,095 |

(855,136) |

(23) |

| Total other comprehensive income |

(475,083) |

(513,191) |

38,108 |

(7) |

(496,504) |

(385,936) |

(110,568) |

29 |

| Total comprehensive income for the year |

2,695,188 |

2,998,240 |

(303,052) |

(10) |

2,318,455 |

3,284,159 |

(965,704) |

(29) |

The total other comprehensive income was a loss of LKR 475 million as compared to a loss of LKR 513 million for the prior year. The losses are primarily due to the mark to market unrealized losses on the Bank’s investment portfolio classified as ’Available-for-Sale‘. These investments are maintained for liquidity purposes and have positively contributed to net interest income due to increasing interest rate environment experienced during the year.

Accordingly the total comprehensive income for the year for the Bank and the Group was LKR 2,695 million and LKR 2,318 million respectively.

Balance Sheet Analysis

|

Bank |

Group |

|

2016 |

2015 |

Change |

Change |

2016 |

2015 |

Change |

Change |

|

LKR '000 |

LKR '000 |

LKR '000 |

% |

LKR '000 |

LKR '000 |

LKR '000 |

% |

| Total assets |

334,544,735 |

309,157,605 |

25,387,130 |

8 |

340,731,768 |

315,353,733 |

25,378,035 |

8 |

| Loans and receivables |

227,639,844 |

209,602,069 |

18,037,775 |

9 |

227,679,939 |

209,665,561 |

18,014,378 |

9 |

| Investments |

80,597,224 |

73,876,707 |

6,720,517 |

9 |

84,436,804 |

77,257,188 |

7,179,616 |

9 |

| Total liabilities |

309,799,685 |

286,456,747 |

23,342,938 |

8 |

309,718,472 |

285,953,016 |

23,765,456 |

8 |

| Customer deposits |

203,866,547 |

184,933,230 |

18,933,317 |

10 |

203,515,828 |

184,152,280 |

19,363,548 |

11 |

| Debt securities issued and other borrowed funds |

59,233,264 |

60,527,844 |

(1,294,580) |

(2) |

59,233,264 |

60,497,844 |

(1,264,580) |

(2) |

| Subordinated term debts |

19,446,501 |

19,573,883 |

(127,382) |

(1) |

19,446,501 |

19,573,883 |

(127,382) |

(1) |

| Total equity to equity holders of the Bank |

24,745,050 |

22,700,858 |

2,044,192 |

9 |

29,936,587 |

28,382,204 |

1,554,383 |

5 |

Total Assets

Total assets of the Bank reached LKR 334 billion, an increase of LKR 25 billion (or 8%) over the prior year. Assets growth for the year was somewhat slower compared to prior years. However, moderated asset growth was anticipated for 2016 in the aftermath of an aggressive asset growth achieved by the Bank of 18% and 31% in 2015 and 2014 respectively.

Return on assets (ROA) of the Bank for 2016 was 1%. This in part reflects the deployment of the Bank’s assets in generating returns to our shareholders. The Bank is focused on increasing its ROA to over 1.5% levels.

The Group total assets also grew by 8% to reach LKR 341 billion over the prior year, with total assests of the group companies contributing LKR 6 billion as at 31 December 2016.

Loans and Receivables

Loans and receivables of the Bank, after setting off impairment allowances as at end 2016, was LKR 228 billion, a 9% growth over the prior year. The growth in loans and receivables was also moderated during 2016 (compared to the 20% increase recorded in 2015 and 28% in 2014) partially due to the constrained liquidity position which the market faced during the year. On the other hand, the Bank has been managing its balance sheet structure and funding options, under which the loans and receivables growth is commensurate to the growth on deposits.

The Bank continues to draw strength from its deep rooted competencies in project financing, as reflected in the growth in the PIF portfolio. The relatively low growth reported by the corporate banking portfolio is a reflection of the intended strategy of the Bank where the focus is shifted towards expanding the retail and SME portfolio.

On a product base analysis of the loans and receivables, the key contributors for the portfolio growth was long-term loans, overdrafts, trade finance loans and housing loans.

Further analysis on the loans and receivables can be found in Note 25 – Loans and Receivables to Other Customers in page 322 under Financial Reports and in Credit Risk Analytics in page 165 under the Risk Management Report.

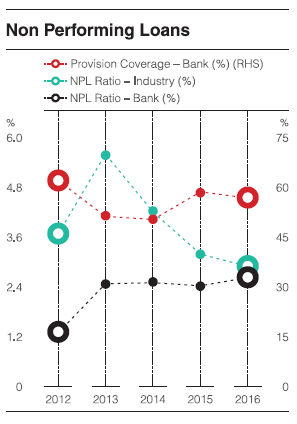

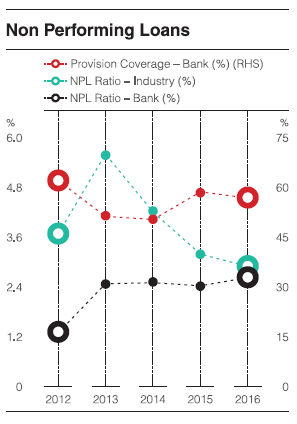

Asset Quality

Asset quality as measured by the gross non-performing loan (NPL) ratio was 2.63% as at 31 December 2016. The well-maintained asset quality of the Bank is a result of the strong loan reviewing, monitoring and recovering process of the Bank, which the Bank has perfected over the years.

The NPL ratio of the Bank has historically been below that of the industry.

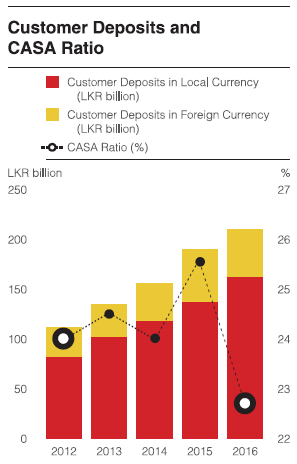

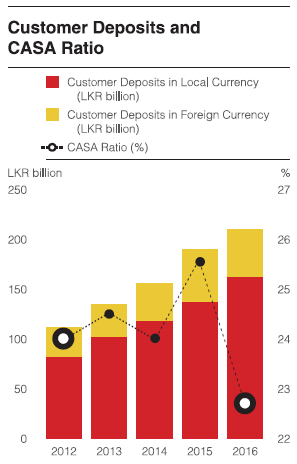

Customer Deposits

The Bank’s customer deposits grew by 10% over the prior year, reaching LKR 204 billion, and crossing the LKR 200 billion mark for the first time in the Bank’s history. This landmark in customer deposits was achieved by the Bank in a gratifyingly short period of just over 10 years, since the Bank attained commercial banking status in 2005.

Within the total customer deposits, the rupee deposit base accounted for 78% and the foreign currency deposit base accounted for 22% as compared to 72% and 28% respectively as at 31 December 2015. The positive shift in the rupee deposit base is in line with the Bank’s expanding branch network.

The CASA ratio for the Bank was 22.7% and is relatively low compared to the banking industry averages.

Increasing the Bank’s CASA ratio from its current level is a key strategic priority for the Bank. Improving CASA remains a challenge to the Bank as well as the industry at large in an increasing interest rate environment, as depositors’ preference largely skews towards time deposits. This skewness is further augmented by the considerable interest rate gap that prevails between the savings and time deposits in the Sri Lankan banking and non-banking sphere, which will also pressurize the NIMs in the industry.

More details on customer deposits are available on Note 37 – Due to other customers in page 341 under Financial Reports section.

Capital Adequacy

|

Bank |

Group |

|

2016 |

2015 |

2016 |

2015 |

| Eligible Tier I capital – LKR million |

22,404 |

20,018 |

29,108 |

27,154 |

| Eligible Tier II capital – LKR million |

8,749 |

9,596 |

9,376 |

10,262 |

| Capital base (Tier I + Tier II) – LKR million |

31,153 |

29,614 |

38,484 |

37,416 |

| Tier I capital adequacy ratio (%) |

9.31 |

8.51 |

11.55 |

11.07 |

| Tier I & II capital adequacy ratio (%) |

12.95 |

12.59 |

15.27 |

15.25 |

Bank's Tier I capital adequacy ratio for 2016 was 9.31% whilst its total capital adequacy ratio was 12.95%. The same ratios for the Group were 11.55% and 15.27% respectively and are well above the regulatory minimum levels of 5% and 10% respectively, as specified by the Central Bank of Sri Lanka. The Bank is preparing for the migration to the BASEL III compliance requirement in July 2017. In this preparation process, infusion of fresh capital to support the Bank’s growing franchise is a key strategic priority, which the Bank will pursue during 2017.

Currently, the Bank remains well within the new regulation requirement proposed by the Fiscal Budget of the Government for 2017 on the minimum capital of commercial banks of LKR 20 billion.

Please refer pages 186 to 189 under the Risk Management Report for a detailed calculation of the Bank’s and Group’s capital adequacy levels.

Liquidity

The Bank maintained its liquidity levels well above the statutory requirements during the year. In addition, the Bank maintains liquidity levels to meet the customers’ demands for deposits at any given point of time. Liquid assets are deployed, taking into account the profitability implications as well.

The statutory liquid ratios for DBU and FCBU were 21.50% and 22.93% respectively as at 31 December 2016 and were well above the minimum regulatory requirement of 20%.

The Bank also maintains the Liquidity Coverage ratio stipulated under BASEL III guidelines which was, 125.63% for all currency liquidity and 142.53% for the rupee liquidity as at 31 December 2016. The ratios are well within the minimum stipulated ratio of 70% for the year 2016.

Total Shareholder Returns

Total shareholder equity comprising of capital, statutory reserve fund, retained earnings and other reserves as at end 2016 was LKR 24.7 billion at the Bank level and LKR 30.0 billion at the Group level. The Bank’s shareholder equity recorded a 9% growth over the prior year. The movement in same can be further analyzed by referring the Statement of Changes in Equity available in the pages 290 to 293 of the Financial Reports section.

The Bank’s return on average shareholders' funds (ROE) for the year ended 31 December 2016 was 13.36% with earnings per share (EPS) of LKR 19.19. The same measures for the Group were 9.23% and LKR 16.29 respectively.

Share Price and Market Capitalization

The NDB share closed trading at LKR 156.00 at the end of the year and the Market Capitalization was LKR 25.8 billion.

Please refer pages 128 to 150 under the Investor Relations for a detailed analysis of the performance of the Bank’s share and other the key investor performance indicators during the year 2016.

Improving the NII to net fee and commission income ratio is a key priority for the Bank, whilst harnessing the cross selling opportunities available through the Group companies.

Economic Value Added

Economic value defined: Economic Value Addition (EVA) is the excess value created over the required return of the Bank’s investors who comprise shareholders and debtholders. EVA is a measurement of profit distinct from that of financial profit.

| For the year ended 31 December |

2016 |

2015 |

2014 |

2013* |

2012 |

|

LKR million |

LKR million |

LKR million |

LKR million |

LKR million |

| Invested equity |

|

|

|

|

|

| Total equity |

24,745 |

22,701 |

22,238 |

19,620 |

14,942 |

| Add: Allowance for impairment charges for loans and receivable and other losses |

6,134 |

5,517 |

5,121 |

4,379 |

2,972 |

| Total |

30,879 |

28,218 |

27,359 |

23,999 |

17,914 |

| Earnings |

|

|

|

|

|

| Profit after tax and dividend on preference shares |

3,170 |

3,511 |

3,418 |

7,723 |

2,924 |

| Add: Impairment for loans and receivables and other losses |

1,367 |

712 |

566 |

1,238 |

106 |

| Less: Loan losses written off |

14 |

(34) |

(64) |

(76) |

(67) |

| Total |

4,551 |

4,189 |

3,920 |

8,885 |

2,963 |

| Cost of equity (Based on 12 months weighted average T-bill rate plus 2% for risk premium) |

11.94% |

8.63% |

10.24% |

12.63% |

14.02% |

| Cost of average equity |

3,528 |

2,398 |

2,630 |

2,647 |

2,357 |

| Economic value added |

1,023 |

1,791 |

1,291 |

6,238 |

607 |

*The one-off equity income of LKR 6,031 million in 2013 is included.

Financial Value Added

The Bank creates value through the banking and non-banking activities that it carries out. After the cost of services and impairment charges for loans and receivables, the remaining value is available for distribution to the key stakeholder groups that partner with the Bank. A portion of the value created is retained within the Bank to be invested for expansion and growth.

| For the year ended 31 December |

2016 |

2015 |

2014 |

2013 |

2012 |

|

LKR million |

Change

% |

LKR million |

Change

% |

LKR million |

Change

% |

LKR million |

Change

% |

LKR million |

Change

% |

| Value added |

|

|

|

|

|

|

|

|

|

|

| Income from banking services |

32,290 |

|

24,924 |

|

24,518 |

|

23,556 |

|

19,448 |

|

| Cost of services |

(20,399) |

|

(14,250) |

|

(13,998) |

|

(15,858) |

|

(13,038) |

|

| Value added by banking services |

11,891 |

|

10,674 |

|

10,520 |

|

7,698 |

|

6,410 |

|

| Non-banking income |

992 |

|

931 |

|

444 |

|

6,100 |

|

754 |

|

| Impairment for loans and receivables and other losses |

(1,367) |

|

(712) |

|

(566) |

|

(1,238) |

|

(106) |

|

| Total |

11,516 |

|

10,893 |

|

10,398 |

|

12,560 |

|

7,058 |

|

| Distribution of value added |

|

|

|

|

|

|

|

|

|

|

| To employees |

|

|

|

|

|

|

|

|

|

|

| Salaries and other benefits |

3,435 |

30 |

3,204 |

29 |

2,873 |

28 |

2,389 |

19 |

2,173 |

31 |

| To providers of capital |

|

|

|

|

|

|

|

|

|

|

| Dividends to equity holders |

654 |

|

1,815 |

|

1,978 |

|

3,222 |

|

657 |

|

| Interest to debenture holders |

2,255 |

|

1,840 |

|

1,378 |

|

95 |

|

– |

|

| Total to providers of capital |

2,909 |

25 |

3,655 |

34 |

3,356 |

32 |

3,317 |

26 |

657 |

9 |

| To Government |

|

|

|

|

|

|

|

|

|

|

| Income tax |

1,003 |

|

872 |

|

1,213 |

|

854 |

|

1,023 |

|

| Financial Services VAT |

904 |

|

770 |

|

882 |

|

911 |

|

622 |

|

| Nation Building Tax |

144 |

|

140 |

|

147 |

|

– |

|

– |

|

| Corporate Insurance Levy |

30 |

|

23 |

|

24 |

|

77 |

|

– |

|

| Super gain tax |

– |

|

732 |

|

– |

|

– |

|

– |

|

| Total Government |

2,081 |

18 |

2,537 |

23 |

2,266 |

22 |

1,842 |

15 |

1,645 |

23 |

| For expansion and growth |

|

|

|

|

|

|

|

|

|

|

| Retained profit |

2,516 |

|

964 |

|

1,440 |

|

4,501 |

|

2,267 |

|

| Depreciation/amortization |

435 |

|

370 |

|

323 |

|

302 |

|

265 |

|

| Deferred taxation |

113 |

|

154 |

|

127 |

|

194 |

|

38 |

|

| Total for expansion and growth |

3,065 |

27 |

1,488 |

14 |

1,890 |

18 |

4,997 |

40 |

2,570 |

36 |

| To community investments |

|

|

|

|

|

|

|

|

|

|

| Donations |

27 |

|

8 |

|

13 |

|

14 |

|

13 |

|

| Total to community |

27 |

0 |

8 |

0 |

13 |

0 |

14 |

0 |

13 |

1 |

| Total distributed |

11,516 |

100 |

10,893 |

100 |

10,398 |

100 |

12,560 |

100 |

7,058 |

100 |

Our well diversified customer base is served through an amalgam of dedicated and specialized business units. The contribution of the business units to the overall performance of the Bank are discussed in the section that follows.

Performance of Business Units

Commercial Banking

The Corporate Banking Division, which contributes 55.4% of the Bank’s asset base and 25.8% of its net revenue, encapsulates two main arms, development banking and commercial banking. The services offered, which include a wide range of products, are targeted to satisfy both the short and long-term needs of corporate customers. The focus of the development banking activities is mainly on project and infrastructure financing.

Strategic Focus

The commercial banking arm specializes in providing working capital solutions to the large and medium size corporate enterprises, and the Bank has evolved in a short span of time to become one of the major players in this domain. The expertise the Bank has built-up in commercial banking, project and infrastructure financing, cash management coupled with Islamic Banking has positioned it to offer a unique selling proposition in these lines of business. The unit has also supported Sri Lankan companies to venture overseas including countries such as Maldives, Cambodia, Bangladesh and Uganda.

The Bank always endeavours to align its policies with national growth strategies. Accordingly the Bank’s commercial lending during the year was concentrated in sectors such as construction/property development, agriculture (including tea, paddy and related crops), Business Process Outsourcing (BPO) and tourism. However, we did not confine our lending to the large and medium sectors. By facilitating solutions down the entire value chain, through the Distributor Financing and Supplier Financing portfolio, our branch network was able to indirectly reach the rural sector.

Performance

In today’s fast moving commercial environment the needs of customers are also dynamic. The Commercial Banking Unit, while maintaining traditional products, has to constantly innovate to keep pace. Products include import and export, guarantees, overdraft, short-term loans and advanced treasury products. During the year the Unit’s highly qualified and professional management team, whose skills were topped up with our seamless processes, were able to consolidate the existing portfolio and selectively acquire new customers.

During the year the Bank had to contend with severe competition, not to mention the challenging economic and political environment. In this context, the strategic challenge for the division was to strengthen the relationships while adapting to the changes in the external environment. Despite the unfavourable milieu, the Division was able to consolidate the portfolio and improve profitability. The net interest margins remained stable and fee based income recorded 33% of net revenue which helped sustain overall profitability.

There is a fairly equitable balance in the Corporate Banking asset portfolio between foreign and local currency loans and advances. Declining exports in the apparel industry, the EU ban on Sri Lankan seafood and drop in tea production adversely affected exports. The Commercial Banking asset portfolio was rationalized during the year, whilst its own liability portfolio accounting for 54% of its funding requirement. The CASA ratio was maintained at a very commendable level of 28.2%. The Unit’s revenue recorded modest growth of 8% in 2016.

| KPI |

2016

LKR million |

2015

LKR million |

YoY Change |

| Total operating income |

3,047 |

2,816 |

8% |

| Profit before tax |

1,375 |

968 |

42% |

| Profit after tax |

812 |

581 |

40% |

| Non-performing loans |

2,039 |

2,081 |

-2% |

| Cost to income ratio |

27.9% |

27.7% |

– |

| Total loans and receivables |

74,483 |

78,884 |

-6% |

An unfortunate result of the adverse macroeconomic factors has been that our Commercial Banking non-performing loan (NPL) ratio marginally increased to 2.7% from 2.6% in 2015. However, despite this, the NPL percentage remains within acceptable industry standards. It is noteworthy that the NPL ratio of our Commercial Banking portfolio has shown a healthy average of below 3% for over five years. Excellent credit origination methods and proactive administration procedures have helped mitigate the impact of an adverse environment. Adaptation of LKAS 36 on ‘Impairment of Assets’ on a monthly basis has also helped in timely identification of vulnerable situations and taking remedial actions when required.

Outlook

Along with the overall financial services sector of the country the Bank seeks to adapt its business model to accommodate the changes that took place in the micro as well as the macro environment.

We wish to capitalize on the opportunities in growth sectors such as logistics, construction, tourism and agro business which have been bolstered by concessions granted to these sectors in the 2017 Budget and Government Policy. Revised economic policies of the Government and the more favourable climate regarding international relations

have opened up opportunities for off shore lending and attracting more foreign direct investments (FDI) into the country. The present trend of diminishing interest rates and net interest margins being squeezed as a result, makes it imperative to boost fee based income.

Geared by ISO 9001: 2008-Certified Corporate Banking and Trade Finance Departments, growing portfolio of Islamic Banking business, an electronic banking system leveraging cutting edge technology and an expanded correspondent banking network the Bank's Commercial Banking business looks forward to 2017 with optimism.

Cash Management Unit

Towards the end of year 2015, Cash Management unit was repositioned within the Corporate Banking unit in order to further strengthen the corporate transaction business, whilst continuing to provide its services to the Retail & SME and the Bank’s subsidiaries for domestic and cross border payments.

The scope of the Cash Management unit covers the areas of corporate electronic banking, managing of Corporates, financial and institutional relationships, the Chinese Desk and the collection & payments of capital market transactions.

The online banking platform has been further upgraded to serve its Corporate and SME clients to better manage their payments and documentary credits electronically, during the year 2016. As a result of these efforts, during 2016 the Bank was successful in increasing its Corporate Electronic Banking network by over 42%, with a throughput increase in transactions by 36%. We anticipate this trend to continue and the electronic banking delivery will be a key element of our strategy in ‘brick walling’ our clients and attracting new clients.

Further the unit was able to execute many Escrow deals during the year 2016.

During the year, the Cash Management Unit successfully tied up with the EPF Department for straight through EPF settlement. This enabled the Corporates to settle their EPF payments online. EPF Settlement System (ESS) has been fully integrated with the online web services of the EPF department of the Central Bank of Sri Lanka; the Bank has achieved another milestone as the first bank in Sri Lanka to implement the fully online integrated system for EPF.

In the year 2016, the Cash Management Unit continued to serve as the banker for many capital market transactions.

Further, the unit has been able to strengthen its Chinese business arm and penetrate many of the large to small business entities of the Chinese business segment. The Chinese desk exclusively caters to multiple banking needs of the Chinese business community and has managed to create a unique value proposition in order to capture Chinese industry giants. Significant revenue growth has been recorded along with high customer acquisition.

Project and Infrastructure Financing

Strategic Focus

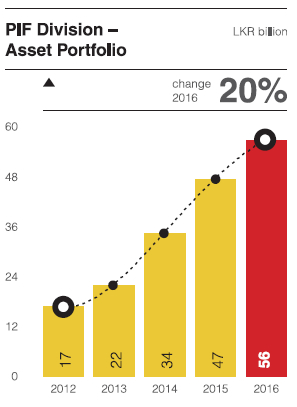

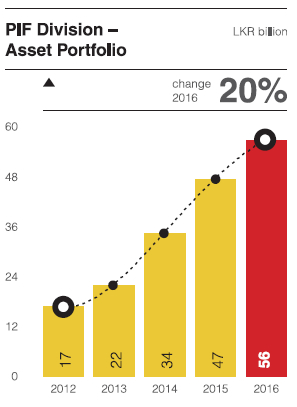

The Project and Infrastructure Finance Division (PIF) executed some key strategic initiatives during 2016 and was able to reap the results during the year. Consolidating the path followed in 2015, the division focused on achieving a profitable balance sheet growth through off shore lending to overseas projects of both Sri Lankan companies and overseas companies. In addition it sought to diversify the portfolio into growth sectors such as construction and power and energy. The focus on domestically funded infrastructure projects was also continued.

Despite constraints arisen from restricted liquidity in the banking system resulting in increasing the cost of funds and stiff competition from other banks offering project financing, PIF achieved an impressive asset growth of 20% during the year. With the rising interest rates during the year, coupled with variable interest rates on assets, PIF division was able to achieve a higher revenue in 2016.

Key Strengths

From its inception, PIF has built trusting and long lasting relationships with its clients through a deep understanding of their business needs. The unit is driven by multi-disciplinary professionals who are well-qualified and experienced. Our organizational knowledge, built over the years through experience in various industries and overseas countries makes NDB PIF the financial partner of choice for companies who are looking for long-term financing. In addition to our core products, we also offer our customers advisory services in legal and certain technical aspects making the Bank's PIF unit, not a mere financier but a valued partner.

Performance

Key outcomes as at end December 2016 of the above strategic initiatives ensured that the unit achieved the following growth.

PIF has sustained a healthy growth in asset portfolio in the last three consecutive years, recording a compounded annual growth rate of 37% which is remarkably above the industry growth rate.

For the second consecutive year PIF has won the award for ‘The Best Domestic Project Finance Bank of the Year’ at Asian Banking and Finance, Wholesale Banking Awards ceremony. This is a tribute to the role the Bank has played in the Project and Infrastructure Financing arena and shows that it is well positioned to become a dominant player in the Sri Lankan long-term financial services market.

Products on Offer

The Bank's PIF division offers the following long-term financial solutions to its customers.

- Long-Term Loans (in both LKR and Foreign Currencies)

- Islamic Banking Long-term financing products (in both LKR and Foreign Currencies)

- Lease Facilities for Corporates

- Securitization of Future Tea Sales

- Securitization of Lease and Hire Purchase Receivables

- Investments in Listed Rated Debentures

- Investments in Listed Preference Shares

- Offering services as Arranger, Lead Bank in syndications

Overseas lending activities have contributed to 9.6% of the total assets of the PIF as at 31 December 2016.

PIF – KPIs

| KPI |

2016 |

2015 |

YoY Change |

|

LKR million |

LKR million |

% |

| Total operating income |

815 |

719 |

13 |

| Profit before tax |

178** |

642* |

-72 |

| Profit after tax |

136 |

407 |

-67 |

| Non-performing Assets |

862 |

176 |

390 |

| Cost to income ratio |

37% |

38% |

– |

| Total loans and receivables (Including Investments) |

55,909 |

46,709 |

20 |

*Includes a provision reversal of LKR 196 million

**Resultant of provisions of LKR 336 million

NPL Situation weakened due to two instances of company specific issues.

Achievements in Year 2016

PIF's major achievements in the year 2016 were:

- Acted as the lead bank for a syndicated facility to finance the development of a major mixed development project, which will greatly enhance the skyline of Colombo in the years to come.

- Spearheaded financing Sri Lankan companies investing in overseas energy projects, particularly in the East African region, by approving a facility to a mini hydro power project in Uganda. This was also in line with the Bank’s emphasis on renewable sources in power generation

- Approved facilities to Cambodian financial institutions

The Bank wishes to place emphasis on the alternative renewable sector in power generation and has been working closely with its customers on a number of renewable energy projects locally but importantly in the East African region.

Outlook

Low net interest margins have created a need to improve the percentage of fee based income and tight controlling of costs. Further there is a need to source funds to match long tenure accommodations. PIF recognizing these opportunities in adversity, proposes to face the challenge by exploring high yielding lending opportunities, enabling it to maintain the asset growth momentum of the past.

PIF will also continue to explore new avenues in the domestic market in order to grow the asset portfolio. In line with its environmental consciousness, PIF intends to continue financing power projects that utilize renewable sources, thereby minimizing carbon footprint.

Retail Banking

The Bank has evolved from being a predominantly development bank prior to 2005, to also being a robust retail bank which it is today. The Bank’s personal loan product, 'Dream Maker', has been a major driver in this process, and has secured the leading position in the market. Overall, the Bank has also secured a commendable share of the retail banking market.

Strategic Focus

To increase the Bank’s reach by the widening of the Branch Network, broad basing retail banking, increased cross selling and promoting products. To further push e-statement and mobile banking to keep the Bank abreast in this digital era.

Performance

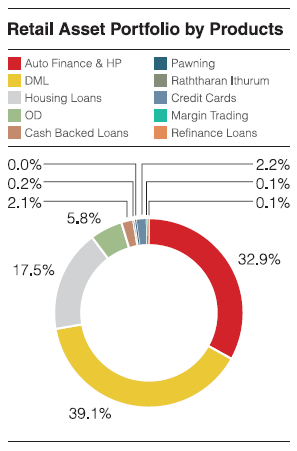

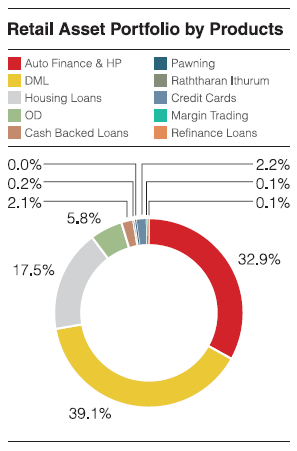

During the year under review the retail banking assets remained flat at LKR 54 billion which is a marginal drop from LKR 55 billion in 2015. This has been achieved despite strong loan recoveries in excess of LKR 12 billion during the year. The overall assets were hampered by an increase in interest rates, and the consequent drop in lending. The personal loan product Dream Maker Loans (DML), accounted for 39% and the largest share of the Bank’s retail asset portfolio and had a healthy NPL ratio of 1.56%. Leasing accounted for 33% and had the second largest share with a NPL ratio of 2.31% while housing loans was in third place with 18% and 1.2% respectively.

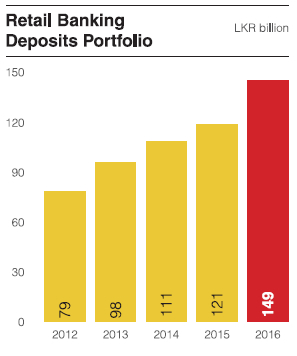

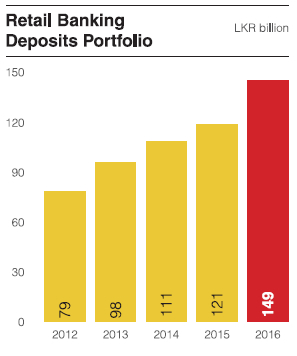

The Bank’s deposit rates in the first half of the year were adversely affected by the low interest rates in the market. Even though the deposits picked up in the latter part of the year with the increase in term deposit rates the growth momentum that was hoped for could not be achieved. At the end of 2016 a growth of 23% has been recorded mainly through the term deposits.

Retail Banking – KPIs

|

2016 |

2015 |

YoY Change |

| KPI |

LKR million |

LKR million |

% |

| Total operating income |

4,293 |

3,574 |

20 |

| Profit before tax |

252 |

17 |

1,423 |

| Profit after tax |

145 |

10 |

1,363 |

| Non-performing loans |

978 |

991 |

-1 |

| Cost to income ratio |

91% |

102% |

– |

| Total loans and receivables |

53,497 |

55,140 |

-3 |

The CASA numbers remain the same; however a drop in the ratio is attributable to the rapid increase in term deposits when compared to the last quarter of 2015.

Outlook

The retail banking outlook for the Bank remains strong with the Bank identifying growth opportunities in credit cards and mobile banking which will compliment the strong franchises in leasing, personal loans and housing. Consequently the Bank is expected to significantly improve its margins and fee income.

The Bank is also focussing in improving its deposit and CASA base using the branch network and new product developments.

Retail Banking – Alternate Channels

Strategic Focus

The alternate channels team was established with a view to porting the conventional banking arena to a digital platform. This initiative has been very successful with the team driving the innovative products and penetrating the emerging market space of e-commerce.

Performance

Mobile Banking

The Bank has broken into the local e-commerce market with its innovative mobile banking solution. This revolutionary application features a multitude of user friendly payment modes and trailblazing features giving it a unique selling point in the financial services industry. The value addition the Bank has achieved by this application is passed onto customers of varying social levels.

The mobile banking app is also referred to as 'shake banking', given various options it make available to the user, at the shake of the phone. This has become increasingly popular due to its convenience as well as its entertainment aspect. At the South Asian Excellence Awards where the Bank won awards for ‘Best Use of Mobile Technology in the Banking Sector’ and ‘Best Use of Mobile Technology in Financial Services’, the unique selling points of our mobile products were recognized. Further the app was bestowed ‘The Most Admired Mobile App’ by the Asia Pacific Customer engagement forum; endorsing the giant leap it has achieved in its digital journey.

E-statements

Routine banking procedures have also been upgraded through technology. Bank statements have been converted into the individual and corporate ‘life style e-statements’ which are smart interactive e-statements.

Off-Site ATMs

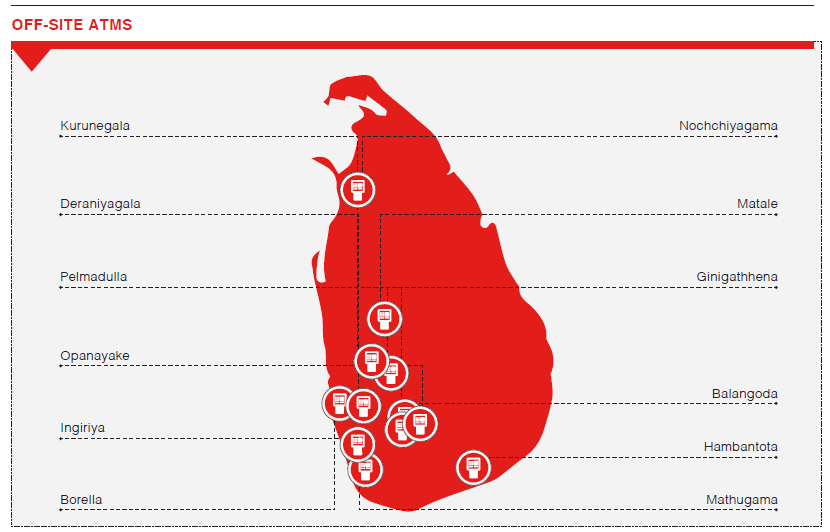

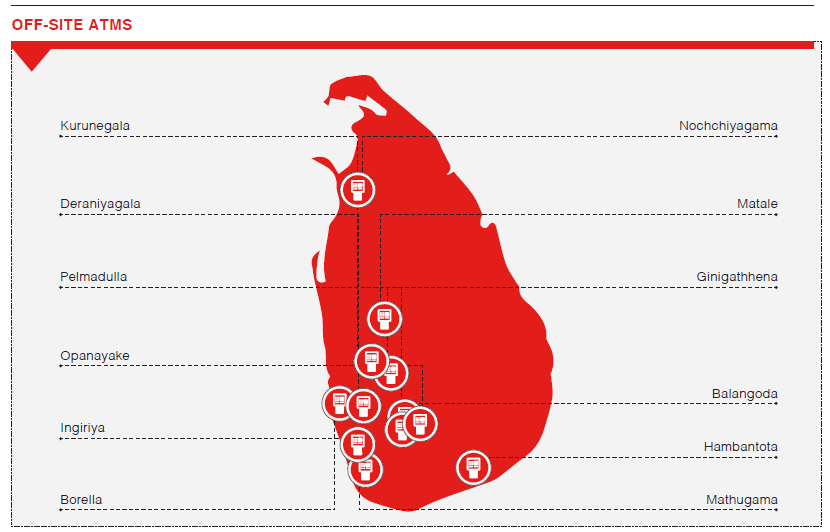

The Bank has increased customer accessibility by positioning ATMs at strategic locations in the suburbs, while delivering additional touch points to the existing customer base. In the midst of an emerging digital zone the traditional transaction modes are still lucrative in non-urban areas. The Bank’s attempt to advance the rural community to the formal banking sector was put to action by installing ATMs at Nochchiyagama, Kurunegala and Mathugama this year enhancing the off-site ATMs to a total of 12.

SME Banking

In Sri Lanka, as in many developing and emerging economies, small and medium enterprises are the backbone of the economy and their role is vital to jump-starting the economy. Recognizing this, the Bank has from its inception responded to the needs of the SME sector by giving adequate credit.

Strategic Focus

Strategic decisions have been taken to drive the SME banking with a mindset change. The recent retail and SME integration at all branches, promotes aggressive cross-selling. The changes combine wider distribution/delivery of SME products with centralized processing to reap the economies of scale – which are fundamentals to building a successful and sustainable SME business proposition in the Bank.

Performance

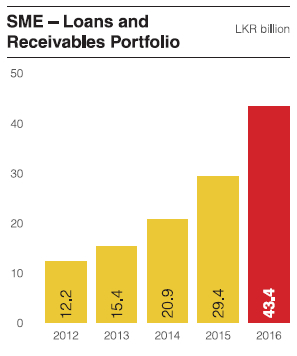

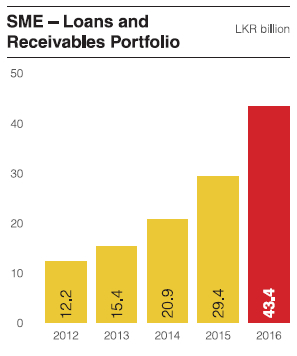

Aligned with national priorities, in the year under review the Bank has extended financial assistance to projects in the key growth sub sectors covering tourism, construction, agriculture, manufacturing and the service sector. Taking into account the anticipated growth levels in the tourism industry, the Bank has geared up to face the anticipated demand for infrastructure development. A large number of SME hotel projects in all regions of the country, including in the Northern and the Eastern provinces, have been assisted. Financing has included both capital expenditure and working capital needs.

SME Asset Growth

SME – KPIs

|

2016 |

2015 |

YoY Change |

| KPI |

LKR million |

LKR million |

% |

| Total operating income |

1,395 |

1,319 |

6 |

| Profit before tax |

576 |

640 |

-10 |

| Profit after tax |

324 |

384 |

-16 |

| Non-performing loans |

1,544 |

1,080 |

43 |

| Cost to income ratio |

46.2% |

36.5% |

– |

| Total loans and receivables |

43,472 |

29,443 |

48 |

Further the Bank has extensively disbursed the available Credit Lines (at concessionary rates) namely, SMILE III and ADB Funding lines mainly to meet the infrastructure development and working capital requirements of the SME sector.

Outlook

The Bank has well identified the dynamics of SME and involves in designing new and innovative approaches for reaching SMEs. Specially designing appropriate products for SMEs and training bank staff to respond to SME needs. The diversity of available financial products is the strength and understanding dynamics help the Bank to give right advice and the right plan at each stage of an SME's life cycle to supports the future success of any SME business.

The Bank will aggressively focus on the growth sectors specially construction, tourism, agriculture service sector and Manufacturing. Special focus will be given to extend the support to exporters of the country which is vital for the country economy.

Micro Finance

Micro finance has emerged in recent times as a major strategy of grassroots development, in emerging and developing economies. The Bank continues to be supportive of micro finance not only for commercial benefit but also for the social value it can generate.

Strategic Focus

During the year micro finance continued its momentum with emphasis on credit quality and risk mitigation. Through the businesses generated by micro finance we empower women and youth, foster environment friendly businesses and otherwise contribute to the country’s development goals. We also strengthened the marginalized section of the economy through non-financial services such as improving financial literacy, management and technical skills training and market linkages. Funding caters to numerous needs ranging from business start-ups, expansions, assets building, working capital requirements and agriculture.

Performance

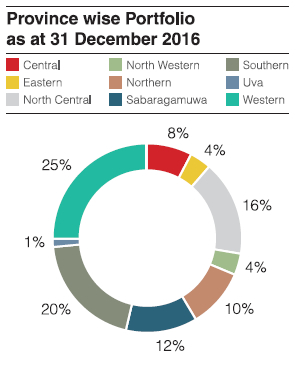

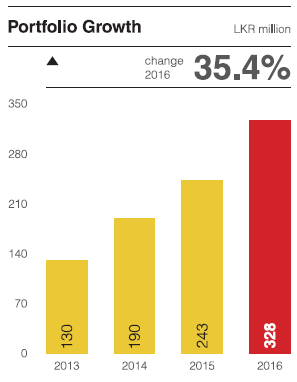

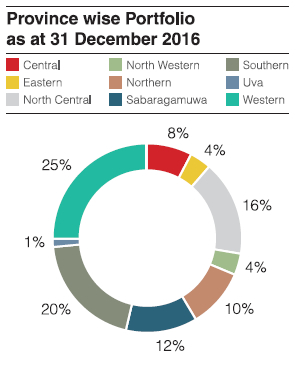

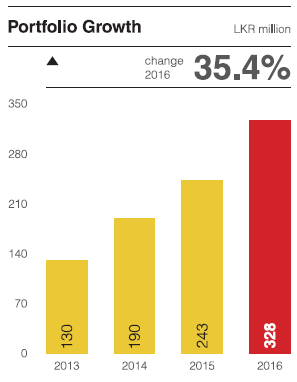

As at end December 2016, the portfolio stood at LKR 328.4 million. Covering 2,334 numbers of clients. Females continued to account for 60% of the micro finance clients. With the passion, commitment and hard work of the staff a YoY growth of 35.4% in the total outstanding loan book has been achieved.

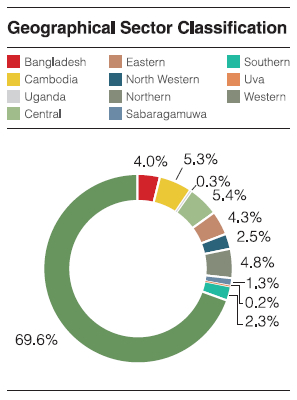

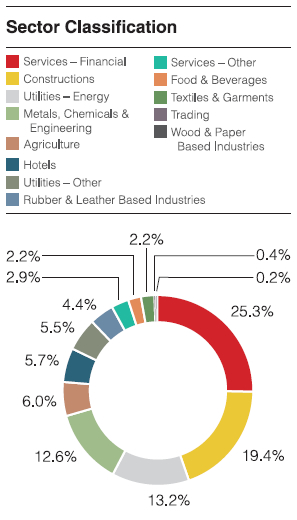

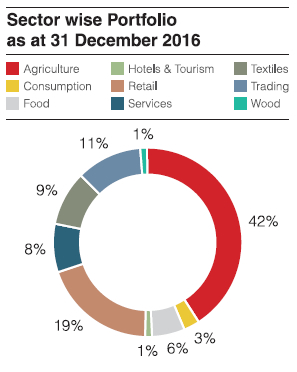

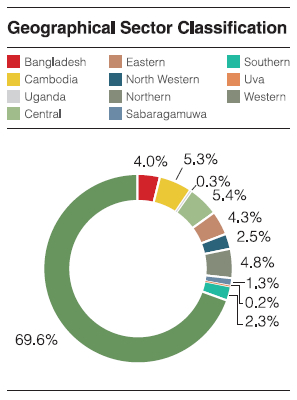

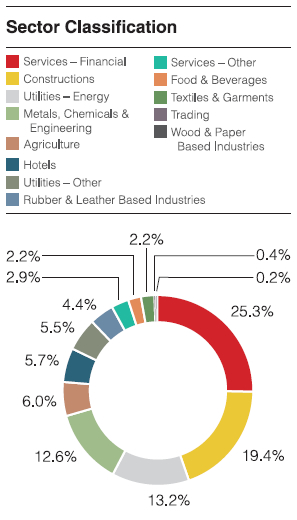

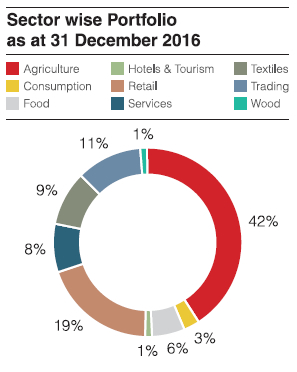

Sector Dispersion and Geographic Dispersion of the portfolio are illustrated below.

The Bank's Micro finance is connected to rural and marginalized sector through various channels. During the year the Bank commenced the following new channels which recorded highest repayments.

01. Lending through Community Based Organizations

The Bank reaches the bottom of pyramid clients through their societies. The Bank lends in bulk to community based organizations which in turn provide credit facilities to their members.

02. Cluster Based Lending

The Bank has adopted the cluster based approach model which is currently being commonly used by micro finance practitioners. Comprehensive assessments and regular follow ups are conducted in order to ensure proper use of loan funds.

The following examples paint a broad picture of the social and economic impact we are creating through our micro finance lending:

a. The Garment Industry is one of the Largest Export Industries in Sri Lanka

The industry unfortunately largely conforms to the stereotypes associated with globalization in manufacturing: low wages and 'flexible' contracts. Most of the workers in this sector are vulnerable, being young, poor, unmarried and having low literacy levels. Many of them continue to be breadwinners of their natal household and send a significant percentage of their earnings back to their rural families. At financial literacy trainings, it has been unearthed that young female garment workers have a poor ability to manage money and exercise control over their own income. To help them surmount the obstacles that they face, the Bank has tailor-made financial literacy programmes; it also provides micro finance loans at affordable fees and conditions to procure personal needs particularly for renovation of their rural homes.

b. Promote Export Agriculture

The export agricultural sector is also provided assistance by enabling them to add value to their products and acquire new technological innovations. The Bank is improving the capacity of growers to meet international food safety and hygiene standards and in the process is boosting the export capabilities of the country. This project is being done in collaboration with the Export Agriculture Department. Further, the Bank provides financial support at concessionary interest rates to adopt best practice and international standards of food handling.

c. Encouraging Organic Seed Paddy Cultivation

Another very socially beneficial micro finance initiative is encouraging organic seed paddy farming in Polonnaruwa through our financial services. The organic seeds provided have been highly praised and identified as a national requirement. The Department of Agriculture is collaborating the project and provides guidance for the cleaning and processing of seeds. Financial services were provided to purchase machinery and for cultivation.

d. Continuous Assistance to Empower Rural Entrepreneurs

Another initiative which has been implemented with Citi Bank and the Ceylon Chamber of Commerce as partners, seeks to promote entrepreneurship at the bottom of the pyramid by connecting with underdeveloped settlements in Dadayamkanda, Embilipitiya. This programme endeavours to bring a banking culture to communities which had no exposure to banking whatsoever hitherto.

Outlook

The micro finance initiative of the Bank has been two fold, i.e. Provision of credit and advances directly aimed at livelihood development under ’Divi Aruna‘ and Empowerment and capacity building initiatives targeted at financial inclusion.

The ’Divi Aruna‘ initiative is aimed at developing livelihood for prospective entrepreneurs who are not within the mainstream of banking. The philosophy also underlies the thinking that, in the economic resurgence that will generate many growth opportunities, with industries like fisheries, agriculture and infrastructure development poised to take off, the improvised and marginalized individuals in the rural sector would miss out, if not given a helping hand at inception. This scheme, which was initiated in June 2010 in the north and the east subsequently expanded to cover other parts of the country synonymous with branch openings and other expansion initiatives.

With the experience gained in engaging the micro finance sector since 2010 the Bank intends to leverage such experiences and systematically grow its business dealings with identified micro finance segments.

In addition, the Bank also aims to promote a savings culture, and to bring the marginalized and the forgotten into the banking stream. The scheme gives the option of saving a specified sum monthly, giving them the confidence to enter the mainstream of banking with value additions such as ATM cards thereby instilling in them a sense of belonging to the community.

Success Story

“I started with very little, but I always try to build on what I know ...”

- S H Sri Jayantha, Badanagala.

S H Sri Jayantha is a man with ‘success story’ written all over him. His hard work and diverse innovative ideas in blacksmith industry have made him one of the most successful entrepreneurs in Polonnaruwa District. He is the pioneer in blacksmith industry in Polonnaruwa and farmers trust his agricultural tools. “Last year, in the Light Engineering division I was awarded the first place in the North Central Province and the third place all-island. As the manual process to heat the steel for forging is a difficult process I had a desire to manufacture an electrical machine for steel forging.

For this purpose I obtained a loan of LKR 500,000 from the NDB Branch office at Kaduruwela. Having repaid this loan, I was able to obtain a further loan of LKR 500,000 to enable me to manufacture forging machines.”

“ A Street Food Vendor at Galle Face Green became a Canteen owner who provides three meals per day for 135 workers.”

- Mrs. Ishari Maduwanthi

Ishari was a street food vendor who commenced her business with one mobile cart at Galle Face Green. A Diviaruna micro finance loan from NDB Bank enabled her to expand to a second mobile cart. With her second loan of LKR 30,000, she purchased yet another mobile cart and developed her finger food business. Ishari’s next target was to own a small hotel and move from Galle Face Green. With her 3rd loan, in the year 2016, she was able to acquire the canteen of a multinational construction company, having 135 residential employees. Ishari is providing all three meals for them and her average sales turn over recorded LKR 1.6 million per month. Presently she has created employment opportunities for seven people. “The NDB bank is helping small entrepreneurs like us to build up our businesses. The Bank makes things easy for us, by enabling us to obtain loans quickly and without property bonds. We can also get loans using only two guarantors. I am sure that NDB Bank will continue to help me in the future.”

Refinance Operations

Strategic Focus

Source of finance is a pivotal capital decision when the investors embark on scaling up of their current operations and the concessionary funding schemes get prime attention in this context. The Bank’s refinance operations claim a proud legacy and a strong reputation which has left its financial footprint over countless projects across the country creating millions of employment opportunities across its dual role as an apex body as well as a Participating Financial Institution (PFI) for Credit Lines.

During the year 2016, in the context of rising exchange rates, there was great eagerness across the entire range of borrowers to approach concessionary funding schemes. The Bank continued its financial assistance through its network, extending term loan facilities at concessionary rates under its refinancing window and operated the schemes shown below in its role as PFI.

Performance

| Name of the Scheme |

Project Management Unit |

Sponsor |

Value of Loans

Disbursed

(LKR million) |

No. of

Loans |

| Saubhagya |

Central Bank ofSri Lanka |

Central Bank of Sri Lanka |

81 |

44 |

| Small and Medium Enterprises Line of Credit (SMELOC) |

Ministry of Finance & Planning |

Asian Development Bank |

1,821 |

160 |

| Working capital loan for Registered Tea Factories |

Central Bank of Sri Lanka |

Ministry of Finance & Planning |

802 |

14 |

| New Comprehensive Rural Credit Scheme (NCRCS) |

Central Bank of Sri Lanka |

Ministry of Finance & Planning |

26 |

101 |

| SMILE II Revolving |

Ministry of Industry & Commerce |

Japan International Co-operation Agency (JICA) |

911 |

92 |

|

|

|

3,641 |

411 |

SMILE III Revolving Fund

At present under the SMILE III Revolving Fund, ten Financial Institutions act as PFIs and the Bank granted 92 facilities during 2016.

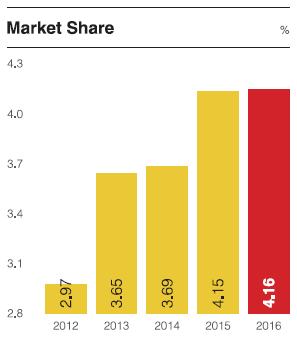

Total disbursements by NDB as at the end of the year was LKR 1.02 billion. This represents 10.4% market share of the SMILE III Revolving Fund which stands LKR 9.8 billion. Currently, NDB is ranked First place among all PFIs for the SMILE III Revolving Fund.

USD 100 Million Small & Medium Enterprises Line of Credit (SMELOC)

This credit line was sponsored by the Asian Development Bank to assist the small and medium enterprises in Sri Lanka and channelled through the Ministry of Finance & Planning. The credit line was officially launched in March 2016, and 10 financial institutions including the Bank, partnered the scheme as PFIs. Credit line introduced a novel concept to Sri Lanka, where the PFIs are required to bid for the borrowing cost to win the fund at an online auction platform. The Bank emerged the winner of the first auction out of eight scheduled and was awarded USD 12.5 million (LKR 1,821 million). The Bank granted 160 facilities using the funds out of which 19 facilities were granted to women led enterprises and another 24 facilities were granted to first time borrowers on start up projects; these two segments illustrate the social and economic impact of the Bank through the credit line.

Tea Factories Loan Scheme

To mitigate the financial problems the Registered Tea Factories (RTF) were facing, the CBSL launched the loan scheme to help them meet their obligations in spite of the declining prices at the tea auctions during 2016. The Bank, which has long standing links with the tea industry made its contribution to this national effort by assisting 14 tea factories. The Bank released facilities up to LKR 802 million at concessionary rates jointly with the Central Bank of Sri Lanka.

Outlook

Stemming from the strategic importance of increasing its customer base by granting concessionary loans, in 2016, the Bank increased its refinance portfolio approximately by three folds over the previous year and continues its focus to promote more concessionary funding schemes in 2017. The Bank wishes to partner ‘Swashakthi’ Micro Finance Credit scheme of the Government of Sri Lanka, an initiative to create 25,000 new self-employment projects by granting loan facilities worth LKR 200,000 and a grant of LKR 50,000 sponsored by the Finance Ministry. The Bank also wishes to partner Ministry of Industry and Commerce in its E-Friends Revolving II Loan scheme to be launched this year sponsored by JICA. The Bank will also join ‘Kapruka’ loan scheme of the Coconut Development Board to promote coconut cultivation. Above schemes would back the growth of SME financing and widening of Micro Financing Operations of the Bank to reach its intended growth magnitude. Finally Refinance operations steer its best effort to enhance reputation as a best Participating Financial Institution among external institutional stake holders leading new Re-financing partnerships in achieving sustainable growth prospects of the Bank.

Islamic Banking

Strategic focus

Islamic banking also referred to as NDB - Shareek is an area that has contributed towards the Bank's bottom line while simultaneously building of social capital during its short tenure of engagement.

Offering of Sharia Compliant products such as Ijarah, Murabahah, Diminishing Musharakahah and Mudarabah for the retail sector have proved to be very popular resulting in 25% of the Islamic Banking portfolio being in the retail sector.

Performance

Despite the volatile markets in the conventional markets in the interest rates as well as the exchange rates NDB – Shareek achieved a commendable performance during the year recording positive growth in deposits and advances while maintaining an extremely low NPL position for the sector.

The success of our Islamic Banking facilities is demonstrated by an important accolade; NDB – Shareek was adjudged as the Best Emerging Islamic Finance Entity of the Year 2015, by Islamic Finance Forum of South Asia and received the Gold Award.

Given our extensive network covering all areas of the country and our comprehensive Islamic banking products and services, the portfolio was well-managed and was able to maintain a NPL ratio below 0.01%.

During the year, we have carried out many customer awareness programmers in areas where there is potential.

The motivated and dynamic team of the NDB – Shareek Unit ably carried out the Unit’s vision and strategy to service the customers throughout the Bank’s network who desire Shariah compliant products.

Outlook

Given the extensive network coverage in the country, the comprehensive Corporate, SME and Retail banking products on offer supported by the customer awareness programmes carried out in potential areas and by a committed and knowledgeable team NDB – Shareek possesses the capability of expanding in the years ahead.

Treasury

Market Position

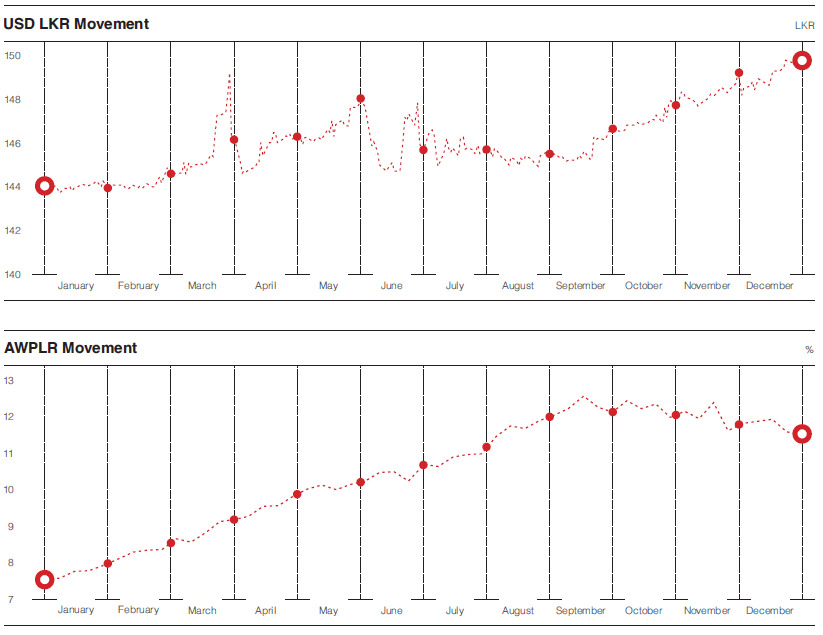

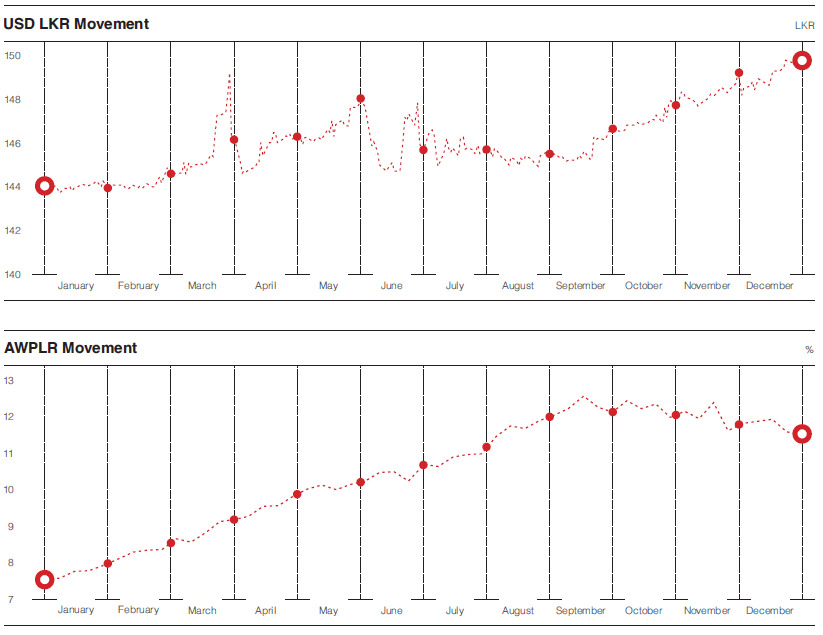

During the second half of 2016 the macroeconomic focus was on building economic momentum and bettering investor perceptions about the country. These hopes were bolstered by the USD 1.5 billion funding pledge from the IMF in June and a USD 1.5 billion dual tranche sovereign bond issue in July. The IMFs Extended Fund Facility (EFF) gave an impetus for increased foreign flows into the debt and equity markets so much so that the Central Bank of Sri Lanka decided not to re-issue two Sri Lanka Development Bond maturities during the second half of 2016. However, the EFF imposed conditions on the country to keep to a promised programme of fiscal reforms. In addition the slowing of economic growth in China, which has detrimental impact on exchange earnings and the lackluster global economic performance, were additional hurdles the country had to face. In mid-February, Fitch downgraded Sri Lanka's long-term foreign and local currency issuer default ratings to B(+) from BB(-) with a negative outlook, citing concerns over increased refinancing risks. However the Country continued its efforts to reach EFF compliance with efforts to broaden the tax base and increasing the value added tax form 11% to 15%, while bringing a broader range of items into the net. Two severe droughts during early and late 2016 and a devastating flood which affected much of the Western Province trading hub in Colombo had a very adverse impact on the economic growth.

With the objective of curtailing above average private sector credit growth the Central Bank of Sri Lanka moved to tighten credit, by raising benchmark rates by 50 basis points in February and July. Consequently, short-term rates were adjusted upward, with money market rates and benchmark weighted prime lending rates rising throughout the year. The Dollar exchange rate which fluctuated between LKR 145 to 148 for most of 2016, ended the year at LKR 149.80 recording a depreciation of 3.80% for the year. The above mentioned factors contributed to the Rupee depreciation.

Performance

The fluctuations in exchange rates gave an opportunity, which if exploited judiciously, opened up opportunities for foreign exchange trading gains. Exporters and importers sought to gain advantage of the peaks and the troughs to book forward and minimize exposure. The Bank continued to capitalize on its strengths as a dominant market maker providing a range of foreign currency related products such as plain vanilla FX forwards, FX derivatives, dual currency deposits, FX options and FX swaps to the entire spectrum of corporate, retail and interbank clients. The Bank exploited all possible opportunities to reap the fruits of the dynamic market situation.

Buoyed by volatility in both the local USD/LKR as well as the international cross currency market, the FX desk achieved sizeable trading gains recording a trading profit of LKR 645 million, despite the restrictions imposed by the Central Bank of Sri Lanka. Through good customer orientation and building on new relationships the Sales desk also achieved a record revenue of LKR 333 million.

Asset & Liability Management

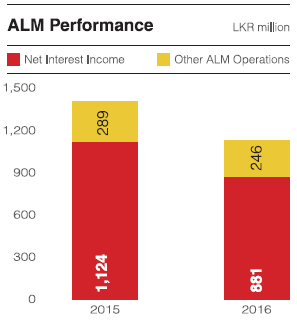

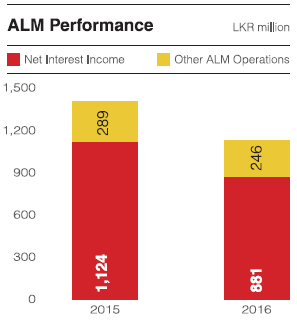

There was intense competition in the interbank market to accumulate deposits to fuel above average credit growth. With the deposit rates continually rising throughout 2016, the Asset & Liability Management (ALM) desk focused on supporting the Bank’s credit growth amidst a price war. Despite considerable fluctuations during the year in the Government security yield curve, the overall yields movement during the year was upwards. With this background, the ALM unit was able to achieve moderate trading gains, managing the market risk to optimize revenue.

Outlook

The budget proposal to remove the notional tax credit available on Government security investments and increasing the withholding tax from 10% to 14%, created uncertainty in the debt market. Lack of clarity on implementation of the proposals created hesitation among market participants. Federal Reserve raised interest rate by 25 basis points in December which raised the threat of a faster pace of tightening in 2017. Against this backdrop the LKR yield curve is expected to creep up during 2017. Emerging markets are expected to suffer Dollar outflows further exerting pressure on reserves and current accounts. The Sri Lanka Rupee is expected to depreciate moderately within the median witnessed over the past years.

The rising yield curve should have a propitious impact on the balance sheet. The gapping process has been optimized to earn maximum revenue in such a scenario. While a volatile environment can be expected in 2017, the FX desk will be capable of handling any adverse situations that may arise through innovative, dynamic and proactive product and pricing solutions.

|

2016

LKR million |

2015

LKR million |

YoY Growth

% |

| Other ALM operations |

246 |

289 |

(15) |

| Net interest income |

881 |

1,124 |

(22) |

| Foreign exchange income |

982 |

1,088 |

(10) |

Our capital market cluster plays an industry leader role in the Sri Lankan investment banking sphere. The same is affirmed by the multiple awards which are conferred on our businesses within the cluster.

Performance of Group Companies

The Group comprise of the capital market cluster and a company engaged in property management business.

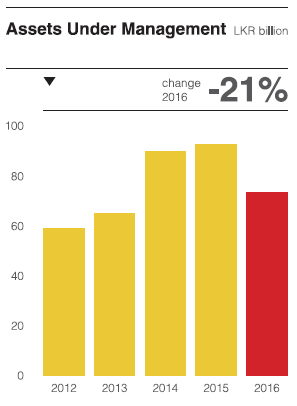

The Capital Market Cluster

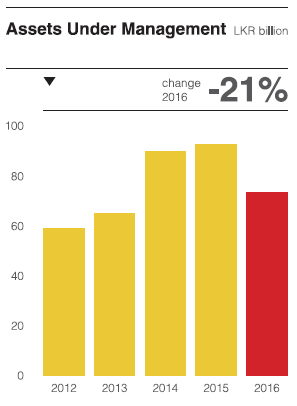

The focus of the capital market cluster of the Group consists of fund based and fee based operations related to investment banking, stock broking, wealth management and private equity management. The cluster endeavours to provide a comprehensive range of investment banking and related services to a wide range of clients, both corporate and individual. With a rapidly changing socio-economic environment and competition, constant innovation to keep abreast becomes imperative.

The investment banking cluster of the Group comprised of the following:

NDB Capital Holdings Ltd.

Strategic Focus

The unique strengths and skills of the investment banking cluster of the Bank position it well to be the leading full service investment bank in the country. The cluster is involved in a wide range of activities including fund based and fee based investment banking (both in Sri Lanka and Bangladesh), asset management, stock brokering and private equity management. The services provided by the Capital Market Cluster has facilitated the Group to be one of the leading integrated financial service providers in the country, with a diversified product and service portfolio spanning both commercial banking and investment banking spheres.

Performance

NDB Capital Holdings Ltd. formerly known as Capital Development and Investment Company PLC (CDIC), was formed in 1983 as a venture capital company. CDIC was subsequently listed on the Main Board of the Colombo Stock Exchange in 1996. Following a restructuring within the Group in mid-2012, CDIC was transformed into a full service investment bank and rebranded as NDB Capital Holdings Ltd. (NCAP).

NCAP and its subsidiaries (collectively referred to as the investment banking cluster or NCAP Group) are strategically positioned to play a key role in the economic development and growth of the capital market of Sri Lanka. NCAP is involved in both fee based operations as well as fund based operations. While the main fee based operations of the company are carried out through its subsidiaries, NDB Investment Bank Ltd. (NDBIB), NDB Wealth Management Ltd. (NWM), NDB Securities (Pvt) Ltd. (NDBS) and NDB Zephyr Partners Ltd. (NDBZ), NCAP directly participates in fund based operations including but not limited to investments in listed equities, private equity, fixed income securities and structured products.

Business Line Performance

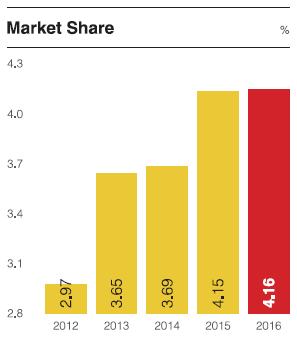

Despite an improvement over the uncertain political climate that prevailed in 2015, local market conditions remained lackluster in 2016. The average daily market turnover of the share market dropped from LKR 1,060 million by the end of 2015 to LKR 743 million by the end of 2016 marking a drop of approximately 30% over the period under review. While NDBS absorbed the direct impact of this drop in market activities, NCAP managed to minimize any losses from its short/medium-term equity portfolios owing to timely changes in the asset allocation decision.

NCAP has not confined itself to commercial activities but has also ventured into CSR activities. An important initiative in this regard is the NDB Capital Scholarship Trust Fund which was launched in 2014. The recipients for this programme are selected through a transparent and conscious process. A number of criteria are considered including financial needs, academic prowess, extracurricular activities and leadership skills. Thus far, 32 scholarships have been awarded to students from local universities. A total service is offered to the students, including career counselling, career development opportunities and internships. ‘Be the best you were born to be’ by Dhammika Kalapuge is one of such training programmes conducted by the Trust for scholarship recipients in March 2016.

Financial Performance

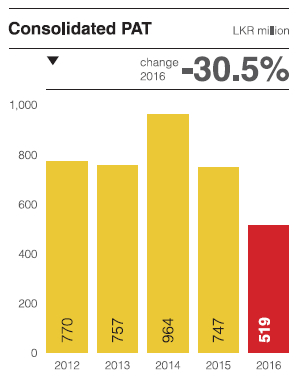

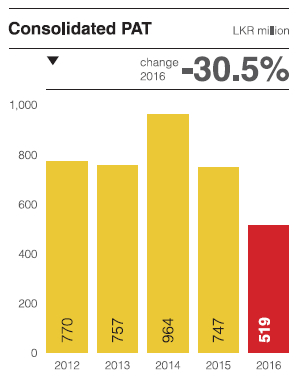

The Capital Market cluster recorded a consolidated profit after tax of LKR 519 million by the end of 2016.

Note: The 2012 profit and net asset value have been adjusted for the one-off capital gain reported from divestiture of AIA Insurance, while that of 2013 is adjusted for the impact on profits due to investment income earned from the aforesaid capital gain due to the divestiture of AIA.

| KPI |

2016 |

2015 |

YoY

Change

% |

| Total operating income (LKR million) |

1,182 |

1,513 |

(22) |

| Profit after tax (LKR million) |

519 |

747 |

(31) |

| Return on equity (%) |

9.0 |

11.8 |

(24) |

| Operating profit margin (%) |

49.0 |

55.0 |

(11) |

| Net profit margin (%) |

44.0 |

49.0 |

(10) |

Outlook