MANUFACTURED CAPITAL

Strategy - Leveraging Assets to Create Value

While the Bank does possess intangible assets, the traditional ‘bricks and mortar’ continue to be important and need to be leveraged to produce value to stakeholders. Manufactured capital includes physical objects or other artefacts that are used in the provision of services by the Bank including buildings, vehicles, plant and machinery, IT equipment and software. These assets are those that are usually directly utilised in servicing customers. The expansion strategy of the Bank, such as opening new branches, naturally creates a need for additions to manufactured capital such as buildings, furniture, IT equipment, and other services directly affecting the customers. Today software is a key component of any service organisation’s competitive edge. The Bank gives utmost importance to continuously leveraging the power of IT to provide more and more value to its customers.

We are growing our network sustainably and strategically. In doing so, we are reaching into localities within the country that needs us the most with a bid to empower and enrich the lives of the people in these localities.

Branch Expansion

Branch Network of the Bank

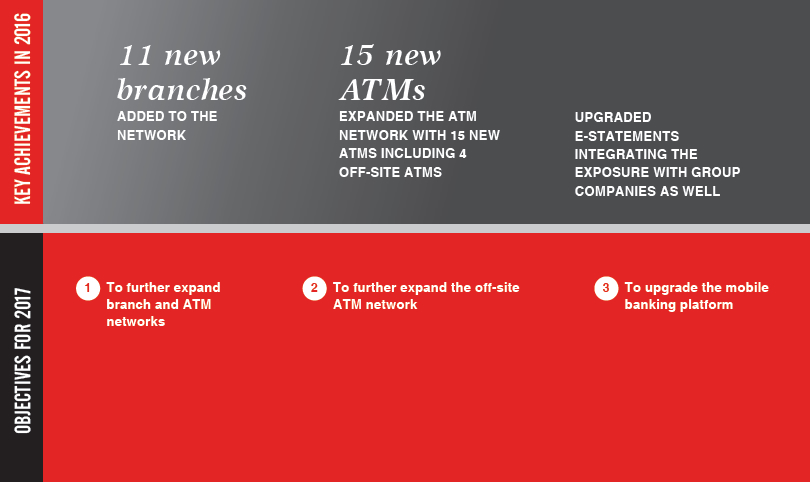

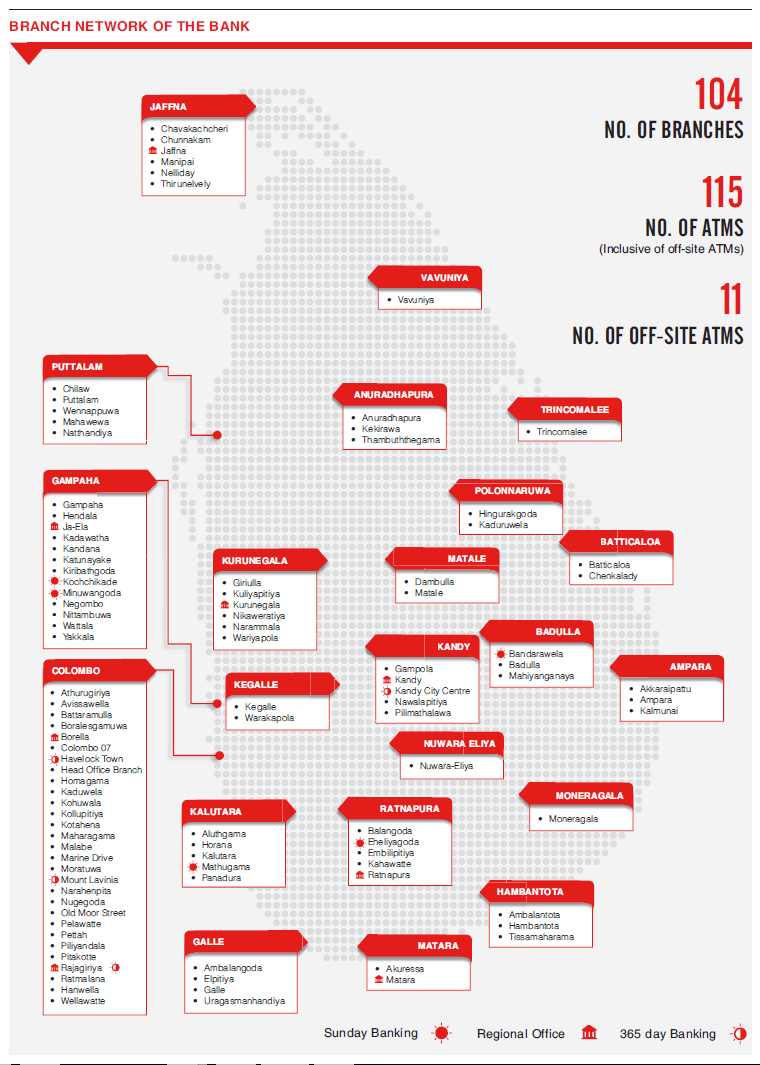

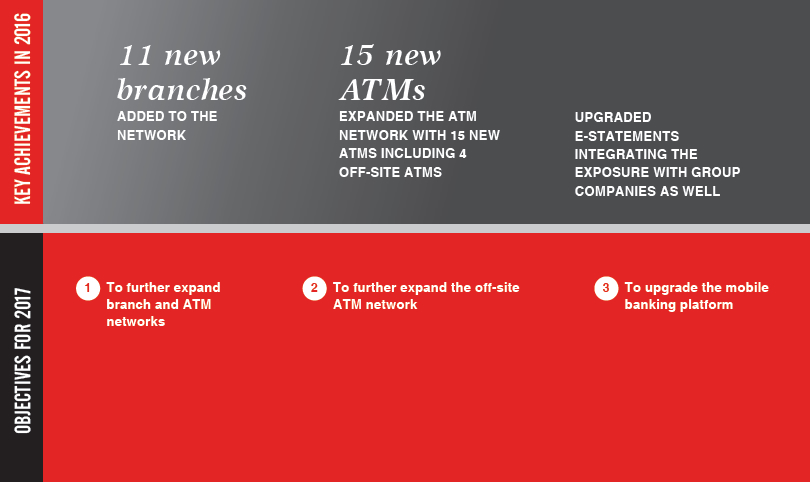

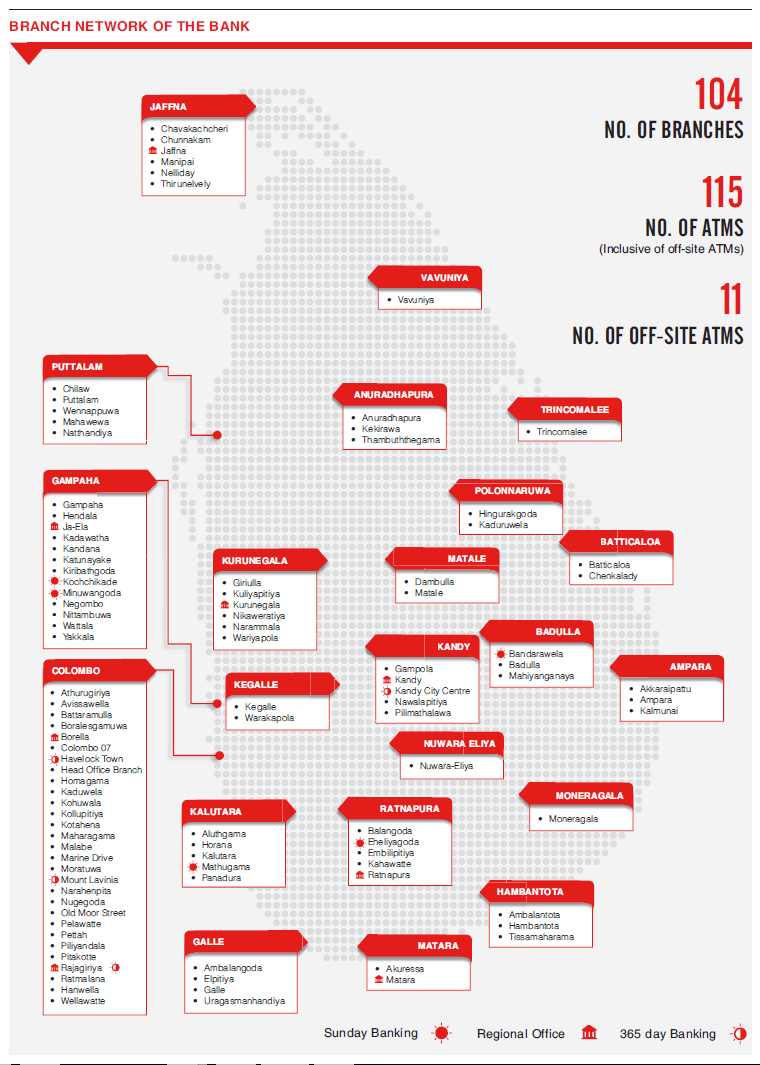

The Bank added 11 new branches to its growing network, which reached a total of 104 fully-fledged branches. Majority of the branches were opened outside the Western Province, which increased the presence of the Bank in rural areas and across the country. The 100th branch was ceremonially opened at Hingurakgoda, with all branch managers and the senior management team of the Bank gracing the occasion. We expect this aggressive business expansion through our branch network, to continue in the coming year, coupled with our focus to enhance service delivery through cutting edge technology.

The Bank remains dedicated to bringing its customers one step closer to realising their aspirations in life and uplifting their standards of living through the range of services that is accessible by means of its growing branch network. By bringing a gamut of retail banking products including current/savings accounts, fixed deposits, housing loans, pawning services, vehicle leasing, mobile banking as well as insurance services to the residents of each of these locations, the Bank will help them grow and secure their wealth, while enjoying easy access and convenience of banking with automated facilities such as Visa Debit Cards, Internet Banking and Western Union Money Transfer Services.

Branch Openings

As part of a strategy of growth and expansion, during the year, the Bank extended its geographic reach by further widening its branch network across the island. Opening of new branches was carried out in Hanwella, Narammala, Manipay, Thirunelveli, Chavakachcheri, Mahawewa, Marine Drive, Hingurakgoda, Warakapola,Thambuththegama and Nattandiya during this financial year.

New branch openings were supported by advertising in press and radio, that created NDB brand and product awareness. News broadcasting on national television stations and media coverage on newspapers also built up further publicity for the new outlets, while strengthening the Bank’s position as a fast growing financial institution.

New Branches Opened During the Year

| Branch Name |

District |

Province |

| Hingurakgoda |

Polonnaruwa |

North Central Province |

| Thambuththegama |

Anuradhapura |

North Central Province |

| Narammala |

Kurunegala |

North Western Province |

| Natthandiya |

Puttalam |

North Western Province |

| Mahawewa |

Puttalam |

North Western Province |

| Manipai |

Jaffna |

Northern Province |

| Chavakachcheri |

Jaffna |

Northern Province |

| Thirunelvely |

Jaffna |

Northern Province |

| Warakapola |

Kegalle |

Sabaragamuwa Province |

| Hanwella |

Colombo |

Western Province |

| Marine Drive |

Colombo |

Western Province |

Information Technology

Strategic Focus

Technological innovations have opened the door for the banking industry to provide efficient delivery channels. Our banking sector has embraced the use of technology to serve our clients. The progress of technology, the development of worldwide networks and mobile banking solutions are continually driving down the cost of global fund transfers. The global business environment is constantly evolving and information technology has facilitated the banking industry to deal with the challenges the new economy poses. Information Technology systems continue to play a leading role in reinforcing the competitive edge enjoyed by the Bank in Sri Lanka’s highly competitive banking environment.

Banks in Sri Lanka are rapidly moving towards introducing mobile banking services in order to cater to customers who perform their banking transactions while on the move. The mobile banking solution implemented by the Bank, will enable it to move forward ahead of the curve, while providing convenient, cutting edge technology enabled banking services to customers. The mobile banking solution runs on any device (smart-phone, feature phones or tablet devices), seamlessly integrating devices through all channels. It provides customers a portal to execute transactions with merchant and utility services providers. The implemented solution is locally based, ensuring that customers can conveniently access the best offers and deals. With the introduction of the Prevention of Money Laundering Act No. 5 of 2006, Convention on the Suppression of Financial Terrorism Act No. 25 of 2005 and Financial Transactions Reporting Act No. 6 of 2006 it is mandatory for the financial institutions in Sri Lanka to comply with requests for information from the Financial Intelligence unit from time to time. Therefore, the Bank has implemented the Anti-Money Laundering (AML) system to facilitate compliance. It is the paramount duty and responsibility of the Bank to verify the identity and activities of our customers to facilitate establishing the correctness/genuineness of the credentials for extending better customer service.

As part of the infrastructure upgrade and the Business Continuity Plan (BCP), the IT department has successfully implemented the latest Data Domain for a total backup solution. In the process, the traditional tape backup solution has been moved to a disk based backup solution, featuring advanced integration with a leading Backup Enterprise Application. The latest Data Domain has reduced the operational overheads by minimizing human involvement and human error. With the expansion of the branch network, there are demands on the systems to cater to increased volumes, while providing efficient customer service. To cater to this need, the Bank upgraded the wide area network. The implementation of Voice Over IP (VOIP) solution by the Network Management Division, enabled calls received at a branch, to be transferred automatically to the next available extension to provide best customer service through one location. In 2016, the Multifunction ATM has been introduced to improve better customer service by providing the facility of cash deposits and utility payments through the Multifunction ATM.

The role of IT Shared Services (ITSS) at the Bank is threefold, encompassing Project Management, Software Development & Support and Software Quality Assurance. ITSS has completed more than 15 successful projects during the year 2016 and provides seamless support for smooth banking operation.

Performance

The award winning mobile banking system which was launched in February 2016 is strategically aligned with the Bank’s objective of providing a great customer experience and promoting environment sustainability. ’Shake and Bank‘, the mobile banking system has opened doors to a new era of digital banking, by enabling customers to execute transactions, within a fully secured environment, without being physically present at a Branch.

The products such as Wakala offered through Islamic Banking and HomeSend Remittance Systems, have facilitated opening up new business ventures and opportunities. ITSS considers it the mission of the team, to develop sophisticated and secure solutions to enhance the business capabilities of the Bank and to provide value to customers by supporting new business innovations with determination and enthusiasm.

IT implementations such as EMV, which enable the Bank to secure International Card transactions with high competence and integrity, keep the Bank on par with global standards of banking operations.

Key Strengths

The team is staffed by experienced developers with a thorough knowledge of new technologies and industry best practices, a well-established QA team possessing high analytical skills and in-depth knowledge about all banking processes, a highly enthusiastic support team to address and resolve the system issues in the minimum possible time period without compromising the quality of deliverables, a strong Project Management office (PMO) consisting of qualified Project Managers (PMs) who guide the projects, keeping to internationally approved project management standards.

Challenges and Future Outlook

The Bank is currently enhancing the capabilities of ITSS through strategic and technical training, standardization and quality assurance, in order to face the future technical challenges; it is embracing the opportunities through technical advancement and supporting the Bank’s objective of enhancing digital banking capabilities.

Shared Services

Shared Services came into being during the latter part of the year where the processing of transactions under a centralized operations on behalf of business units was consolidated as one hub. The strategic focus is to operate a transaction processing hub with internationally recognized processing standards to handle business related operations and transactions with emphasis on uniformity, quality, efficiency, minimizing rework, timely delivery, duly measuring performance of individuals and teams on a regular basis and fine-tuning to attract a growth in volumes contributing towards non-interest income. The synergies and skills of the existing human resources were utilized to create the human capital for Shared Services.

During the year, in pursuit of the aforesaid goals, the Bank joined the Common Electronic Fund Transfer Switch to facilitate on line real time Sri Lanka Rupee fund transfers between banks in Sri Lanka. In addition, it acquired and implemented a new Cheque Imaging & Truncation System for clearing of cheques and introduced the concept of work-flow to facilitate communications and links between business units and Shared Services related to transaction processing.

It was also decided to deploy a team under Business Process Re-engineering, to review and recommend operational processes to ensure secure, reliable and robust processing. The results of this initiative are expected in the year ahead.

Work is in progress to engage in the new on line Domestic USD Clearing process, which is expected to replace the current manual clearing procedure and on the online real time payment system for Sri Lanka Customs to effect payment of Customs Duty, Demurrage and other fees on behalf of Import/Export Customers.

With the new tools and monitoring mechanisms in place, it is envisaged that with the data extracted from Shared Services the focus would be to effect changes and introduce new processes to improve outcomes, whereby on the long-term, Shared Services may attract third party requests, both locally and internationally for such services on their behalf.

Trade services

Our Trade Finance Department, which is ISO 9001:2008 certified, is staffed with a team of well trained

and highly motivated individuals. It continues to provide a high level service for trade related transactions. The team has ventured outside the Western Province, to educate customers and staff on international trade through familiarisation seminars and training programmes. By these sessions, it is intended to give customers the confidence to initiate trade transactions by themselves instead of relying on middlemen.

Thus, the Trade Services programmes have been linked to the retail and SME sectors, in addition to the corporates. In recognition of the value generated to customers by the Trade Finance Department, the Bank was conferred the award ‘ Best Partner Bank in Sri Lanka’ for the second consecutive year by Asian Development Bank, better known as ADB TFP Award.

SMS Operations

Strategic Focus

To provide an appropriate level of authorized access to IT applications used by the Bank, ensuring compliance with the Bank’s information security policy and facilitating efficient transaction processing, whilst minimizing the possible risk arising from unauthorized access to applications.

Performance

During the year under review the following activities were carried out by the Unit to support the Bank’s business:

SMS helped to implement 14 new systems during the year, in addition to existing 33 systems which contains 7,197 user access profiles across the Bank. Further, the user profile reviewing process was upgraded to enhance and strengthen the application access mechanism.

Key Strengths

The key strength of the Unit is team work, which helps to achieve our expected targets with limited human resources to meet the organization’s deadline of ‘go live date’ of all the implemented banking applications.

Challenges and Future Outlook

With vibrant technological changes, expansion of reach and rapid changes in needs of stakeholders who come from different regions, ethnicities and walks of life and as a result, have different perceptions, cultures, languages etc., we face difficulties with managing access to the banking application; this becomes a critical challenge for all members of the unit.

Transactional and Institutional Banking

Institutional Banking

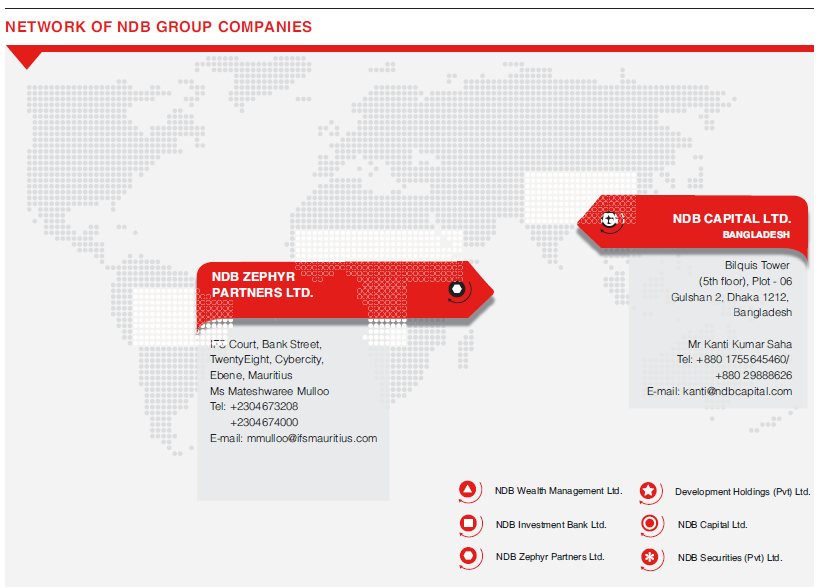

Institutional Banking performs an important role for the Bank by providing the expertise to manage the Bank’s relationships with all correspondent banks and remittance partners.

Traditionally, the Bank has maintained broad networks of relationships with correspondent banks. Through the extensive correspondent banking network, the Bank can access financial services in different jurisdictions and facilitate cross-border payment services to their customers, supporting international trade.

However there are growing indications that some international banks providing these services are reducing the number of relationships they maintain and are establishing few new ones. This creates a possibility that cross-border payment networks might fragment and that the range of available options for these transactions could narrow, making this function a more important one than ever.

Despite these challenges, through a focused approach, the Institutional Banking team was able to significantly enhance its global coverage in 2016 to serve its customers better.

Further, the Institutional Banking Team has created a strong reputation for itself among its correspondent banking fraternity, as a reliable local bank for guarantee issuances resulting in higher fee based revenue to the Bank. Looking ahead, the Institutional Banking team will not only look at engaging closely with its correspondent banking partners to improve benefits to the Bank by negotiating better terms with fee based income and cost optimization, but also will establish the Bank as the most reliable local partner for their operations in Sri Lanka.

The Bank also marked an important development during the year as a principal agent for Western Union operations. For the first time, the Bank introduced a daily gift program through its network of branches to reward all recipients of inward remittances, accordingly, increasing customer loyalty and footfall.

Recognizing the value of our Western Union sub-agent network, which continues to play an important role in increasing our coverage, supplementing the branch network, we added a further 286 outlets by tying up with M/s SoftLogic Retail (Pvt) Ltd. and Sarvodya Development Finance Ltd., bringing our current network to a total of 1,158. We also take this opportunity to thank our current partners Singer Sri Lanka PLC, Rural Development Bank, Vision Care Optical Services (Pvt) Ltd. and Union Chemist (Pvt) Ltd.

Adding value to our e – Remittance platform in the current year, the Bank also announced its partnership with HomeSend, a joint venture between Mastercard, eServGlobal and BICS, to offer greater security and convenience to the millions of Sri Lankans resident overseas, who remit money to the country. Connecting the Bank’s state-of-the-art e-remittance service to the HomeSend Hub, this arrangement will allow consumers to credit funds directly to a beneficiary’s bank account through a wide network of remittance services around the world.

In line with our vision of being a driving force in the remittance market, we also actively pursue other partnerships to add to our existing network, to offer greater security and convenience to millions of Sri Lankans sending money home from abroad.