INTELLECTUAL CAPITAL

Strategy - Exemplary Stewardship

To ensure the sustainability of the Bank, it is necessary to practice good governance and build its brand image. Good governance is built on a bedrock of ethics, values and transparency. For this, systems and procedures have to be built, implemented and monitored to ensure that the interests of all the relevant stakeholders are respected and protected. Risks have to be effectively monitored to protect the interests of shareholders and customers. Brand image is nurtured by transparency, ethical conduct and excellence of service. It needs to be disseminated by judicious use of all possible media, and through customer experience.

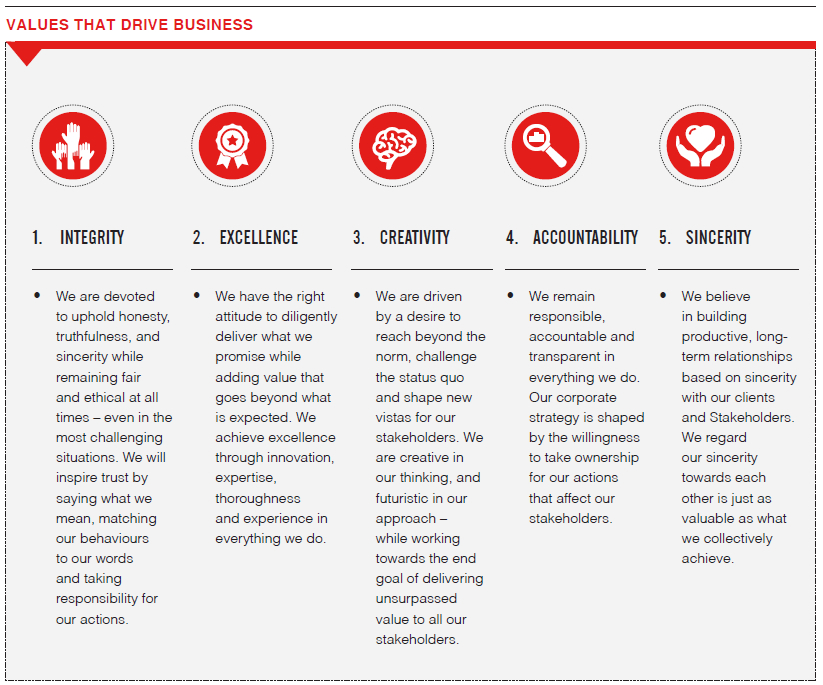

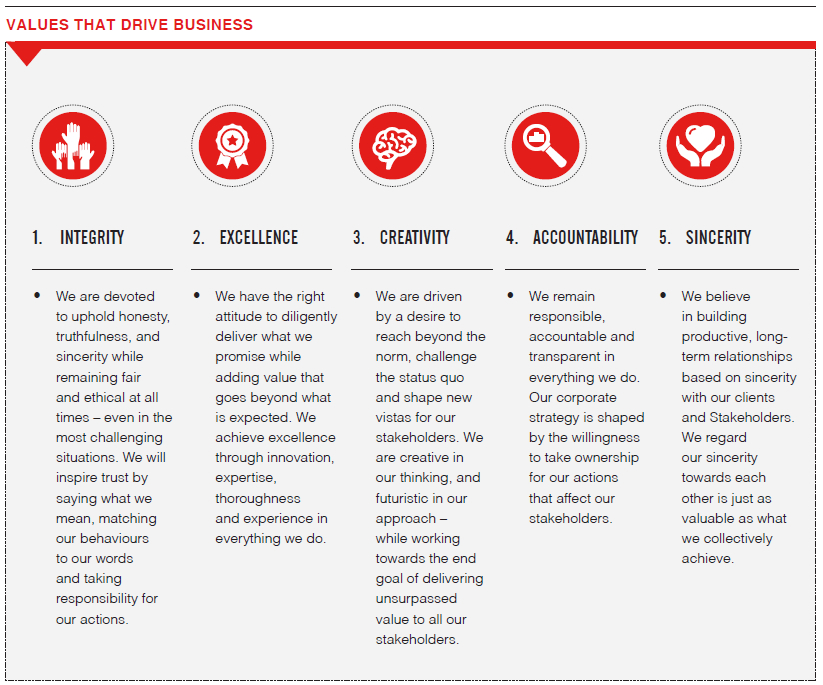

Values that Drive Business

Five core values underpin all our business activities. The values are inculcated into all staff during recruitment, training, performance management and other people related activities. The milieu in which we operate, including changes in the regulatory environment, investor confidence and society’s expectations of banks, constantly bring out the relevance of our values and the need for our employees to be mindful of them in the execution of their duties in the following ways:

Corporate Governance

Corporate governance is a process used to manage the business and affairs of the Bank and its group companies in order to balance attainment of corporate objectives and the alignment of corporate behaviours with the expectations of society, while being accountable to its shareholders.

Corporate governance includes all systems, processes and procedures of the Bank and its group companies and all oversight committees and other bodies charged with ensuring compliance with such. Managing risk, while ensuring a satisfactory return, is an important facet of corporate governance.

A mindset of good corporate governance permeates the Bank and its group companies at all levels and is extended to business partners.

Managing Risk

Group Audit

Strategic Focus

All functions and processes of the Bank and its group companies are independently evaluated by Group Audit, which is a risk- based function governed by the Bank’s Board Audit Committee (BAC) Charter and reporting directly to the BAC. Group Audit reports functionally to the BAC and administratively to the Group CEO. The Head of Group Audit has the authority to communicate directly and separately with the members of the BAC and the Management.

All auditable areas/processes are audited annually, based on a risk based plan approved by the BAC. Group Audit provides reasonable assurance to the BAC on the design and effectiveness of the internal controls.

Performance

There is an ongoing process of reviewing the status of Group Audit activities by the BAC.

The audit reports are tabled at BAC meetings, where the Committee discusses the issues raised and action plans given to address the issues and the implementation status. The Committee also reviews coverage of the approved audit plan on a quarterly basis.

Group audit has implemented in December 2016 an Audit Management workflow system to support the Group audit function in line with the risk based methodology.

Continuous Training and Development of Audit Staff

A high priority is given to training of audit staff to ensure that they have the necessary skills and competencies to carry out their duties and are kept up-to-date with new developments. Training is usually carried out on a planned basis; however, when special needs or opportunities arise to acquire additional skills or knowledge, it is carried out on an ad hoc basis as well. In addition, Group Audit encourages and supports staff members to acquire professional certifications to enhance their professional credibility.

Challenges and Future Outlook

It is a continuous challenge for Group Audit to recruit, train and retain specialized and experienced audit staff, while keeping abreast with the new developments and changes in the business model.

Credit Review Division

Strategic Focus

The largest regulatory capital requirement of the Bank is driven by the credit risk and therefore, it needs to be monitored closely. Two distinct processes are applied at the Bank for pre-credit and post-credit reviews.

The Credit Review Division, which was set up in October 2015, handles two broad areas – Corporate Credit and Branch Credit. There are separate committees dealing with each, manned by senior staff from Credit Review Division and the relevant business lines, and chaired by the Head of Credit Review. Approval limits are assigned as per the Board approved delegated authority limits and representation from Credit Review Division is mandatory on all proposals, whose values fall within committee approval limits.

The Retail Credit Centre, which handles all retail product reviews according to the approved Product Programme Guidelines, also reports to the Head of Credit Review.

Throughout the credit approval process, the Credit Review Division, though organisationally separate from the Business Lines, works closely with them. The contribution made by the Credit Review Division, includes minimising risk and ensuring adequate returns. In the process, the following principles are adhered to:

- Ensure credit is extended only to suitable identified customers who maintain strong standards of ethics and integrity, where source of repayment is known and specific, and the use of funds is well established.

- Review lending proposals according to the risk profile of borrowers and ensuring an optimal risk-return payoff for the Bank

- Ensure identified cash flow sources for repayments either from borrowers’ normal operations or other financial arrangements. Recoverability of security value as a fallback option

- Continuously monitoring the overdue position of clients, actions taken for recovery, adequacy of impairment provisions, quarterly review of watchlisted facilities and annual review of revolving facilities

- Risk considerations shall have priority over business and profit considerations.

Key Strengths

The Credit Review Division has a staff strength of 12, subdivided into two teams: one focussed on approval process and the other on monitoring and reporting. All team members of Credit Review Division and Retail Credit Centre have received job-specific as well as personal development training during the year and are well equipped to carry out their duties in a responsible manner.

The Head of Credit Review, who reports directly to the CEO, brings with her 34 years experience in Credit, Treasury and Risk Management which, ensures that a holistic approach is taken in the credit review process. The approval team has a strength of five, all of whom are Assistant Vice Presidents or Senior Managers, with considerable credit and general banking experience.

The Retail Credit Team is headed by a Chief Manager with nearly 20 years experience in diverse fields of banking. Product verticals, such as personal loans, home loans and credit cards are handled by team leaders at Deputy Managers and Associate Manager levels; there is also a post credit approval team for credit administration. Manned by 56 staff members, the Retail Credit Division functions as a centralized processing hub for retail credit products and accordingly is a strong support function to the Retail Credit Business Line.

Performance

During the year, the following initiatives were taken by the division.

- Introduction of a Risk-Based Pricing methodology across Corporate and SME Business Lines

- Revision of Credit Appraisal formats and alignment of formats across business lines for ease of credit origination

- Training of branch staff on the delegated authority limits in force, management of excesses, credit evaluation and impairment

- Joining Relationship & Branch Managers on-site visits to obtain a better understanding of projects and also to assist in structuring appropriate facilities

- Review of Product Programme Guides (PPG) with necessary amendments based on portfolio reviews, learnings, business line requirements and best practices in the market.

- Integration of Corporate Master (Pre cleared list of Employers for retail products) in order to facilitate all retail products as opposed to product wise clearance and streamlining the company clearance and review process

Challenges and Future Outlook

Adherence to risk based pricing poses a major challenge to the unit in view of the intense competition in the current environment. Expansion in the network and the number of clients impose a need for streamlining the processes. To cope with this, an automated Loan Origination Platform is to be considered to improve efficiency; further training for the staff will also be undertaken.

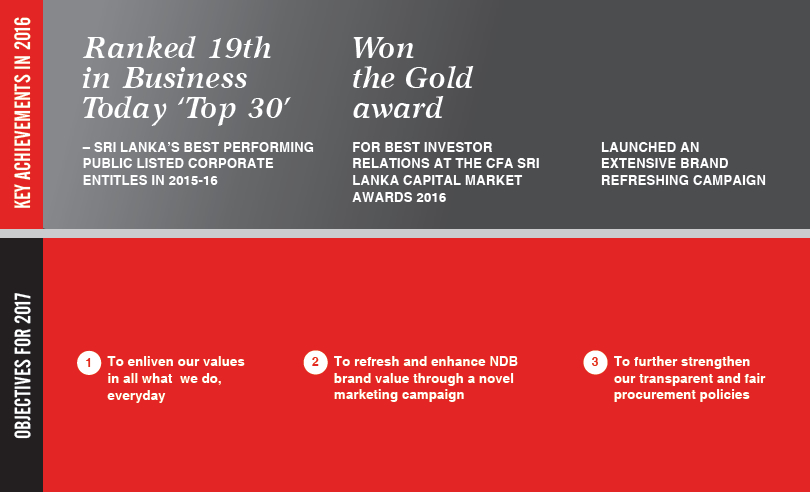

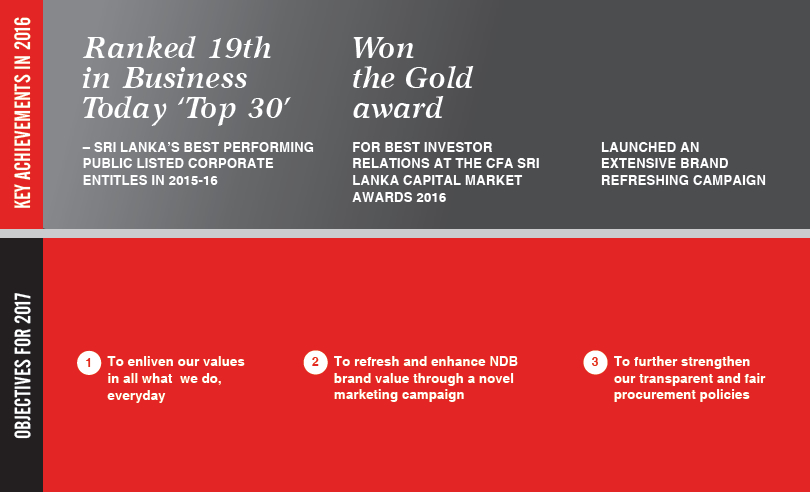

Building the brand

Having transformed from a development bank to a fully-fledged commercial bank, the Bank has built up a secure niche in the business and financial landscape of Sri Lanka. Its brand is well established both in the corporate sector and in households throughout the country. As recorded by the Brand Finance Lanka’s ‘Brands Annual 2016’ ratings, the Bank’s brand was ranked at 19 position within the diverse target audiences of the Bank.

The Bank’s leadership remained steadfast in its support and commitment towards the strategic building of the brand Image and keeping it visible, relevant and discernible and possible in a highly competitive market place.

During the year under review, the Bank continued to strengthen its brand presence among relevant target audiences through various channels such as selected television and radio networks, magazines, national newspapers, strategic outdoor locations, branch premises, online and digital media. All advertising, whatever, the media disseminated the unique message of ‘ Our Commitment, Your Success’ which reiterated the strength of the Group – a diversified conglomerate with the ability to deliver multiple financial services under one roof. The numerous product/brand name advertising conducted throughout the year also contributed to the brand equity of the NDB brand, while portraying the brand as a dynamic force within the industry.

An extensive brand refreshing campaign was carried out during the year. A TV commercial highlighting the strength of the NDB brand was developed and the second commercial was developed featuring NDB Brand Ambassador Angelo Mathews and his own father. The latter was created to highlight the element of commitment towards achieving success.

The Bank carried out an extensive brand refreshing campaign during the year, based on the Bank's tagline 'Our Commitment Your Success'.

Business Ethics and Integrity

Our activities are governed by several frameworks, codes and control mechanisms that shape our business ethics and integrity. Our employees are guided by the Bank’s Compliance Policy and Code of Conduct; which outlines how they should interact with customers both internal and external.

We deliver the highest standards of service to all customers, integrating respect, efficiency, integrity and suitable protection in all our interactions with them, while bearing always in mind, the appropriate regulatory, contractual and fiduciary responsibilities.

A formal Supply Chain Management Process, which takes into account assessment of suppliers in the context of labour, environmental and social factors, ensures ethics and integrity in relationships with business partners.

Systems and Processes

Administration Department

In 2016, the Administration Department of the Bank specially focused on reducing costs by embarking on various initiatives. For this purpose, a four-pronged drive was undertaken, targeting optimizing costs, staff productivity, streamlining of processes and space utilization.

Key contributors were:

- Cost optimization initiatives:Courier costs were renegotiated with the vendors through the procurement committee and the courier companies were assigned to geographical locations. Further, significant savings were achieved relating to mobile bills, printing costs, paper costs and security costs etc.

- Productivity optimization initiatives:Reduce delays in posting statements and advices and adhering to internal Service Level Agreements, accordingly, reducing costs involved and the number of complaints received. The service quality standard of the outsourced security company personnel was improved by providing training internally.

- Streamlining of Processes:A versatile Inventory Control System was implemented, which brought in cost controls, accurate order placing, and timely deliveries to the users, as well as eliminating stock shortages and write-offs. Further, the process pertaining to fixed asset purchases was streamlined, which resulted in timely processing and delivery of assets. Improvements made to the payment processing system has also resulted in timely payments to vendors as well as ease of reconciliations and maintenance of records.

- Space Optimization Initiatives:Documents archived at Kadawatha Yard and Kadawatha Branch, were brought in to the common Archiving Service Provider’s Location, so ensuring the safety and easy access of such documents.

The staff at the Administration Department, bring with them many years of skill, experience and dedicated service and always strive to maintain highest professional standards in carrying out their function.

Procurement Policy

In order to continue its business activities effectively and efficiently, the Bank and its group companies needs to ensure the provision of quality goods and services at the lowest possible cost in a timely manner. Our procurement procedures are drawn up to ensure transparency and a level playing field for all qualified suppliers to participate in the Bank’s procurement process. While ensuring fairness, transparency and consistency in the evaluation process, the Bank also respects the suppliers concerns by maintaining confidentiality of information provided by bidders.

The Bank's Board-approved procurement policy was further developed and revised during 2016 to effectively streamline the overall procurement process of the Bank.

This Board-approved procurement policy, is guided by an eight member procurement committee appointed by the CEO. The procurement process is centralized across the Group, except for Bangladesh operations. The Group procurement process has brought results in terms of cost and quality of goods and services sourced, thereby contributing to two important strategic objectives of the Bank, cost optimization and operational excellence. With the exception of Bangladesh operations, 100% of requirements are sourced from local suppliers.

Outsourcing Policy

The Bank outsources certain professional services, leaving it to concentrate on its core business while the non-core activities are taken care of by external experts. In its outsourcing policy, which has been approved by the Board, the Bank endeavours to maintain an optimum balance between the quality of human resources utilised and the costs for same. Outsourcing activities are directed by an outsourcing committee.

There are trade-offs involved in outsourcing; while there are advantages, there are also issues of confidentiality, business continuity, quality of work and timeliness. In this respect, the Bank is in full compliance with the Banking Act Direction No. 2 of 2012.

Compliance

The Bank’s Legal/Compliance Department has not been informed or pursued any actions where fines were levied in relation to non-compliance with laws and regulations relating to corruption, anti-competitive behaviour, anti-trust, monopoly practices or laws and regulations concerning the use of products and services and related matters during the year. There were no fines charged or non-monetary sanctions for non-compliance with laws and regulations.

Finance and Planning Department

Strategic Focus

The Finance & Planning Department of the Bank is led by the Group Chief Financial Officer. The Department’s expertise spans a number of finance fields including financial accountancy, management accountancy and financial analysis with a number of professionals qualified in these disciplines. The strategic focus of the Department for the year was to make an invaluable contribution to the overall performance of the Bank through a host of support services carried out by the Department.

The Department’s scope of engagement extends to the group companies (excluding Bangladeshi operations) since several key finance related functions are centralized at the Department. therefore, the focus of the Department is extended to the group companies, facilitating seamless finance related processes.

Key Strengths

The key strength of the Finance & Planning Department is its qualified, competent and dedicated members. The Department promotes a cross procedural learning culture thereby making its members well versed with all the processes taking place within the Department.

Furthermore, all finance functions are documented in operating and procedure manuals, which ensure continuity of processes.

Performance

The Department completed another successful year, during which it carried out the following key initiatives amongst other things.

- Performing all regulatory and financial reporting of the Bank in a timely manner

- Conducting and improving investor relations activities

- Implementation and execution of the Bank’s five year strategy as applicable for 2016

- Preparation of the Bank’s budget for the financial year 2017

- Facilitating the annual credit rating reviews of the Bank

- Completion of the centralization of the Group finance function

The Department takes proactive action in ensuring compliance with internal controls relating to financial and regulatory reporting. The internal controls are well monitored to avoid any deviations. These high standards were affirmed in the high audit ratings and low audit queries raised for the Department in internal, external and regulatory audits.

Another highlight of the year was the continuous improvements that were done to the Finance Management Information System (MIS), through which quality analytical information was provided to the Management for timely and efficient decision-making.

Challenges and Future Outlook

The key challenge faced by the Department, is in the area of financial reporting and regulatory reporting guidelines, which keep evolving at a national and international level. The new International Financial Reporting Standards (IFRS) introduced (e.g.: IFRS 9 Financial Instruments) brought demands on the Department’s accountants to continuously keep abreast with such developments and their applications. Regulatory reporting is also subject to such developments, especially in the areas of liquidity coverage and BASEL guidelines.

The Department members are continually updating themselves on such developments in reporting, through continuing professional developments by way of trainings, seminars, etc. The Department constantly strives to provide enhanced services, whilst achieving cost efficiencies.

Legal Department

The Legal Department of the Bank provides an important and an integral service to the Bank in its operations, its key functions, being the provision of advice and support on legal matters and legal documentation for the Bank’s main functions of retail banking and lending in the areas of corporate finance, project finance, SME and housing.

Key Strengths

The Legal Department is located at the head office and consists of 21 in-house Lawyers. The average experience of a Lawyer is 13.52 years. Legal matters pertaining to branches, except for Colombo and Greater Colombo areas, are handled by external Lawyers retained by the Bank who report to the Legal Department. In certain areas of the country, the Bank has appointed Panel of Lawyers to handle the legal documentation of the Bank.

Performance

The matters handled by the Legal Department include title evaluation of lands, loan/security documentation of SME, project financing, corporate banking, housing loans, personal loans and leases, drafting, negotiating and execution of all types of agreements, including IT agreements, drafting formats of various banking products and providing legal advice to the Bank and to the branch network on day-to-day legal issues. The Lawyers also assist in structuring of products offered by the Bank.

One of the key areas of focus of the Legal Department, is the function of securing and safeguarding the Bank against legal risks in complex credit financing transactions, particularly in project financing. The Department has developed internal service levels for the security documentation pertaining to project finance, corporate banking and SME and maintains the said service levels with diligence and commitment. All litigation other than litigation relating to personal loans and credit cards are also handled by in-house Lawyers as instructing attorneys whilst external counsel are appointed for litigating matters in courts.

The Department advises, assists and guides the Management of the Bank on compliance with legal aspects in formulation of processes and guidelines, both internal and external.

The Lawyers ensure that they are abreast with new legislation and constantly update themselves with such matters. The Lawyers also ensure that information on new legislation is shared in order to maintain the highest professional standards. Further, the Legal Department apprises and updates the Management with the latest laws and regulations applicable to banking, as well as extending advisory services to the Board when consulted.

The Legal Department also acts as the custodian for a substantial portion of the legal documentation of the Bank. This function includes scanning of documents preparing making inventories and maintaining legal documentation, facilitating timely releases of documentation and providing copies of the documents at the request of the internal and external customers.

Its tasks include selecting, training, coordinating, supervising and monitoring the new recruits to the Legal Department, as well as retaining external lawyers. The senior lawyers also assist the HR department by conducting training sessions for the new recruits of the Bank.

Challenges and Future Outlook

In 2016, despite the challenge posed by the increased volumes, the departmental staff made every effort to work in sync with the rest of the business units to achieve the goals of the Bank by streamlining the processes which included the revision of the Title Policy of the Bank. All members of the Legal Department strive to maintain the highest professional standards and corporate governance in carrying out their functions.

Centralized Recoveries Department (CRD)

Strategic Focus

In April 2014, the Bank took a strategic decision to set up the Centralized Recoveries Department in order to have special focus/emphasis on the collection/recoveries efforts of the Bank and especially, to proactively manage the Bank's NPLs and NPL Ratios.

Performance

The above move has proved to be an undoubted success across many of the business segments with the NPL ratio ending up at 2.63% by end December 2016.

Key contributors to reduce NPL Ratio are given below:

- Approximately 1.5% NPL Ratio in the Retail segment, which is far below industry levels.

- Around 2% NPL ratio has been maintained in Auto Finance products, in spite of the decrease in portfolios especially in recent times.

- Near total reduction of Pawning related NPLs, despite the declining gold prices.

- Significant sales of acquired assets during the year.

- Sound preventive measures taken to ensure the quality of the credit portfolio, curtailing new NPLs, proactively initiating forced watch listing and blacklisting by CRD.

The performance of the above sectors has jointly contributed to mitigate some NPL increases in the Corporate Banking Division (CBD), Project and Infrastructure Finance (PIF) and SME sector.

The Bank continues to improve its recovery processes proactively which has resulted in an NPL ratio which has remained below the industry average.

Key Strengths

The recovery process of the Bank is divided in to six main areas (as given below) under CRD.

- Retail Recoveries – Retail Recoveries Unit is directly involved in recovery of Dream Maker Loans, Housing Loans and Credit Cards of the entire Bank. Retail recovery team accounts for a wealth of experience in the industry and their management team holds over 15 years of experience on average, offering leadership to a dynamic team while maintaining one of the lowest NPAs in the business.

- Leasing Recoveries – Leasing Recoveries Unit is responsible for the collections and recoveries of auto loans, auto leases and hire purchase facilities. The unit has achieved significant success in the last two years in spite of difficult market conditions. The number of acquired vehicles pending disposal has been kept at minimal levels.

- SME Recoveries – SME Recoveries Unit mainly undertakes a co-ordinating and continuous follow up role, among the branches and regional offices in the network. The unit circulates pertinent and timely management information on a regular basis to ensure a quality SME portfolio. The unit takes leadership in striking workable win-win solutions/deals with delinquent clients.

- Pawning – Pawning Auctions are held at branch locations, where items from several branches are sold in one weekend in one branch.

- Corporate and Other Recoveries –Three members handle the recoveries of the Corporate and Other Recoveries portfolio, comprising mainly of long-overdue facilities transferred from CBD and PIF.

- Corporate Banking Department (CBO) and Project and Infrastructure Financing Recoveries – CBD recoveries are mainly through CBD Relationship Managers in the respective units with co-ordination, follow up and provision of relevant and timely MIS by CRD.

Challenges and Future Outlook

The key challenge for the Bank’s NPLs in 2017 will be to regularize a significant portion of the existing portfolio especially the new (2016) NPLs of the corporate sector and that of the SME segment. Sound proactive measures, notably tightening of the granting of credit, will also be taken in respect of the probable NPLs. Further, lending to clients in arrears or in NPL will be critically reviewed as well as the granting of facilities on a clean basis. Legal action, wherever deemed appropriate, will also be expedited up in the case of wilful defaulters.