HUMAN CAPITAL

Strategy - Building the Strengths of Our People

The human resources practices of the Bank strive to align the attitudes, skills and competencies of its human resources with the values and corporate strategy and thereby ensure achieving the Bank’s goals and objectives. We draw strength from the diversity of our workforce, and provide equal opportunities irrespective of ethnicity, religion, gender and age. Our values of integrity, excellence, creativity, sincerity and accountability are inculcated into all our employees and enable us to deliver value to all our stakeholders.

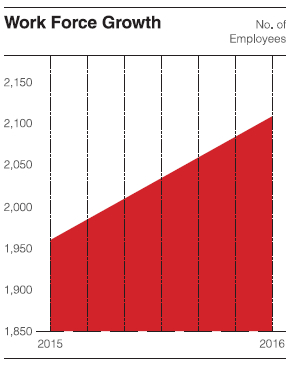

Staff Strength

The HR function strives to make the Bank an employer of choice, creating value for the existing employees by developing their skills and also adequately compensating and rewarding them. The function also aspires to increase productivity and efficiency through simplified HR processes and drive employee engagement through the framework of corporate values. HR vehemently believes that at the heart of the success of the Bank, lie its people and they have to be motivated through a common vision towards achieving the Bank’s goals. Accordingly, our HR policy strives to make our people the driving force behind the Bank, in its mission to spread financial empowerment throughout Sri Lanka.

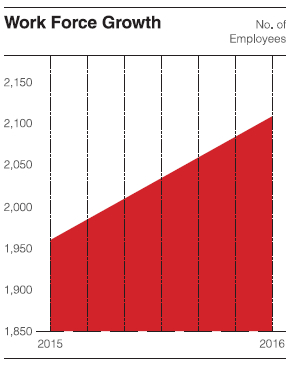

The Bank, has a total staff strength of 2,109, an increase of 7.6% over the previous year’s total of 1,960 persons. In terms of locations, this growth is balanced when centre and regional growth is compared. The centre has adequately grown to support the eight regional centres that have been set up. Further, when considering the gender balance, women form well over one third of the workforce, including in management grades. The Bank is proud to state that it comprises of people from diverse social backgrounds, ethnicities, religions and age groups and draws on this diversity as a strength.

As an equal opportunity employer, the Bank recognizes that diversity in terms of ethnicity, gender, religion and age is an asset to strengthen the collective human talent of the Bank. While they serve to enrich the human capital, diversity arising from hiring locally, helps the Bank to better align its business model to effectively meet the needs of local communities.

Employees in the permanent cadre accounted for 79% of the total workforce by December 2016. The contract staff, who account for less than 25% of the total, have filled only specialized functions. In the last few years, they have manned incentivized jobs with specific reasons. These are mainly sales oriented jobs where Y generation employees who aspire for quick and independent decision-making and concomitant quick gains are recruited. Overall, the contract nature of employment facilitates exits of employees who need not be retained inthe jobs continuously.

Total Staff by Employment Type and Gender

|

Number |

Composition (%) |

| Category |

F |

M |

Grand Total |

F (%) |

M (%) |

| Contract |

106 |

230 |

336 |

5 |

11 |

| Intern |

8 |

4 |

12 |

0 |

0 |

| Permanent |

668 |

1,005 |

1,673 |

32 |

48 |

| Trainee |

31 |

57 |

88 |

1 |

3 |

| Grand Total |

813 |

1,296 |

2,109 |

39 |

61 |

Total Staff by Grade and Gender

|

Number |

Composition (%) |

| Designation |

F |

M |

Grand Total |

F (%) |

M (%) |

| Senior Management |

17 |

24 |

41 |

41 |

59 |

| Management |

76 |

152 |

228 |

33 |

67 |

| Executive |

99 |

227 |

326 |

30 |

70 |

| Non-Executive |

553 |

641 |

1,194 |

46 |

54 |

| Specialized Sales Force |

26 |

180 |

206 |

13 |

87 |

| Other |

42 |

72 |

114 |

37 |

63 |

| Grand Total |

813 |

1,296 |

2,109 |

39 |

61 |

Senior Management by Gender

| Category |

F |

M |

Grand

Total |

F

(%) |

M

(%) |

| Chief Executive Officer |

|

1 |

1 |

0 |

2 |

| Group Chief Financial Officer |

|

1 |

1 |

0 |

2 |

| VP |

6 |

5 |

11 |

14 |

12 |

| Senior Management on contract |

|

1 |

1 |

0 |

2 |

| AVP |

11 |

17 |

28 |

39 |

61 |

| Senior Management Staff Total |

17 |

25 |

42 |

40 |

60 |

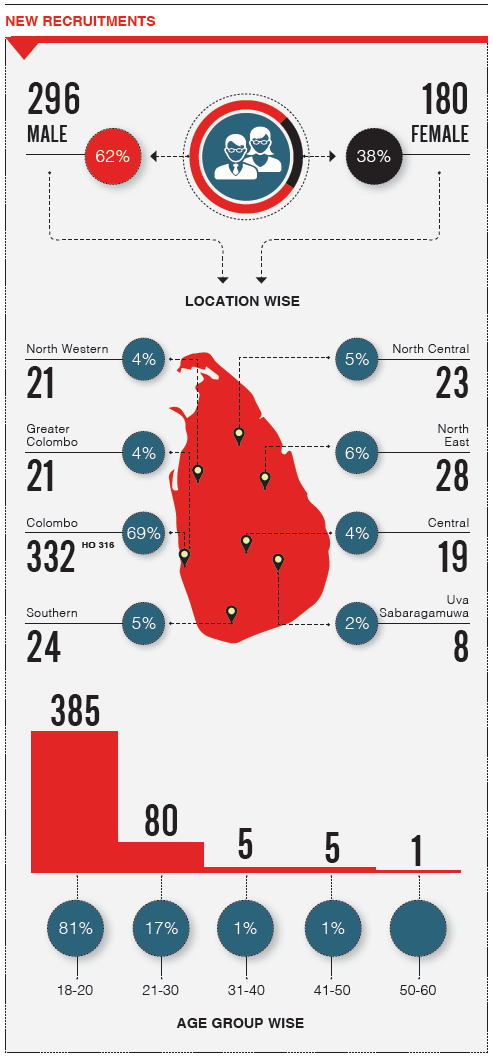

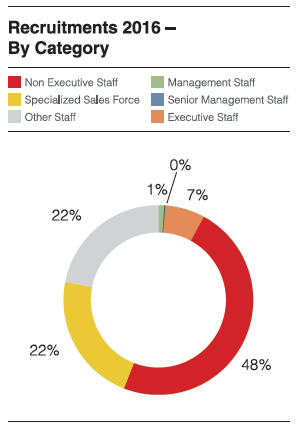

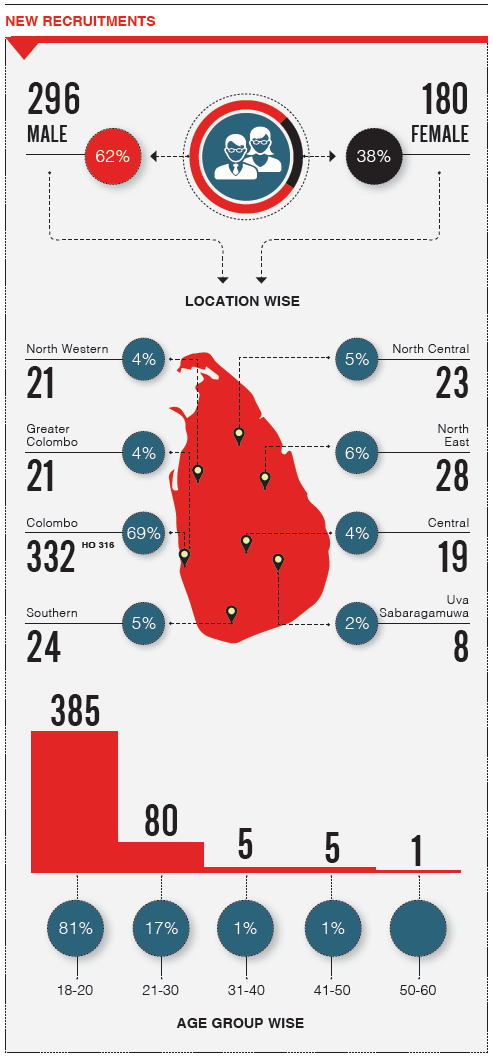

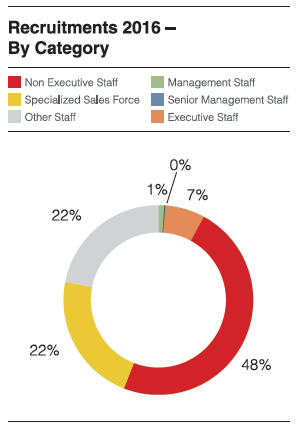

Recruitment

During the year, the Bank continued to grow organically by expanding its Branch network; 11 new branches were added during the year. In addition, 476 new people joined the Bank’s cadre. The HR professionals face a continuous challenge to recruit staff of the right calibre, in the numbers needed, in an environment where the industry in general is expanding and there is intense competition for the cream of talent. However, the Bank has overcome this challenge and has succeeded in attracting the right talent for the right jobs in a transparent manner.

The Bank generally follows a policy of filling senior positions by internal promotions as far as possible. Through this process, talent pools of staff are built up at various levels, so that suitable candidates are in place when a vacancy arises and external candidates are recruited only when necessary.

When external recruitment is necessary, the type of personnel sourced are usually school leavers or newly qualified professionals or university graduates. In order to recruit incentivized contract staff, recruitment drives are conducted to recruit Y generation youngsters. The participants are exposed to state of the art assessment methods, which give them insights which will be of great value in their future career development. Recruitment drives are also conducted in academic bodies such as universities and leading professional bodies in Sri Lanka. The Bank has come to an understanding with universities to recruit newly qualified graduates of certain disciplines.

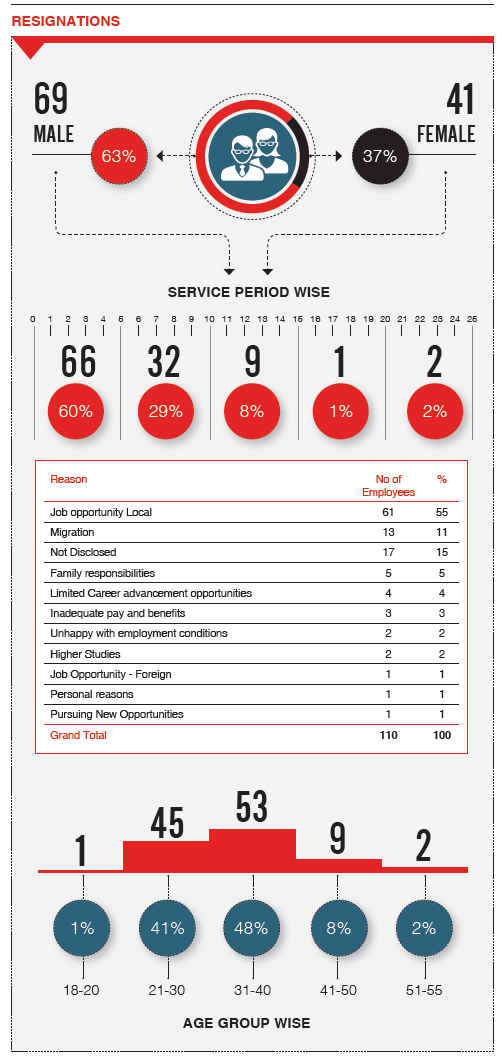

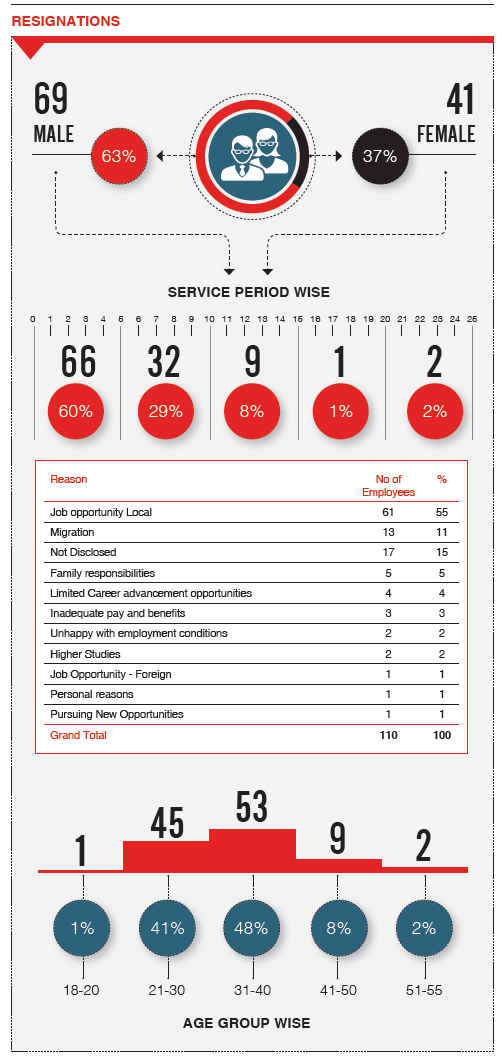

Employee Turnover

The Bank maintained a very satisfactory rate of staff retention during the year. The overall employee attrition rate during the year, as a percentage of permanent staff, was 6.6. The main reasons for attrition were job opportunities both locally and overseas, migration and personal reasons.

During the year, the Bank lost the services of 110 employees through resignations; of these males accounted for 63% and the age group 31 to 40 years accounted for 48%. It should be noted that of those who took maternity leave, 94.3% of staff returned to work on completion of leave, indicating that nurturing children has not been a significant reason for attrition at NDB.

|

2016 |

2015 |

2014 |

2013 |

| Category |

F |

M |

Total |

F % |

M % |

F |

M |

Total |

F % |

M % |

F |

M |

Total |

F % |

M % |

F |

M |

Total |

F % |

M % |

| Senior Management |

0 |

2 |

2 |

0 |

100 |

0 |

0 |

0 |

|

|

0 |

4 |

4 |

0 |

100 |

1 |

0 |

1 |

100 |

0 |

| Management |

3 |

8 |

11 |

27 |

73 |

1 |

18 |

19 |

5 |

95 |

5 |

7 |

12 |

42 |

58 |

3 |

4 |

7 |

43 |

57 |

| Executive |

7 |

17 |

24 |

29 |

71 |

6 |

11 |

17 |

35 |

65 |

7 |

12 |

19 |

37 |

63 |

4 |

8 |

12 |

33 |

67 |

| Non-Executive |

31 |

41 |

72 |

43 |

57 |

17 |

27 |

44 |

39 |

61 |

27 |

29 |

56 |

48 |

52 |

21 |

23 |

44 |

48 |

52 |

| Specialized Sales Force |

0 |

1 |

1 |

|

|

1 |

|

1 |

100 |

0 |

|

|

|

|

|

|

|

|

|

|

| Grand Total |

41 |

69 |

110 |

37 |

63 |

25 |

56 |

81 |

31 |

69 |

39 |

52 |

91 |

43 |

57 |

29 |

35 |

64 |

45 |

55 |

Parental Leave

Total number of employees who were entitled to parental leave, by gender.

813 female employees

Total number of employees who took parental leave, by gender.

53

Total number of employees who returned to work after parental leave ended, by gender.

50

Total number of employees who returned to work after parental leave ended, who were still employed 12 months after their return to work, by gender.

50

Benefits Management

With rapid staff expansion, benefit management is a challenge. HR policies have to be crafted to minimize attrition. Compensation policies have to be tailored to be competitive with the rest of the industry, to maintain parity and fairness within the organization, not to mention controlling costs. During the year, the staff received several benefits of a monetary nature. These included increase in the subsidized staff loan entitlement and benefits in terms of allowances for certain categories of staff.

| Benefits |

Permanent Employees |

Contract Employees |

| Guaranteed Cash & Allowances |

|

|

| Fuel/Travelling Allowance |

Applicable |

Applicable |

| Accommodation Assistance, Cashiers Risk, Weekend/ Holiday Banking Allowance |

Applicable |

Not Applicable |

| Leave Pay/Holiday Allowance |

Applicable |

Not Applicable |

| Job Specific Allowances |

Applicable |

Not Applicable |

| Variable Pay |

|

|

| Performance Bonus |

Applicable |

Not Applicable |

| Sales Incentives |

Applicable |

Applicable |

| Overtime |

Applicable |

Applicable |

| Reimbursable Expenses |

|

|

| Subscriptions (professional & club) |

Applicable |

Not Applicable |

| Educational Assistance (MBAs) |

Applicable |

Not Applicable |

| Other Perquisites |

|

|

| Holiday Bungalow/Annual Trip |

Applicable |

Applicable |

| Medical Insurance Scheme (OPD, In-house, Life, Personal Accident Cover) |

Applicable |

Different scheme applicable |

| Leave |

Applicable |

Applicable |

| Parental Leave (Maternity) |

Applicable |

Applicable |

| Cafeteria, Gymnasium, Library |

Applicable |

Applicable |

| Toast Masters Club |

Applicable |

Applicable |

| Recreation Club |

Applicable |

Applicable |

| Disability and invalidity coverage |

Applicable |

Applicable |

| Subsidized Loan Benefits |

|

|

| Housing, Vehicle, Sundry Loans |

Applicable |

Applicable with conditions |

| Share Ownership plans |

|

|

| Employee Share Ownership Plan |

Applicable |

Applicable with conditions |

| Retirals |

|

|

| EPF/ETF/Gratuity |

Applicable |

Applicable |

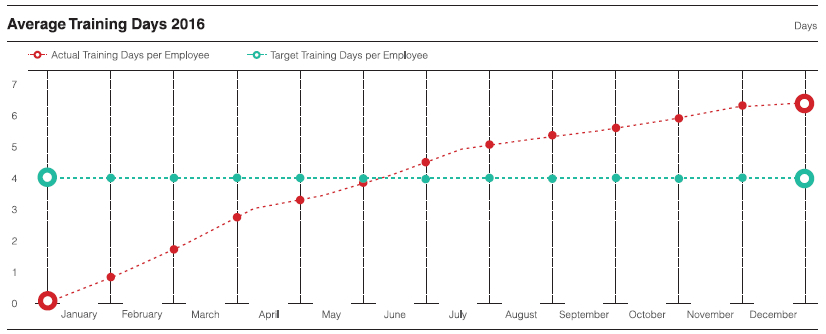

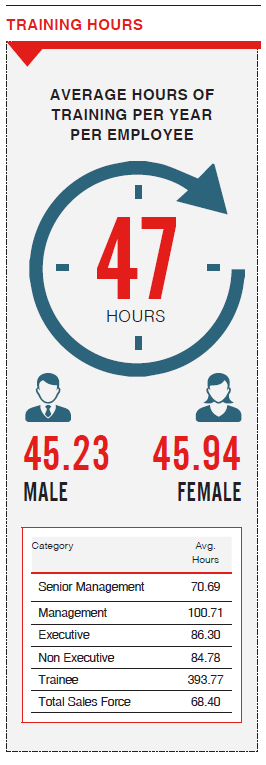

Training andDevelopment

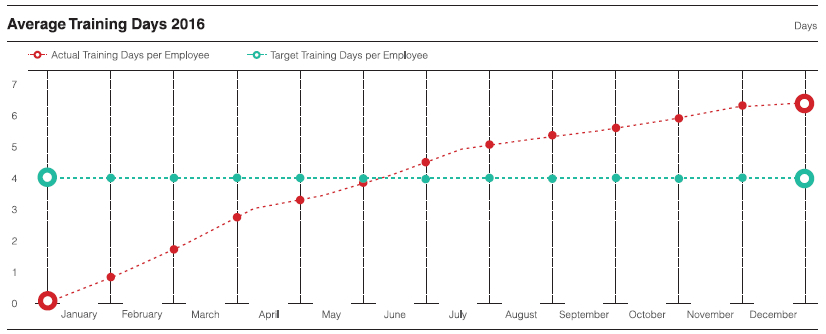

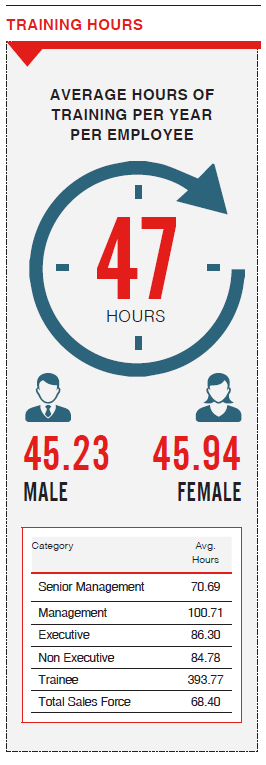

A monthly training calendar is shared with staff members at the beginning of the month, encouraging them to give feedback and participate in the development process. During the year under review, 353 training programmes were conducted for staff, with an employee receiving 6.42 training days on average. This average does not include hours spent on E-learning training, the Bank's inhouse electronic learning platform.

Training Days for each Employee

The Bank has acquired a strong reputation for its stress on education and training of employees. Since it is not practical for the Bank to provide all training needs from internal resources, where appropriate, the Bank has entered into partnership agreements with other organizations to facilitate in-house training. The partnership organisations include the Institute of Bankers of Sri Lanka (IBSL), the apex banking body in Sri Lanka, Centre for Banking Studies (CBS) and CIMA Sri Lanka. The Institute of Bankers, Sri Lanka facilitated in-house Diploma and Certificate courses to employees, providing them an opportunity to obtain professional qualifications. E.g. Diploma in Credit Management, Certificate for Branch Banking Operations. Depending on need, the programmes may be off-the-shelf or customised to suit the needs of the Bank. There is no doubt that these qualifications have facilitated personal growth and development of the members of the NDB team, as well as uplifting their morale and strengthening their commitment to the organization.

The Bank has drawn up a systematic process to identify training needs and draw up training programmes. Information obtained from annual performance review appraisals, training needs assessments at the beginning of each year and regular discussions with line managers are the inputs to identify training needs. Training programmes are prioritized, taking into account operational urgencies or the need to mitigate competency gaps. The thinking behind the Bank’s training policy is to be proactive, and ensure that employees are capable of facing up to any challenges and unforeseen changes in the industry/environment. Some examples of such programmes are Best Practices for Bank Tellers, Special Branch Banking Operations for non-branch staff.

In terms of reinforcing learnings, the Bank has embarked on some unique initiatives. It is mandatory for all new hires to go through two behavioural change programmes aimed at inculcating the values of the Bank ; one done at the Induction Programme and the second after serving the organisation for one year at the ‘In retrospect’ Training Programme. The ‘In retrospect’ programme endeavours to give the employees who have served for one year an opportunity to reflect on their experience and is designed around the theme ‘Living OUR Values’. The team building activity of the training programme is also designed to instil these key elements of our values in staff.

Training programmes are not restricted to those offered by local institutions but include those conducted through affiliations with foreign training bodies such as Euromoney, Marcus Evens, CRISIL, India and Singapore Institute of Management. Methods such as evaluations, presentations are built into re-instating learnings from foreign training. We conduct a diversity of programmes to give exposure and disseminate knowledge to our staff. Short evening presentations, done by eminent speakers who are pioneers of various industries, including those drawn from our customers, and also by volunteer staff members, are included in the annual training calendar in order to add variety and interest.

During the year, the Bank invested LKR 45.2 million to provide a total of 98,970 person hours of training across all categories of staff.

Self-Learning

NDB e-Learning platform provides the opportunity for employees to educate themselves, learn at their own pace and convenience irrespective of geographical locations, with no interference to their work responsibilities and with real time evaluations. This enables the employee to take ownership of his own training and development. The platform will not be restricted to operational and technical subjects but will cover soft skills as well. In addition, various other materials from newspaper articles, articles published by employees of the Bank, local training programme contents on various subjects etc are included. The e-learning platform boasts more than 34 modules, where almost 100% of staff have satisfied their learning needs by using these modules.

The study policy framework at the Bank is designed to equip personnel with the knowledge and skills to cope satisfactorily with present and future duties, by giving them the opportunity to develop themselves through a structured methodology, based on identified knowledge requirements of the Bank. The Bank supports the continuous development of its employees who take an initiative to develop themselves. Any employee who wishes to undertake a study course towards obtaining a work related qualification, a degree or equivalent qualification, is given an opportunity to do so on the basis of experience, service period and the level of responsibility in the organisation.

Diversity and Equal Opportunity

We take pride in the fact that our workforce is extremely diverse in terms of ethnicity, religion, social background and gender. We practise a strict policy of non-discrimination on any of the above criteria. This applies to all aspects of our human resources policies including recruitment, appraisals and promotions. We strongly believe that our policies of equity of treatment have contributed to a high degree of staff retention. Further, our practise of recruitment from local communities throughout our network, whenever suitable persons can be found, have contributed to leveraging our business practices with local knowledge.

To ensure we are on the cutting edge of customer service, we need our staff not only to have all required technical skills but also to be passionate, accountable, professional and ethical.

Gender Equity

Approximately 40% of our workforce are women, inc luding at senior management levels. This confirms the fact that we walk the talk when it comes to gender equity. As with the other criteria mentioned above, there is no gender bias in performance reviews and rewards. The fact that around 94.3% of staff who availed themselves of maternity leave returned on completion of their leave, and practically all of them remain at the Bank after another one year is clear evidence of the fact that our women employees consider themselves fairly treated.

| Designation |

Average basic salary ratio, Female to Male |

|

F |

M |

| Senior Management |

1 |

1.08 |

| Management |

1 |

0.91 |

| Executive |

1 |

0.98 |

| Non-Executive |

1 |

1.07 |

| Specialized Sales Force |

1 |

1.03 |

| Other |

1 |

1.83 |

| Total |

1 |

1.06 |

| Region |

Average basic salary ratio, Female to Male |

|

F |

M |

| HO – Colombo |

1 |

1.00 |

| Region 1 – Colombo |

1 |

1.34 |

| Region 2 – Greater Colombo |

1 |

1.21 |

| Region 3 – Southern |

1 |

1.49 |

| Region 4 – North Western |

1 |

1.25 |

| Region 5 – North Central |

1 |

1.60 |

| Region 6 – Central |

1 |

1.50 |

| Region 7 – Uva Sabaragamuwa |

1 |

1.46 |

| Region 8 – North East |

1 |

1.59 |

| Total |

1 |

1.06 |

Rewarding Performance

Compensation and rewards at senior management levels need to be tailored to their roles and how their contribution can be judged. A new Employee Share Option Scheme was introduced in 2016, for the employees ranking at and above Senior Manager and the Chief Executive Officers of the Group. Persons in these categories will be entitled to share awards based on the performance of the Bank, the Group and the designation and performance of the individual.

Employees Receiving Regular Performance Reviews

| Designation |

F |

M |

Grand

Total |

F

(%) |

M

(%) |

| Senior Management |

17 |

24 |

41 |

41 |

59 |

| Management |

76 |

152 |

228 |

33 |

67 |

| Executive |

99 |

227 |

326 |

30 |

70 |

| Non-Executive |

553 |

641 |

1194 |

46 |

54 |

| Specialized Sales Force |

26 |

180 |

206 |

13 |

87 |

| Other |

42 |

72 |

114 |

37 |

63 |

| Grand Total |

813 |

1,296 |

2,109 |

39 |

61 |

Collective Bargaining

Although the Bank does not have formal collective bargaining agreements, it follows an open door policy and has mechanisms through which, any employee may voice his or her grievances and receive a fair hearing. Any employee may follow this procedure without any fear of reprisals.

When any major operational changes are in the offing, employees are given adequate notice of the changes and their impacts. This will contribute to reducing any adverse impact on staff morale as a result of such changes. The Bank offers approximately two weeks notice prior to such changes.

Occupational Health and Safety

The Bank takes a holistic view of the employees well being. We believe that a healthy body and a healthy mind will have a positive impact on their professional and personal lives. A number of initiatives are in place to improve the health, safety and well-being of the staff. The Bank offers a diverse range of recreational activities and programmes to help employees pursue their interests, find ways to unwind and achieve work-life balance. These include the comprehensive gymnasium, aerobics, yoga, social dancing sessions, NDB Health Week and Work-Life Balance Week. These awareness sessions, health screening and check-ups have been truly beneficial to the employees as well as their family members.

The HR Department of the Bank also provides counselling services which are conducted very confidentially and are structured appropriately. Counselling is conducted by specially trained counsellors who are on the staff of the HR Department. However, they are supported by an external professional psychiatrist and are also assisted by other external experts. Depending on the context and employee preference, the staff members are directed to an appropriate counsellor.

Employee Engagement

The Bank has many mechanisms for employee engagement and communication. Constant communication from senior management to wider staff is vital to keep employees motivated. Town Hall meetings, where the CEO addresses the staff members regularly, are aimed at keeping the staff aligned with the strategic goals and making them focused through direct and clear communication. The CEO also communicates with staff through email and shares important news, achievements and strategic changes of the Bank, to increase awareness of the workforce. In addition, the CEO of the Bank has commenced a process whereby he communicates to all staff the principles pertaining to compensation and increments and variable pay details. He also discloses the senior management’s performance evaluation principles to bring about more accountability and responsibility. Thus constant communication between employees of the Bank is a clear channel of strengthening employee engagement at the workplace.

In order to provide employees a wider range of cross-functional exposure, open up wider future career options as well as help them appreciate each other’s functions, the Bank has created cross functional teams at various levels. At the strategic level each function is supported by a cross functional team. Further, for special projects, team members are selected across the organization from various units and are given specific tasks. An example was the revamping and re-launch of the Bank’s vision, mission and values. The Bank has also initiated the practice of having open ‘Q & A’ sessions, where staff members may voice any concerns they have regarding an existing laid down process and/or Bank policy. The concerns will be heard and answered by the senior management team. Such sessions are held concurrently with the Branch Managers’ meetings.

In-line with the Bank’s belief that personal development strengthens employee engagement, in turn leading to professional excellence, the Bank initiated the NDB Toastmasters Club in 2013 and joined the Global Toastmasters fraternity. This has helped many to improve their oral communications, while placing them on a better footing to participate in professional forums. The Club has acquired strength through wider participation; many branch members also participate in addition to Head Office staff. The strength of the Club is demonstrated by the fact that it has won many accolades, including three international Awards.

Camaraderie, togetherness and team spirit are fostered through the events organized by the Staff Recreation Club (NDBSRC). The calendar of events organized during 2016 by the NDBSRC included sports days, celebrating religious events of all religions such as Vesak, Ramadhan, Thai Pongal, Christmas and staff trips to which families are also invited. The Bank strongly encourages the participation not only of the employee but the family of the employee as well. It is strongly believed that positive sentiments about the Bank among the families will contribute towards producing a happy and engaged employee.

‘Skillart’ music group is an internally formed group of employees, where music and singing is used to help our team members relax and motivate them. It is this internal group that entertains at the Bank’s internal events and customer gatherings as well.

Grievance Handling

Good labour practices and proper grievance mechanisms are essential to maintain healthy labour relations and improve productivity. Effective Human Resource practices, which are embedded into the HR Policy, as well as specific job descriptions which spell out to each staff member his duties and responsibilities clearly, are implemented through a structured approach.

Staff grievances are a major potential cause of reduced morale. Therefore we endeavour to address staff grievances promptly. There is a clearly laid down procedure, through a Grievance Handling Policy, for employees to have their grievances heard and resolved in a prompt, methodical and fair manner. The purpose of the Grievance Policy of the Bank is to help employees maintain a positive work environment with respect and responsibility towards each other and make them feel they have been fairly treated. While the Bank will endeavour to provide such an environment, the employee may raise specific grievances or complaints, where there is a cause.

The newly formed Employees' Association is another channel through which individual and collective staff grievances are escalated.

During the year under review, grievances have not been reported through external sources.

Good communication is vital and the Bank has an open door policy where employees can communicate even with the CEO.