STAKEHOLDERS

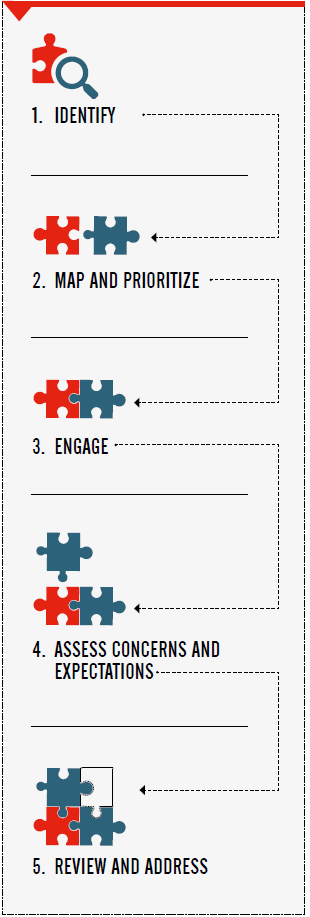

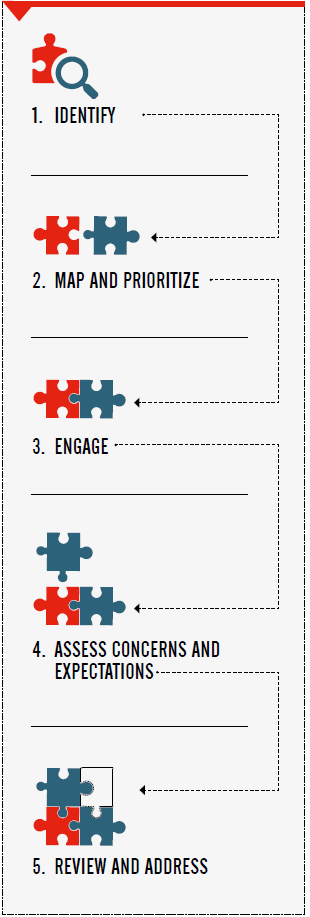

STAKEHOLDER ENGAGEMENT PROCESS

Stakeholders are individuals or entities who are significantly affected by the Bank’s activities, products and services and whose actions, attitudes and perceptions have a significant impact on the ability of the Bank to carry on its activities and attain its goals.

The Bank’s primary stakeholders are customers, investors, employees, suppliers, local communities where we operate, the general public as well as Government authorities and regulators. The Bank has a rigorous process to identify the key stakeholders with whom we need to engage.

OUR KEY STAKEHOLDERS

Investors

Definition of the Stakeholder Group:

Investors by definition are the stakeholders who have invested funds in the Bank with the expectation of returns on their investments. For the purpose of investor relations, the concept of investors has to be interpreted more broadly where a wider group of stakeholders are covered. Such other stakeholder groups are potential investors, investment and fund managers, stock brokers and analysts, multilateral funding agencies, rating institutions, media and the like.

Rationale for Engaging Investors as a Key Stakeholder Group:

Investors are the crucial stakeholder group that provides the strong foundation to the business via quality capital. Investment and fund managers, analysts, rating agencies, etc. are those groups who will carry out impartial analysis on the Bank and provide recommendations to the investor fraternity, which will also lead to an optimally priced share of the Bank in the Stock Market.

Strategic Objectives of Maintaining Sound Relationships with the Stakeholder Group:

To attract and maintain best in class relationships with investors and deliver superior and sustainable value to our shareholders.

| Method of Engagement |

Frequency of Engagement |

Key Topics and

Concerns Raised |

How the Bank Responded to Such Topics and Concerns |

|

Meetings

|

|

|

|

- One-to-one on-site investor meetings

- Investor webinars and fora on quarterly financial performance

- Annual General Meetings

- Extra-Ordinary General Meetings

- International investor fora

- Investor road shows

|

As and when required

Quarterly

Annually

As and when required

As and when required

As and when required

|

The financial performance of

the Bank.

Future strategies and possible directions for growth and profitability.

The macroeconomic environment, regulatory stances taken, particularly any significant changes and their impact on the performance of the Bank.

The political stability, consistency of economic policy, conduciveness for investments and the overall confidence levels on the country.

Expansion strategies

of the Bank (local branch network and overseas presence).

Corporate governance and risk management framework of the Bank.

|

Our investor relations endeavours are well-structured and scheduled. Schedules for routine investor activities are announced well in advance for the benefit of the stakeholders.

We follow an

open-door policy for all our investors on their requests for periodic meetings and reviews. We maintain a high level of accessibility to the Senior Management of the Bank in investor relations. Investor engagements are always hosted by the Chief Executive Officer or the Group Chief Financial Officer.

Based on any specific investor needs, the meetings will be attended by relevant business heads.

Our investor relations are driven on the principles of consistency, transparency, clarity and openness to scrutiny and executed by a dedicated investor relations team.

We are consistently fair in our disclosures and at no times do we treat any party with preference.

|

|

Publications

|

|

- Annual Reports

- Interim Financial Statements released to the CSE

- Press releases on financial performance

- Transcripts of investor webinars held

- Investor presentations on financial performance

- Announcements made to the Colombo Stock Exchange

- Prospectus

|

Annually

Quarterly

Quarterly

Quarterly

As and when required

As and when required

As and when required

|

|

Special Features

|

|

- Investor relations web page within the NDB corporate webpage

- SMS alert on the Annual Report release

- Email notifications on results releases

- Earnings calls on special requests

|

Continuously

Annually

Quarterly

As and when required

|

Customers

Definition of the Stakeholder Group:

Individuals; micro and SME businesses and large corporates.

Rationale for Engaging Customers as a Key Stakeholder Group:

Building sustainable relationships with the customers through superior value creation and seamless communication.

Strategic Objectives of Maintaining Sound Relationships with the Stakeholder Group:

To understand the customer needs better and maintain long-term customer relationships by delivering superior value to our customers.

| Method of Engagement |

Frequency of Engagement |

Key Topics and

Concerns Raised |

How the Bank Responded to Such Topics and Concerns |

|

Customer feedback scores to measure customer satisfaction level across

the branch network

|

Periodic

|

Types of products

and services.

Product pricing (interest rates, other fees and charges).

Level of customer service and quality of customer interactions

at key touch points.

Availability of branches, ATMs and other physical touch points.

Physical appearance

of the Branch network.

Level of interaction via social media.

Attitude, knowledge

and skills of staff.

|

Our dedicated contact centre team provides around the clock full service including card activation, lost card deactivation, handling balance and transaction inquiries etc.

In addition to routine query handling, contact centre also handles the Online Banking mail box and the contact@ndbbank.com mail ID. All queries received via these channels are actioned within 3 working days.

The Customer Relationship Management Unit attends to customer queries and complaints Monday to Friday 8.30 a.m. – 5.00 p.m. However, customers can raise their feedback through the Branch Network (Branch Managers are the dedicated service ambassadors),

24-hour Contact Centre and via online messages/by e-mailing at contact@ndbbank.com or by writing to The Manager – Customer Relationship Management. National Development Bank PLC., No. 42, Sagara Road, Marine Drive, Colombo 04.

|

|

Mystery customer survey to measure customer satisfaction level across the branch network

|

Periodic

|

|

|

Customer interaction through visits, get-togethers and workshops

|

Periodic

|

|

|

Extended banking hours

at selected branches

|

24/7 x 365 days

|

|

|

NDB corporate website

|

24/7 x 365 days

|

|

|

Online messages

(NDB Bank Online)

|

24/7 x 365 days

|

|

|

contact@ndbbank.com

|

24/7 x 365 days

|

|

|

Social media interactions

|

24/7 x 365 days

|

|

|

Contact centre

|

24/7 x 365 days

|

|

|

Print and electronic media

|

24/7 x 365 days

|

|

Employees

Definition of the Stakeholder Group:

Senior Management, Executives, Non-Executives, Contract Staff

Rationale for Engaging Employees as a Key Stakeholder Group:

Employees are key to delivering superior and sustainable value to the shareholders.

Strategic Objectives of Maintaining Relationships with the Stakeholder Group:

To create an environment conducive for employees to deliver their best in creating a high performing workplace to be successful and remain in the forefront of the banking sector.

| Method of Engagement |

Frequency of Engagement |

Key Topics and

Concerns Raised |

How the Bank Responded to Such Topics and Concerns |

|

Employee Surveys

|

|

Responsibility of retaining existing talent of the Bank.

In order to do so provide staff with correct blend of skills, competencies and knowledge.

Ensure staff get value addition in personal capacity as well as professional capacity.

Reward and recognize staff with monetary and non-monetary benefits.

Responsibility of simplifying processes in order to increase productivity in making best use of the human talent and delivering best value to external stakeholders.

Adopt staff to the Bank’s values and culture.

Attaining work – life balance across all levels.

Regional engagement in a context of rapid expansion.

Maintain information flow within the organization.

Maximize emotional engagement of staff with the workplace.

Enhance the emotional engagement of the staff member beyond himself/ herself to embrace the Company as a family.

Ensure fairness to staff members and strengthen their voice at adversity.

Ensure a healthy environment for staff to work in, which is physically and mentally conducive.

|

On joining the Bank employees go through an induction process to make them feel comfortable with the job and the organization.

They are provided ongoing training in order to acquire required skills. They are also remunerated and rewarded for their performance both in monetary and non-monetary terms. Further, specific initiatives are introduced to facilitate work life balance and maintain a high degree of engagement within the organization.

|

- Employee Satisfaction Survey

|

Annually

|

|

|

Annually

|

- Internal Department Survey

|

Annually

|

|

Induction Programmes

|

|

- Employee Induction Programme

|

Quarterly

|

- ’In Retrospect‘ programme

|

Quarterly

|

|

Periodic Staff Meetings

|

|

|

|

As and when required

|

- The Leadership Team meetings

|

Weekly

|

|

|

Monthly

|

- Network Management

National Conference

|

Annually

|

- Regional Managers’ meetings

|

Monthly

|

- Branch Managers’ meetings

|

Quarterly

|

|

|

Ongoing

|

|

Staff Societies

|

|

|

|

Ongoing

(Annual calendar of staff events)

|

|

|

Ongoing

(Annual calendar of staff events)

|

- Cross Functional Staff Committees

|

Ongoing

|

|

Technologically Driven Platforms

|

- Performance

Development System

|

Ongoing

|

- Human Resource Information System (HRIS)

|

Ongoing

|

|

Bank Policies

|

|

|

|

|

- Open door management policy

|

|

- Diversity and Inclusion policy

|

|

|

|

|

- Non-discrimination policy

|

|

|

Recognition Schemes

|

|

|

|

Annually

|

- Staff talent recognition programme

|

Ongoing

|

|

Welfare Agenda

|

|

- Employee Volunteerism Programmes (Sustainability and CSR Agenda)

|

Ongoing

|

|

- HR Welfare Programmes (covering staff and their

family members)

|

Ongoing

|

|

Suppliers and Business Partners

Definition of the Stakeholder Group:

Suppliers are persons or organizations who are providers of goods and/or services required to carry out the Bank’s operations including business partners such as correspondent banks that facilitate cross border transactions for our customers.

Rationale for Engaging Suppliers and Business Partners as a KeyStakeholder Group:

Suppliers and business partners are paramount in ensuring uninterrupted and seamless services at the Bank within Sri Lanka and overseas. Their practices and processes are also important to us from an ethical, labour and environmental viewpoint.

Strategic Objectives of Maintaining Sound Relationships with the Stakeholder Group:

To timely procure quality goods and services required to carry out the Bank’s business at optimized costs, whilst aligning the suppliers and service providers in the Bank’s value creation process through ethical business practices and global standards.

The strategic object encompassing our extensive correspondent banking network, is to closely engage with them, whilst continuously evaluating means to match our customer needs in this area, as correspondent banks are an essential component in the global payment system, especially for cross border payments to facilitate international trade.

| Method of Engagement |

Frequency of Engagement |

Key Topics and

Concerns Raised |

How the Bank Responded to Such Topics and Concerns |

|

Board approved Group

Procurement Policy

|

Ongoing

|

Integration of the suppliers and the business partners in the Bank’s value creation process.

Ensuring fair pricing and equitable treatment for all suppliers.

Ethics, environmental implications, labour laws and procedural standards adopted by the suppliers.

Quality of the deliverables.

(In relation to correspondent banks) – Maintaining a robust and dynamic AML CFT and KYC compliance programme in line with the specific laws and regulations.

|

The Bank maintains a continuous and healthy dialogue with suppliers and business partners at all times. All such relationships are guided by a Board approved Procurement Policy.

The Bank focuses on fostering long-term relationships with its suppliers and making them an integral part of the Bank’s success story, whilst helping them prosper in their businesses.

With regard to our correspondent relationships, we engage with them to ensure the service levels agreed by them are maintained. Regular evaluation of existing correspondent relationships and selection of new international and local correspondent banks for establishing relationships is carried out to serve our customer needs better.

The strategic objective encompassing our extensive correspondent banking network is to closely engage with them whilst continuously evaluating means to match our customer needs in this area, as correspondent banks are an essential component in the global payment system especially for cross border payments to facilitate international trade.

|

|

Periodic supplier reviews and assessments

|

As required

|

|

Meetings with suppliers

|

As required

|

|

Press advertisements, information hosted on the Bank’s corporate website

|

As required

|

|

Tenders, bids, requests for proposals, etc.

|

As required

|

|

Internally approved policy guidelines

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

We follow a comprehensive and dynamic legal and regulatory compliance programme covering AML CFT and KYC through a designated compliance officer who is responsible for co-ordinating and overseeing same on a day-to-day basis. We also review our correspondents annually to ensure they maintain a high level AML CFT and KYC programme in line with the laws and regulations in place.

|

Society and Environment

Definition of the Stakeholder Group:

An individual or group potentially affected by the activities of the Bank; including those affected by environmental or social factors such as suppliers, customers, local communities and the general public.

Rationale for Engaging Society and Environment as a Key Stakeholder Group:

Society and environment are very important stakeholders, directly contributing to the sustainability of the organization. Negative perceptions of the Bank, particularly from local communities can have a very adverse impact in the long term.

Strategic Objectives of Maintaining Relationships with the Stakeholder Group:

To add value to the stakeholders and identify any concerns and address them, whilst maintaining a relationship that will add value to both parties.

| Method of Engagement |

Frequency of Engagement |

Key Topics and

Concerns Raised |

How the Bank Responded to Such Topics and Concerns |

|

Meetings

|

|

The cost of being environmentally and socially compliant amidst a competitive market.

The need to have a level playing field with regard to appraising the facilities for environmental and social aspects in addition to the general economic aspects.

|

The Bank offers a value added service and the stakeholders are advised at the outset. Concerns raised on cost vs. benefit are addressed during appraisal, clearly showing that there would be a long-term benefit in ‘going green’.

The Bank also held capacity building programmes to educate the stakeholders on these aspects.

The banks in Sri Lanka are presently collaborating to level the playing field with respect to environmental and social appraisals.

Giving employees an opportunity to participate in socially and environmentally beneficial programmes giving them the satisfaction of making a contribution to society

|

- Meetings with beneficiaries

of community projects

|

As and when required

|

- Meetings with beneficiaries

of environment projects

|

As and when required

|

- Capacity building programmes for customers

|

Annually

|

- One-to-one meetings with suppliers

|

As and when required

|

- One-to-one customer meetings

|

At each stage of the process with follow-up as per post-lending requirements. Also as and when required

|

|

Publications

|

|

- Sustainability aspects covered in the Annual Report

|

Annually

|

- Press releases on community and environmental projects

|

As and when required

|

|

Special features

|

|

- Community and Environment Projects

|

Ongoing

|

- Sustainability web page within the NDB corporate webpage

|

Continuously

|

- Regular updates on

Social media

|

Continuously

|

Regulators and Government Authorities

Definition of the Stakeholder Group:

Entities which are empowered to exercise a regulatory or supervisory function over the Bank such as the Central Bank of Sri Lanka, the Securities and Exchange Commission of Sri Lanka, the Colombo Stock Exchange, the Inland Revenue Department, etc..

Rationale for Engaging Regulators as a Key Stakeholder Group:

Regulators play a pivotal role in ensuring the effective functioning of the Bank while maintaining the financial stability and sustainability.

Strategic Objectives of Maintaining Relationships with the Stakeholder Group:

To ensure compliance with all regulatory requirements applicable to the Bank.

| Method of Engagement |

Frequency of Engagement |

Key Topics and

Concerns Raised |

How the Bank Responded to

Such Topics and Concerns |

|

Submission of returns/ information

Directions, circulars and guidelines

On-site visits

Consultations

and meetings

Announcements to the Colombo Stock Exchange

|

Ongoing

As and when required

As and when required

As and when required

As and when required

|

Update on the

regulatory requirements

affecting the Bank.

Adherence to the

laws and acts relevant to the banking/financial sector.

Adherence and compliance to all applicable regulations of the Central Bank of Sri Lanka, The Colombo Stock Exchange and other regulatory bodies.

Awareness of developing regulatory and governance practices

(E.g. Basel III).

Adherence to provisions of the Inland Revenue Department.

Meeting legislative requirements in respect of consumer protection and engaging with the Financial Ombudsman of Sri Lanka to resolve customer grievances.

|

A dedicated Compliance Department headed by a senior officer, independently monitors adherence to all applicable laws, regulations and statutory requirements and reports to the Integrated Risk Management Committee and the Corporate Governance and Legal Affairs Committee.

The Bank prioritizes on maintaining the highest level of compliance with all legislations, regulations and rules applicable to its business on a risk based approach.

All regulatory changes are disseminated to the relevant business units together with an explanatory note to facilitate in understanding the regulations.

Compliance Department reviews all policies and Product Programme Guides to ensure that they are in line with regulatory requirements.

Compliance programme covers reviews conducted on products and accuracy checks on certain returns to ensure that they are in compliance with regulatory requirements and are submitted on the

due date.

Compliance training and awareness play a key role in sustaining a culture of compliance within the Bank and in mitigating compliance risk. Training and awareness initiatives provide useful sources of reference for our employees and enable us to entrench compliance and values-based behaviour at every level of the Bank. The employees (both front line and support services) are trained on an ongoing basis and all staff members are required to complete mandatory regulatory and compliance training. Training is delivered through various means, including staff induction programmes, e-learning, face-to-face training and focused activities such as e-flyers.

The Bank contributes to the development of policy, legislation and regulation through submissions of our comments and views to technical committees and associations we are a part of within the banking industry as well as through regular engagement with regulators.

The Bank has in place a comprehensive core-banking system which facilitates and ensures accurate and timely regulatory reporting.

Furthermore, the Bank maintains open and continuous dialogue with the regulatory bodies on matters of concern.

|

|

|

|

|

|

|

Memberships

|

1

|

Association of Professional Bankers (APB)

|

–

|

Bank has obtained membership for Vice-Presidents and

Assistant Vice-Presidents

|

|

2

|

Institute of Bankers of Sri Lanka (IBSL)

|

–

|

Bank has obtained corporate membership covering all staff

|

|

3

|

Employers' Federation of Ceylon Ltd. (EFC)

|

–

|

Bank has obtained corporate membership covering all staff

|

Strategic External Initiatives

| External Entity |

Bank’s Level of Involvement |

| Sri Lanka Forex Association |

Bank’s Treasury staff members are active members of this Association. |

| Sri Lanka – China Business Council |

The Bank has been a member of this Business Council since 2014 and has built close ties with the Chinese business community during this period. The Vice-President – Corporate Banking currently acts in the capacity of the Treasurer of this Council. |

| Trade Finance Association of Bankers |

All members of the Bank’s Trade Finance team are members of this Association, whose primary objectives are to share expert knowledge and engage with authorities on matters of concern and seek solutions. A senior member of the Trade Finance team of the Bank gives leadership to this important Association as the President, while another senior member functions as the Editor of the official newsletter of the Association. |

| Banks’ CIO Forum |

This is a forum functioning under the Sri Lanka Banks’ Association, tasked with uplifting the level of technology governance across the banking sector. This includes assisting the Central Bank of Sri Lanka (CBSL) with policies including aspects of technology, cyber security, payment systems, etc., as well as organizing events with world renowned speakers. The Bank’s Vice-President – Information Technology is the Deputy Chairperson of the Forum. |

| Lanka SWIFT User Group |

This is an entity representing all users of SWIFT within Sri Lanka and represents the country at the annual global SIBOS event. The Bank’s VP – Information Technology is a member of the Executive Committee of the Group. |

| Employers’ Federation of Ceylon Ltd. (EFC) |

As a member of the Federation the Bank receives professional advice on legal and labour-related matters when required. The Federation also appears on behalf of the Bank on Labour related matters. |

| Institute of Bankers of Sri Lanka (IBSL) |

The Bank widely patronizes all IBSL hosted events/seminars etc. The Bank also reimburses costs of IBSL conducted banking exams across all levels of staff.

The Institute facilitates and delivers customized and off-the-shelf programmes which include Certificate courses, Diploma courses and other subject specific seminars. These are conducted exclusively for the Bank’s employees in-house and at IBSL as required. |

| Payment Cards Industry Association of Sri Lanka (PCIASL) |

The Bank is a member of this Professional Industry Association. Its membership consists of all payment card acquiring and issuing financial institutions in the country. It is the industry voice dealing with industry issues regarding VISA Intl., MasterCard Int., CBSL, Inland Revenue, Exchange Control, SLBA and the Payment and Settlements Department. The PCIASL has quarterly meetings and regularly takes up important issues with the respective institutions on behalf of the industry. |

| International Information System Security Certification Consortium (ISC)2 of the United States |

An officer of the Group Risk Management Department is the current president of the (ISC)2 Colombo Chapter. (ISC)2 is the largest not-for-profit membership body of certified information security professionals worldwide, with members in more than 135 countries engaged in developing information security awareness, education and introducing best practices in the country.

Two members of the IS Audit team are also members of the Colombo Chapter. |

| Association of Banking Sector Risk Professionals |

The Bank’s Vice-President – Group Risk was elected President of the Association in September 2016. Further, three members of the Risk Management Team continue to be members of the Association.

The purpose of the Association is to promote fellowship, co-operation and knowledge, whilst undertaking studies and discussions in the area of Risk Management in Banking. They also collectively review regulatory directives and guidelines and co-ordinate with the regulators where necessary. |

| Association of Compliance Officers of Banks Sri Lanka |

The Compliance Officer of the Bank is a member of the Association, which is an effective forum for discussions on issues commonly faced by Banks when interpreting relevant laws, regulations, procedures and best practices. Practical solutions are discussed within the regulatory framework in order to overcome the challenges faced. |

| American Chamber of Commerce (Amcham) |

The Bank's Vice-President – Retail Banking and Transactional and Institutional Banking is represented in the CSR subcommittee of Amcham. |

| Leasing Council of Bankers of Sri Lanka |

The Bank holds membership of the Council and has representation in the Executive Committee of the Council. The Leasing Council of Bankers of Sri Lanka contributes towards the professional development of bankers engaged in leasing, while focusing on the new innovative initiations for the development in the industry as a whole. Further, the benefits of such initiatives cascade down to the SMEs and small industries around the country. |

| The Association of Professional Bankers – Sri Lanka (APB) |

The APB functions with the vision of ’The Power of Professionalism in Banking in Sri Lanka‘ with a membership of approximately 1,200. There are approximately 60 members enrolled inclusive of the entire senior management of the Bank, above the grade of Assistant Vice-President. |

| Inter Bank Association of Internal Auditors of Sri Lanka |

The Inter Bank Association of Internal Auditors is a forum that consists of the Chief Internal Auditors of public and private commercial Banks of Sri Lanka, where emerging trends of the Industry and related practices are discussed.

The Head of Group Audit serves as a member in the committee. |

| Institute of Internal Auditors of Sri Lanka (IIASL) |

The Institute of Internal Auditors Sri Lanka (IIASL) Chapter is affiliated to the Global Institute of Internal Auditors Inc. (IIA Inc.). The objective of the IIASL is to uplift the standards of the internal audit profession in Sri Lanka and to train internal audit professionals.

Six members of the Group Audit team continue to be members of the IIASL. |

| Information Systems Audit and Control Association (ISACA) |

ISACA is an international professional association focused on IT Governance.

Three members of the IS audit team are members of ISACA; while the title of the CISA Certification Director – Board of Sri Lankan Chapter is currently held by the Manager Internal Audit. |