Financial Highlights

|

Bank |

Group |

|

2016 |

2015 |

Change |

2016 |

2015 |

Change |

|

LKR '000 |

LKR '000 |

% |

LKR '000 |

LKR '000 |

% |

| Operating results for the year |

|

|

|

|

|

|

| Gross income |

33,281,736 |

25,855,311 |

29 |

33,776,905 |

26,915,863 |

25 |

| Operating profit before tax on financial services |

5,335,004 |

5,447,875 |

(2) |

5,093,546 |

5,715,283 |

(11) |

| Taxation |

2,164,733 |

1,936,444 |

12 |

2,278,587 |

2,123,006 |

7 |

| Profit for the year |

3,170,271 |

3,511,431 |

(10) |

2,814,959 |

3,670,095 |

(23) |

| Profit attributable to equity holders of the parent |

3,170,271 |

3,511,431 |

(10) |

2,691,014 |

3,542,040 |

(24) |

| Gross dividends for the year |

1,321,484 |

1,816,841 |

(27) |

1,321,484 |

1,816,841 |

(27) |

| Revenue to government |

2,219,013 |

2,572,872 |

(14) |

2,416,656 |

2,862,048 |

(16) |

| Assets and liabilities |

|

|

|

|

|

|

| Due to other customers |

203,866,547 |

184,933,230 |

10 |

203,515,828 |

184,152,280 |

11 |

| Loans and receivables |

227,676,876 |

209,704,701 |

9 |

227,716,971 |

209,768,193 |

9 |

| Total assets |

334,544,735 |

309,157,605 |

8 |

340,731,768 |

315,353,733 |

8 |

| Total liabilities |

309,799,685 |

286,456,747 |

8 |

309,718,472 |

285,953,016 |

8 |

| Total equity to equity holders of the Bank |

24,745,050 |

22,700,858 |

9 |

29,936,587 |

28,382,204 |

5 |

| Profitability (%) |

|

|

|

|

|

|

| Net interest margin |

2.64 |

2.63 |

0 |

2.70 |

2.67 |

1 |

| Non-performing loans ratio |

2.63 |

2.43 |

8 |

2.63 |

2.43 |

8 |

| Return on assets |

0.99 |

1.23 |

(20) |

0.82 |

1.21 |

(32) |

| Return on equity |

13.36 |

15.63 |

(15) |

9.23 |

12.59 |

(27) |

| Total leverage (times) |

13.52 |

13.62 |

(1) |

11.38 |

11.11 |

2 |

| Cost to income ratio |

49.04 |

49.55 |

(1) |

52.34 |

51.39 |

2 |

| Investor Information (LKR) |

|

|

|

|

|

|

| Net asset value per share |

149.80 |

137.44 |

9 |

181.23 |

172.35 |

5 |

| Market value per share – as at 31 December |

156.00 |

194.10 |

(20) |

NA |

NA |

– |

| Earnings per share – basic |

19.19 |

21.26 |

(10) |

16.29 |

21.51 |

(24) |

| Earnings per share – diluted |

19.19 |

21.26 |

(10) |

16.29 |

21.51 |

(24) |

| Price earnings (times) |

8.13 |

9.13 |

(11) |

NA |

NA |

– |

| Dividend per share |

8.00 |

11.00 |

(27) |

NA |

NA |

– |

| Dividend cover (times) |

2.40 |

1.93 |

24 |

NA |

NA |

– |

| Dividend yield (%) |

5.13 |

5.67 |

(10) |

NA |

NA |

– |

| Market capitalisation (LKR' 000) |

25,768,939 |

32,058,981 |

(20) |

NA |

NA |

– |

| Regulatory ratios (%) |

|

|

|

|

|

|

| Capital adequacy ratios: |

|

|

|

|

|

|

| Tier I – (minimum ratio of 5%) |

9.31 |

8.51 |

9 |

11.55 |

11.07 |

4 |

| Tier I & II – (minimum ratio of 10%) |

12.95 |

12.59 |

3 |

15.27 |

15.25 |

0 |

| Statutory liquid assets ratio: |

|

|

|

|

|

|

| DBU |

21.50 |

22.24 |

(3) |

N/A |

N/A |

– |

| FCBU |

22.93 |

24.91 |

(8) |

N/A |

N/A |

– |

Profitability & Growth

- ROE of 13.36%

- Loans and receivables growth of 9%

- Due to other customers growth of 10%

Investor Information

- Dividend per share of LKR 8/-

- Market capitalization rank of 25 in the CSE

Regulatory ratios

- CAR of 12.95%

- Liquidity levels above 20%

Financial Goals and Achievements

|

Goals |

Achievements |

|

|

2016 |

2015 |

2014* |

2013* |

2012 |

|

|

LKR '000 |

LKR '000 |

LKR '000 |

LKR '000 |

LKR '000 |

| Financial indicators – Bank |

|

|

|

|

|

|

| Return on assets (%) |

Over 1.5% |

0.99 |

1.23 |

1.47 |

1.14 |

1.94 |

| Return on equity (%) |

Over 17% |

13.36 |

15.63 |

16.33 |

14.38 |

21.17 |

| Growth in total operating income (%) |

Over 20% |

7.71 |

4.69 |

19.00 |

11.55 |

31.00 |

| Growth in profit after taxation (%) |

Over 20% |

(9.72) |

2.73 |

64.00 |

(29.00) |

60.00 |

| Growth in total assets (%) |

Over 20% |

8.21 |

17.67 |

31.00 |

23.00 |

18.00 |

| Dividend per share (LKR) |

Over 10 |

8.00 |

11.00 |

11.00 |

10.00 |

15.00 |

| Capital adequacy ratios: |

|

|

|

|

|

|

| Tier I (%) – Minimum requirement 5% |

Over 8% |

9.31 |

8.51 |

10.09 |

12.05 |

11.14 |

| Tier I & II (%) – Minimum requirement (10%) |

Over 13% |

12.95 |

12.59 |

14.68 |

17.87 |

12.38 |

*The above achievements are presented excluding the one-off equity income of LKR 6,031 million for the year 2013.

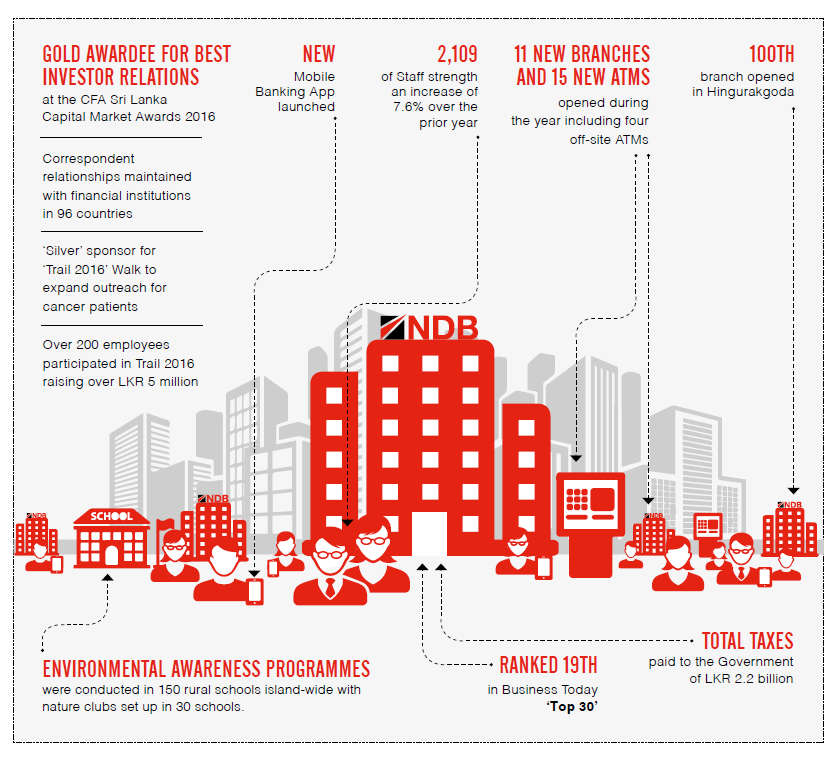

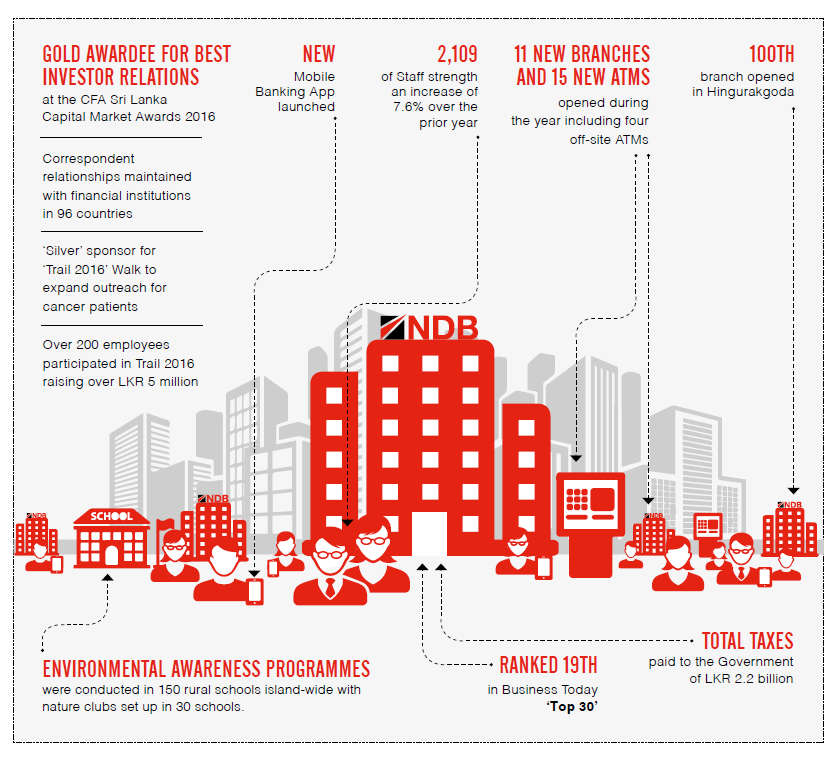

Operational Highlights